As global markets experience a mixed performance, with major U.S. indices reaching record highs while others face declines, investors continue to navigate through a complex economic landscape. Amidst this backdrop, penny stocks remain an intriguing option for those looking to explore smaller or less-established companies that may offer value and growth potential. Despite being considered an outdated term by some, penny stocks highlight opportunities in firms with strong financials and the potential for significant returns. In this article, we spotlight three such stocks that stand out due to their robust balance sheets and promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Innate Pharma (ENXTPA:IPH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innate Pharma S.A. is a biotechnology company focused on developing immunotherapies for cancer patients both in France and internationally, with a market cap of €129.52 million.

Operations: Innate Pharma generates its revenue primarily from its biotechnology segment, totaling €33.79 million.

Market Cap: €129.52M

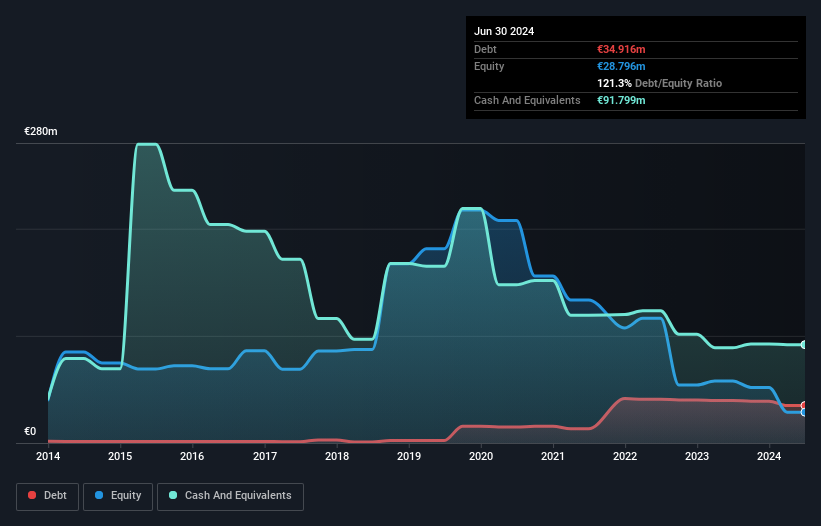

Innate Pharma S.A., a biotechnology firm with a market cap of €129.52 million, has recently seen significant developments, including the announcement of a private placement raising €2.83 million. The company is advancing its proprietary NK cell engager IPH6501 in clinical trials for B-cell non-Hodgkin lymphoma and has received FDA clearance for its ADC targeting Nectin-4 in solid tumors. Despite being unprofitable and experiencing increased losses over five years, Innate Pharma maintains more cash than debt, with short-term assets covering liabilities and sufficient cash runway for over three years based on current free cash flow.

- Dive into the specifics of Innate Pharma here with our thorough balance sheet health report.

- Learn about Innate Pharma's future growth trajectory here.

3D Medicines (SEHK:1244)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Medicines Inc. is a biopharmaceutical company that focuses on researching, developing, and commercializing oncology products for cancer treatment in Mainland China, with a market cap of HK$639.56 million.

Operations: The company generates its revenue from the Biopharmaceutical Research and Development segment, amounting to CN¥488.82 million.

