- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2291

There's Reason For Concern Over LEPU ScienTech Medical Technology (Shanghai) Co., Ltd.'s (HKG:2291) Massive 36% Price Jump

LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. (HKG:2291) shareholders are no doubt pleased to see that the share price has bounced 36% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

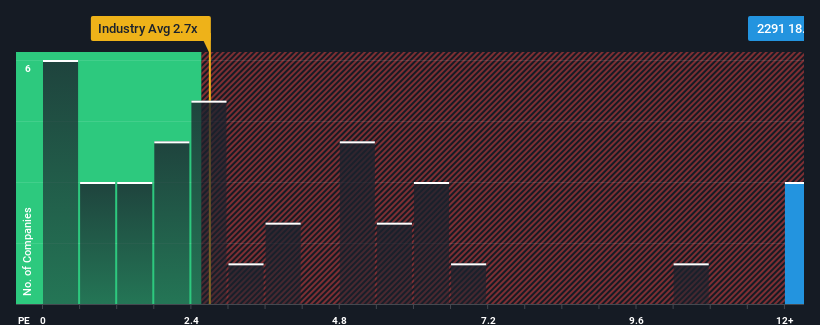

After such a large jump in price, you could be forgiven for thinking LEPU ScienTech Medical Technology (Shanghai) is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 18.5x, considering almost half the companies in Hong Kong's Medical Equipment industry have P/S ratios below 2.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for LEPU ScienTech Medical Technology (Shanghai)

What Does LEPU ScienTech Medical Technology (Shanghai)'s Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, LEPU ScienTech Medical Technology (Shanghai) has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for LEPU ScienTech Medical Technology (Shanghai), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is LEPU ScienTech Medical Technology (Shanghai)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as LEPU ScienTech Medical Technology (Shanghai)'s is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. Pleasingly, revenue has also lifted 120% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 33% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that LEPU ScienTech Medical Technology (Shanghai)'s P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does LEPU ScienTech Medical Technology (Shanghai)'s P/S Mean For Investors?

LEPU ScienTech Medical Technology (Shanghai)'s P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of LEPU ScienTech Medical Technology (Shanghai) revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for LEPU ScienTech Medical Technology (Shanghai) with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on LEPU ScienTech Medical Technology (Shanghai), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2291

LEPU ScienTech Medical Technology (Shanghai)

An investment holding company, engages in the manufacture and sale of interventional treatment series occluders for defective congenital heart disease.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.