- Hong Kong

- /

- Healthcare Services

- /

- SEHK:3309

Update: C-MER Eye Care Holdings (HKG:3309) Stock Gained 25% In The Last Year

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the C-MER Eye Care Holdings Limited (HKG:3309) share price is 25% higher than it was a year ago, much better than the market return of around 9.2% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow C-MER Eye Care Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for C-MER Eye Care Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months C-MER Eye Care Holdings went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

We are skeptical of the suggestion that the 0.3% dividend yield would entice buyers to the stock. We think that the revenue growth of 14% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

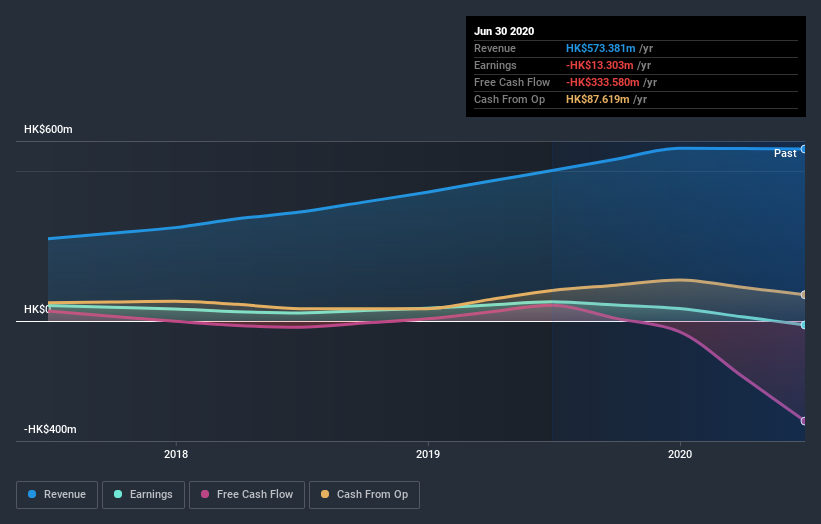

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that C-MER Eye Care Holdings shareholders have gained 25% over the last year, including dividends. We regret to report that the share price is down 1.9% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - C-MER Eye Care Holdings has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading C-MER Eye Care Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade C-MER Medical Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3309

C-MER Medical Holdings

An investment holding company, provides ophthalmic services under the C-MER Dennis Lam brand name in Hong Kong and Mainland China.

Excellent balance sheet minimal.

Similar Companies

Market Insights

Community Narratives