Global markets have been experiencing a notable rally, with U.S. stocks reaching record highs amid expectations of growth and tax reforms following the recent election results. As investors navigate these shifting economic landscapes, the allure of penny stocks remains significant due to their affordability and potential for substantial returns. Though often perceived as relics from past market eras, penny stocks continue to offer opportunities in smaller or newer companies that might pair financial strength with promising growth trajectories.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.865 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

Click here to see the full list of 5,756 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sinohealth Holdings (SEHK:2361)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sinohealth Holdings Limited offers healthcare insight solutions catering to the sales and marketing requirements of medical product manufacturers in Mainland China and internationally, with a market cap of approximately HK$1.86 billion.

Operations: The company's revenue is derived from three main segments: SaaS generating CN¥69.39 million, Data Insight Solutions contributing CN¥191.06 million, and Data-Driven Publications and Events accounting for CN¥150.32 million.

Market Cap: HK$1.86B

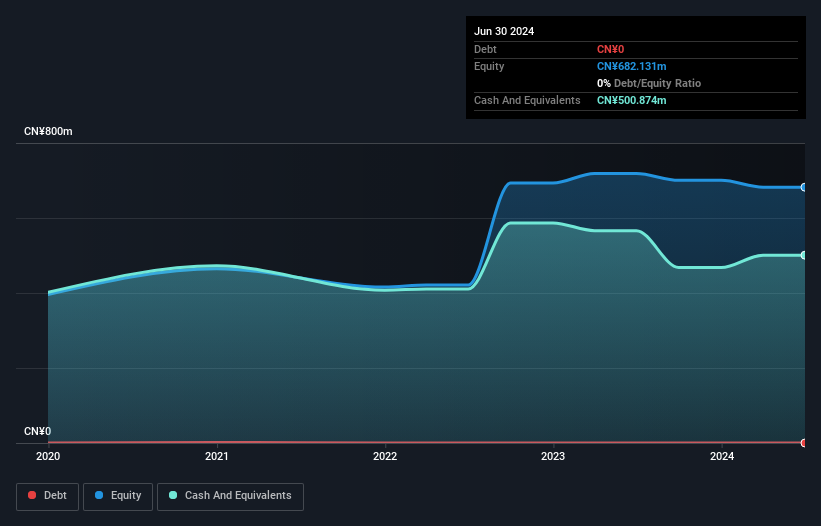

Sinohealth Holdings Limited, with a market cap of HK$1.86 billion, operates in the healthcare insight solutions sector. The company is debt-free and has strong short-term asset coverage for both its short and long-term liabilities. Recent earnings showed a slight decline in net income to CN¥41.68 million despite revenue growth to CN¥159.53 million for the half-year ended June 2024. Its Price-To-Earnings ratio of 18x is below the industry average, indicating potential value, though recent negative earnings growth may concern some investors. Management tenure data is insufficient; however, the board's average tenure suggests experience.

- Click here to discover the nuances of Sinohealth Holdings with our detailed analytical financial health report.

- Understand Sinohealth Holdings' earnings outlook by examining our growth report.

TWZ Corporation (SET:TWZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TWZ Corporation Public Company Limited primarily distributes communication equipment in Thailand and has a market cap of THB794.44 million.

Operations: The company generates revenue from several segments, including THB3.70 billion from communication equipment trading, THB20.74 million from investment property, THB6.34 million from electric vehicles, and THB5.68 million from real estate development.

Market Cap: THB794.44M

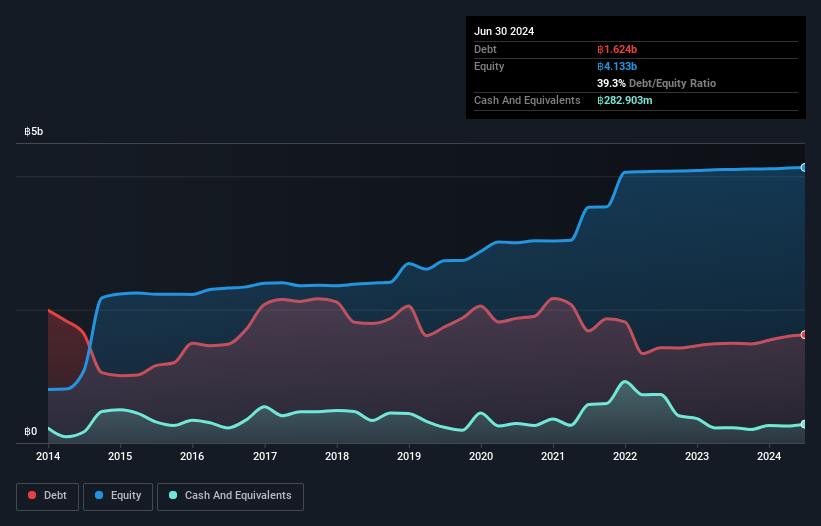

TWZ Corporation, with a market cap of THB794.44 million, has diverse revenue streams, primarily from communication equipment trading. Recent earnings show increased revenue to THB914.85 million for Q2 2024 and net income growth to THB9.26 million compared to the previous year. Despite this, profit margins remain low at 0.7%, and operating cash flow is negative, indicating debt challenges with interest coverage at only 1.3x EBIT. The company's short-term assets exceed both short- and long-term liabilities, suggesting liquidity strength; however, high share price volatility may concern investors seeking stability in penny stocks investments.

