- Hong Kong

- /

- Healthcare Services

- /

- SEHK:3309

C-MER Eye Care Holdings Limited's (HKG:3309) 26% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, C-MER Eye Care Holdings Limited (HKG:3309) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

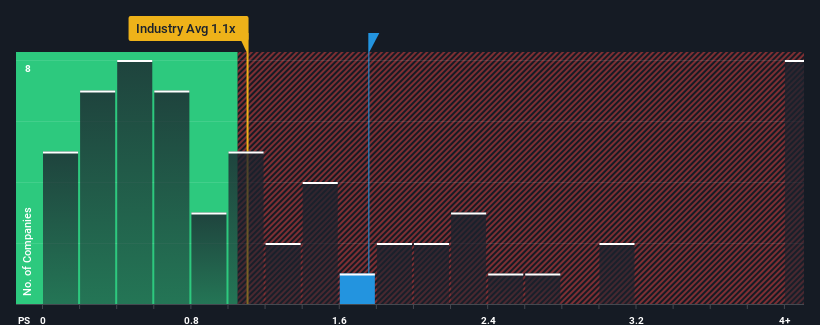

In spite of the heavy fall in price, given close to half the companies operating in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider C-MER Eye Care Holdings as a stock to potentially avoid with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for C-MER Eye Care Holdings

What Does C-MER Eye Care Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, C-MER Eye Care Holdings has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on C-MER Eye Care Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

C-MER Eye Care Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. Pleasingly, revenue has also lifted 214% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 17% as estimated by the only analyst watching the company. With the industry predicted to deliver 16% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that C-MER Eye Care Holdings' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does C-MER Eye Care Holdings' P/S Mean For Investors?

C-MER Eye Care Holdings' P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given C-MER Eye Care Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for C-MER Eye Care Holdings with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3309

C-MER Medical Holdings

An investment holding company, provides ophthalmic services under the C-MER Dennis Lam brand name in Hong Kong and Mainland China.

Excellent balance sheet minimal.

Similar Companies

Market Insights

Community Narratives