- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2587

HealthyWay Inc. (HKG:2587) Shares Slammed 87% But Getting In Cheap Might Be Difficult Regardless

The HealthyWay Inc. (HKG:2587) share price has fared very poorly over the last month, falling by a substantial 87%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

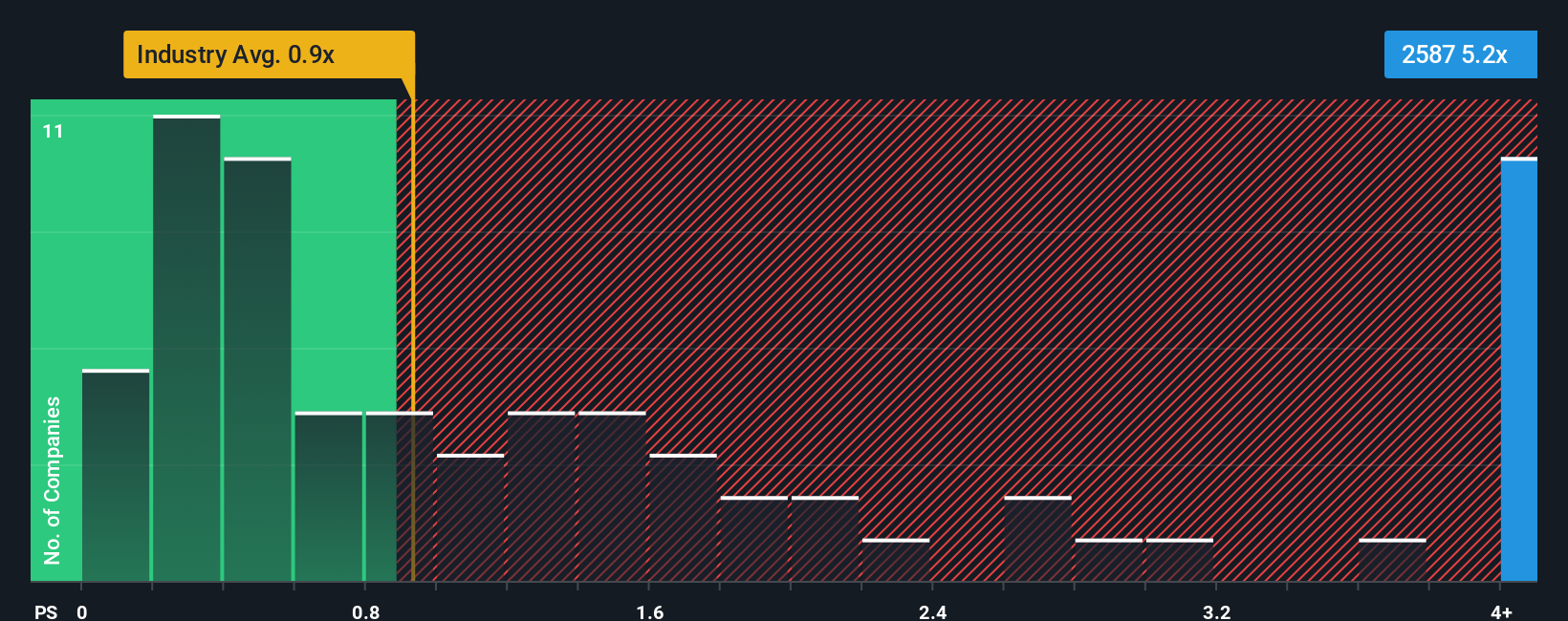

Even after such a large drop in price, when almost half of the companies in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider HealthyWay as a stock not worth researching with its 5.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for HealthyWay

How Has HealthyWay Performed Recently?

As an illustration, revenue has deteriorated at HealthyWay over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for HealthyWay, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, HealthyWay would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. Still, the latest three year period has seen an excellent 178% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.3% shows it's noticeably more attractive.

In light of this, it's understandable that HealthyWay's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does HealthyWay's P/S Mean For Investors?

A significant share price dive has done very little to deflate HealthyWay's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that HealthyWay can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

We don't want to rain on the parade too much, but we did also find 3 warning signs for HealthyWay (2 are a bit unpleasant!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HealthyWay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2587

HealthyWay

An investment holding company, provides corporate and digital marketing, and health and medical services in the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Community Narratives