- China

- /

- Renewable Energy

- /

- SZSE:300335

February 2025 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are nearing record highs with growth stocks outperforming their value counterparts. Amidst this backdrop, penny stocks—often seen as a relic of past market eras—remain relevant due to their affordability and potential for growth. These smaller or newer companies can offer significant opportunities when backed by strong financials, presenting an intriguing option for investors seeking hidden gems in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £468.01M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.09 | £307.32M | ★★★★☆☆ |

Click here to see the full list of 5,692 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Goodbaby International Holdings (SEHK:1086)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Goodbaby International Holdings Limited is an investment holding company that focuses on the research, development, design, manufacture, marketing, and sale of durable juvenile products across Europe, North America, Mainland China, and other international markets with a market cap of HK$1.72 billion.

Operations: The company's revenue is primarily derived from its Car Seats and Accessories segment, which generated HK$3.59 billion.

Market Cap: HK$1.72B

Goodbaby International Holdings, with a market cap of HK$1.72 billion, primarily generates revenue from its Car Seats and Accessories segment (HK$3.59 billion). The company has shown impressive earnings growth over the past year at 507.1%, significantly outpacing the Leisure industry's decline of 5.4%. Despite this rapid growth, the company's Return on Equity remains low at 6.4%. Debt management is satisfactory with net debt to equity at 22.3% and operating cash flow covering debt well (45.3%). However, interest payments are only marginally covered by EBIT (3x), indicating potential financial pressure if earnings don't improve further without reliance on one-off gains like HK$77.8 million recently recorded.

- Click here to discover the nuances of Goodbaby International Holdings with our detailed analytical financial health report.

- Learn about Goodbaby International Holdings' future growth trajectory here.

Town Health International Medical Group (SEHK:3886)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Town Health International Medical Group Limited is an investment holding company offering healthcare and related services in the People’s Republic of China and Hong Kong, with a market cap of HK$1.96 billion.

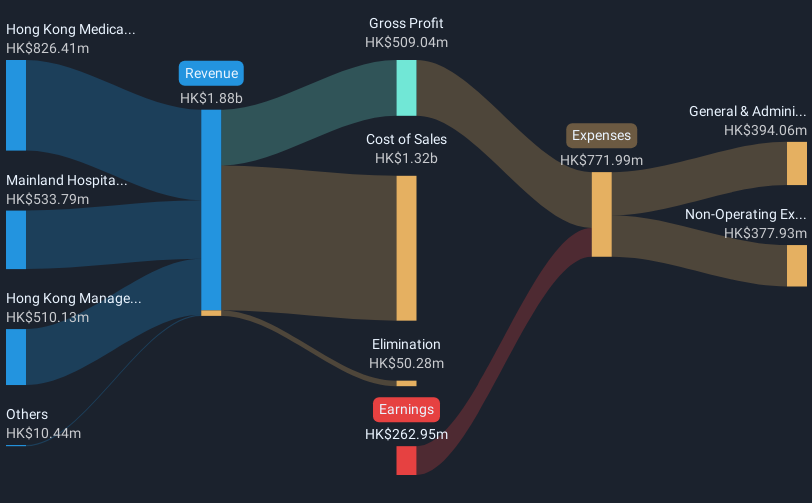

Operations: The company's revenue is primarily derived from its Hong Kong Medical Services segment at HK$826.41 million, Hong Kong Managed Medical Network Business at HK$510.13 million, and Mainland Hospital Management and Medical Services at HK$533.79 million.