Market Cap: HK$639.56M

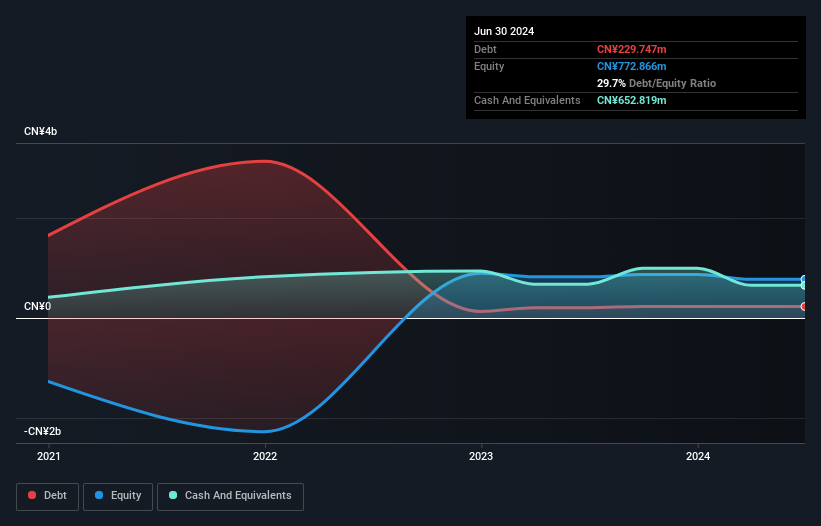

3D Medicines Inc., with a market cap of HK$639.56 million, focuses on oncology products and is currently pre-revenue, generating CN¥488.82 million from its R&D segment. The company has reduced losses by 18.2% annually over five years and maintains more cash than debt, ensuring a cash runway exceeding three years based on current free cash flow. Despite high share volatility and shareholder dilution over the past year, its experienced management team and board provide stability. Short-term assets of CN¥1 billion cover both short- and long-term liabilities effectively, supporting operational resilience amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of 3D Medicines.

- Evaluate 3D Medicines' historical performance by accessing our past performance report.

Sinohealth Holdings (SEHK:2361)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sinohealth Holdings Limited offers healthcare insight solutions for the sales and marketing needs of medical product manufacturers in Mainland China and internationally, with a market cap of HK$1.89 billion.

Operations: The company's revenue is derived from SaaS (CN¥69.39 million), Data Insight Solutions (CN¥191.06 million), and Data-Driven Publications and Events (CN¥150.32 million).

Market Cap: HK$1.89B

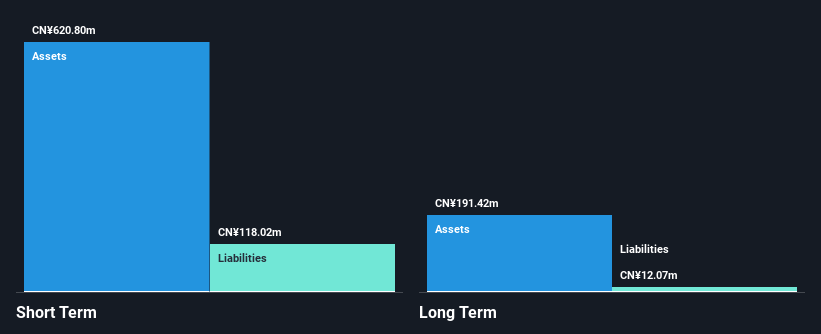

Sinohealth Holdings Limited, with a market cap of HK$1.89 billion, has announced a special dividend of HKD 0.0958 per share, reflecting its financial health and commitment to shareholders. The company's revenue streams are diversified across SaaS (CN¥69.39 million), Data Insight Solutions (CN¥191.06 million), and Data-Driven Publications and Events (CN¥150.32 million). Its short-term assets of CN¥620.8 million comfortably cover both short-term liabilities (CN¥118 million) and long-term liabilities (CN¥12.1 million). Despite recent negative earnings growth, Sinohealth remains debt-free with stable weekly volatility at 5%, positioning it as a potentially resilient investment in the healthcare sector.

- Click to explore a detailed breakdown of our findings in Sinohealth Holdings' financial health report.

- Review our growth performance report to gain insights into Sinohealth Holdings' future.

Where To Now?

- Get an in-depth perspective on all 5,705 Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3D Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1244

3D Medicines

A biopharmaceutical company, researches, develops, and commercializes oncology products and other drug candidates for the treatment of patients with various cancers in the Mainland China.

Excellent balance sheet and slightly overvalued.