- Get an in-depth perspective on TWZ Corporation's performance by reading our balance sheet health report here.

- Evaluate TWZ Corporation's historical performance by accessing our past performance report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, SAP, Microsoft, data intelligence, security, and software development sectors both in Germany and internationally with a market cap of €94.68 million.

Operations: Revenue Segments: No specific revenue segments are reported.

Market Cap: €94.68M

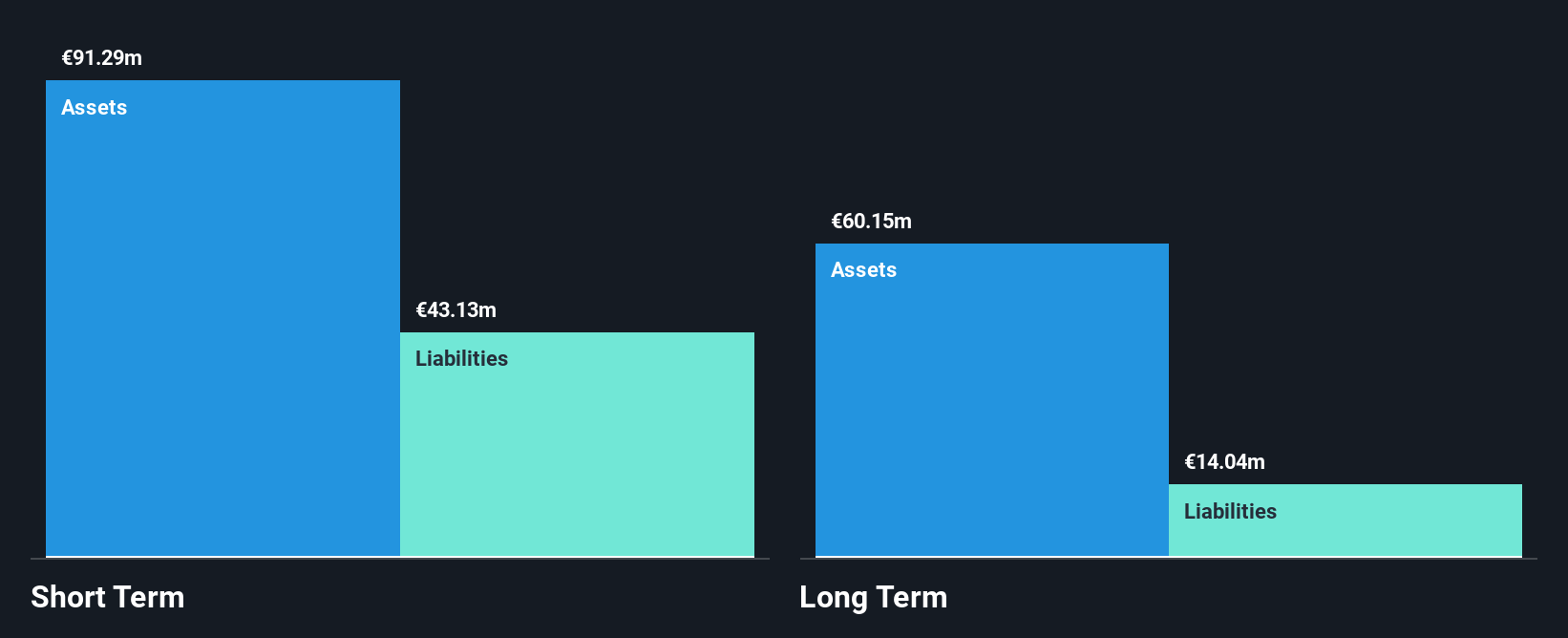

q.beyond AG, with a market cap of €94.68 million, operates in the cloud and software sectors and has shown signs of financial improvement despite being unprofitable. Recent earnings for Q3 2024 revealed sales growth to €47.02 million from €45.45 million year-on-year, while net loss decreased significantly to €0.965 million from €4.23 million previously. The company is debt-free and its short-term assets comfortably cover both short- and long-term liabilities, indicating strong liquidity management. Analysts suggest the stock is undervalued by 63%, with a potential price increase forecasted at 52%.

- Jump into the full analysis health report here for a deeper understanding of q.beyond.

- Gain insights into q.beyond's future direction by reviewing our growth report.

Key Takeaways

- Click this link to deep-dive into the 5,756 companies within our Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:QBY

q.beyond

Engages in the cloud, SAP, Microsoft, data intelligence, security, and software development business in Germany and internationally.

Very undervalued with flawless balance sheet.