Market Cap: HK$1.96B

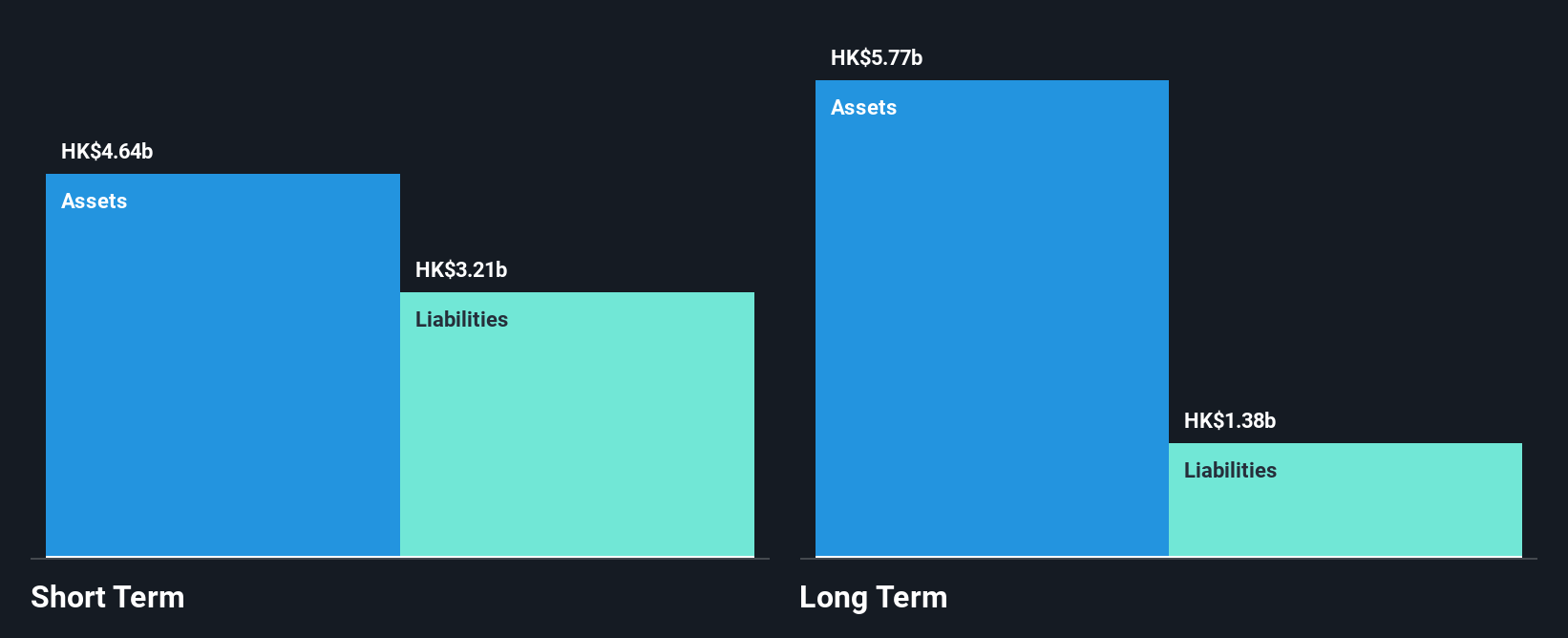

Town Health International Medical Group, with a market cap of HK$1.96 billion, derives substantial revenue from its Hong Kong Medical Services (HK$826.41 million), Managed Medical Network Business (HK$510.13 million), and Mainland Hospital Management and Medical Services (HK$533.79 million). Despite being unprofitable with a negative Return on Equity of -6.42%, the company maintains a strong cash position, covering short- and long-term liabilities effectively, and has not diluted shareholders recently. The 2025-2027 CGB Framework Agreement renewal ensures continued provision of medical services to CGB (HK) while accessing unsecured loan services for operational needs without asset security requirements.

- Jump into the full analysis health report here for a deeper understanding of Town Health International Medical Group.

- Learn about Town Health International Medical Group's historical performance here.

Guangzhou Devotion Thermal Technology (SZSE:300335)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangzhou Devotion Thermal Technology Co., Ltd. (SZSE:300335) operates in the thermal technology sector, focusing on the development and production of energy-efficient heating solutions, with a market cap of CN¥2.39 billion.

Operations: No revenue segments are reported for this company.

Market Cap: CN¥2.39B

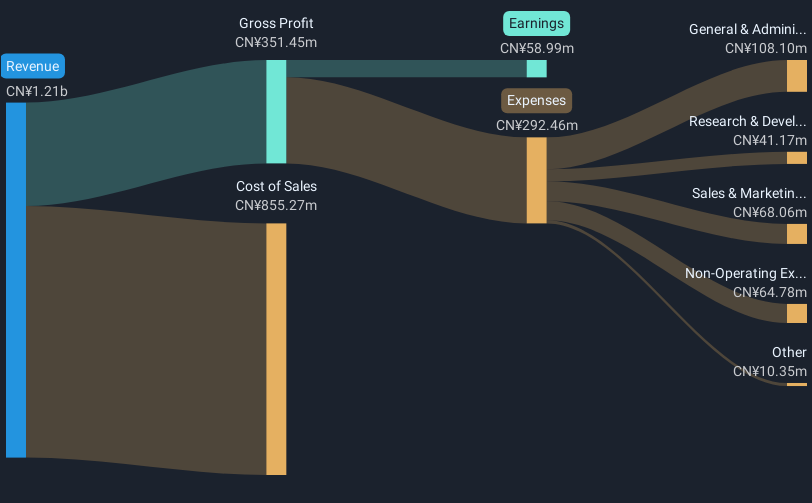

Guangzhou Devotion Thermal Technology, with a market cap of CN¥2.39 billion, shows financial resilience through well-covered debt by operating cash flow and a reduced debt-to-equity ratio from 49.7% to 6.3% over five years. Despite stable weekly volatility and an experienced management team, the company faces challenges with declining profit margins (4.9% from 9.9%) and negative earnings growth (-53.3%) last year, underperforming its industry peers in renewable energy growth rates (6.8%). Short-term assets of CN¥1.1 billion comfortably cover both short- and long-term liabilities, although Return on Equity remains low at 4.5%.

- Dive into the specifics of Guangzhou Devotion Thermal Technology here with our thorough balance sheet health report.

- Explore historical data to track Guangzhou Devotion Thermal Technology's performance over time in our past results report.

Where To Now?

- Click here to access our complete index of 5,692 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300335

Guangzhou Devotion Thermal Technology

Guangzhou Devotion Thermal Technology Co., Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives