- Singapore

- /

- Gas Utilities

- /

- SGX:1F2

Yonghe Medical Group Leads Our Trio Of Promising Penny Stocks

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and a strong labor market boosting sentiment, investors are exploring diverse opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment area despite the term's outdated connotations. By focusing on those with robust financials and potential for growth, investors can uncover hidden value in these lesser-known entities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.215 | £832.65M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £173.2M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £418.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £67.32M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.52 | MYR331.06M | ★★★★★★ |

Click here to see the full list of 5,781 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Yonghe Medical Group (SEHK:2279)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yonghe Medical Group Co., Ltd. offers hair-related healthcare services in China and has a market cap of HK$400.23 million.

Operations: The company's revenue is primarily derived from its hair transplant services, amounting to CN¥1.85 billion.

Market Cap: HK$400.23M

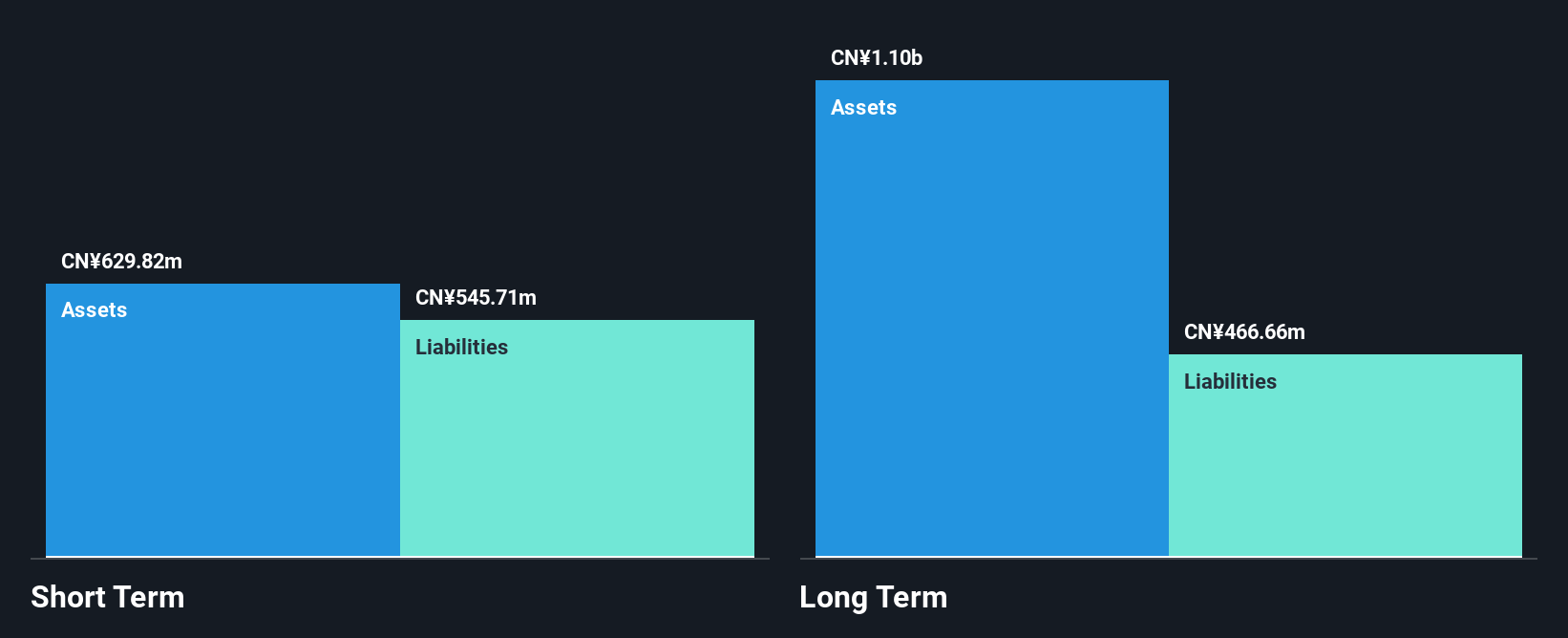

Yonghe Medical Group, with a market cap of HK$400.23 million, primarily generates revenue from hair transplant services totaling CN¥1.85 billion. Despite its experienced board and management team, the company is currently unprofitable with losses increasing at a significant rate over the past five years. It has not diluted shareholders recently and maintains more cash than debt, providing a sufficient cash runway for over three years even if free cash flow decreases significantly. However, the stock has seen increased volatility recently, reflecting potential investor uncertainty about its financial trajectory in the healthcare sector.

- Take a closer look at Yonghe Medical Group's potential here in our financial health report.

- Gain insights into Yonghe Medical Group's past trends and performance with our report on the company's historical track record.

Union Gas Holdings (SGX:1F2)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Gas Holdings Limited is an investment holding company that provides fuel products in Singapore, with a market capitalization of SGD107.97 million.

Operations: The company generates revenue through three primary segments: Natural Gas (SGD5.75 million), Liquefied Petroleum Gas (SGD104.98 million), and Diesel (SGD15.19 million).

Market Cap: SGD107.97M

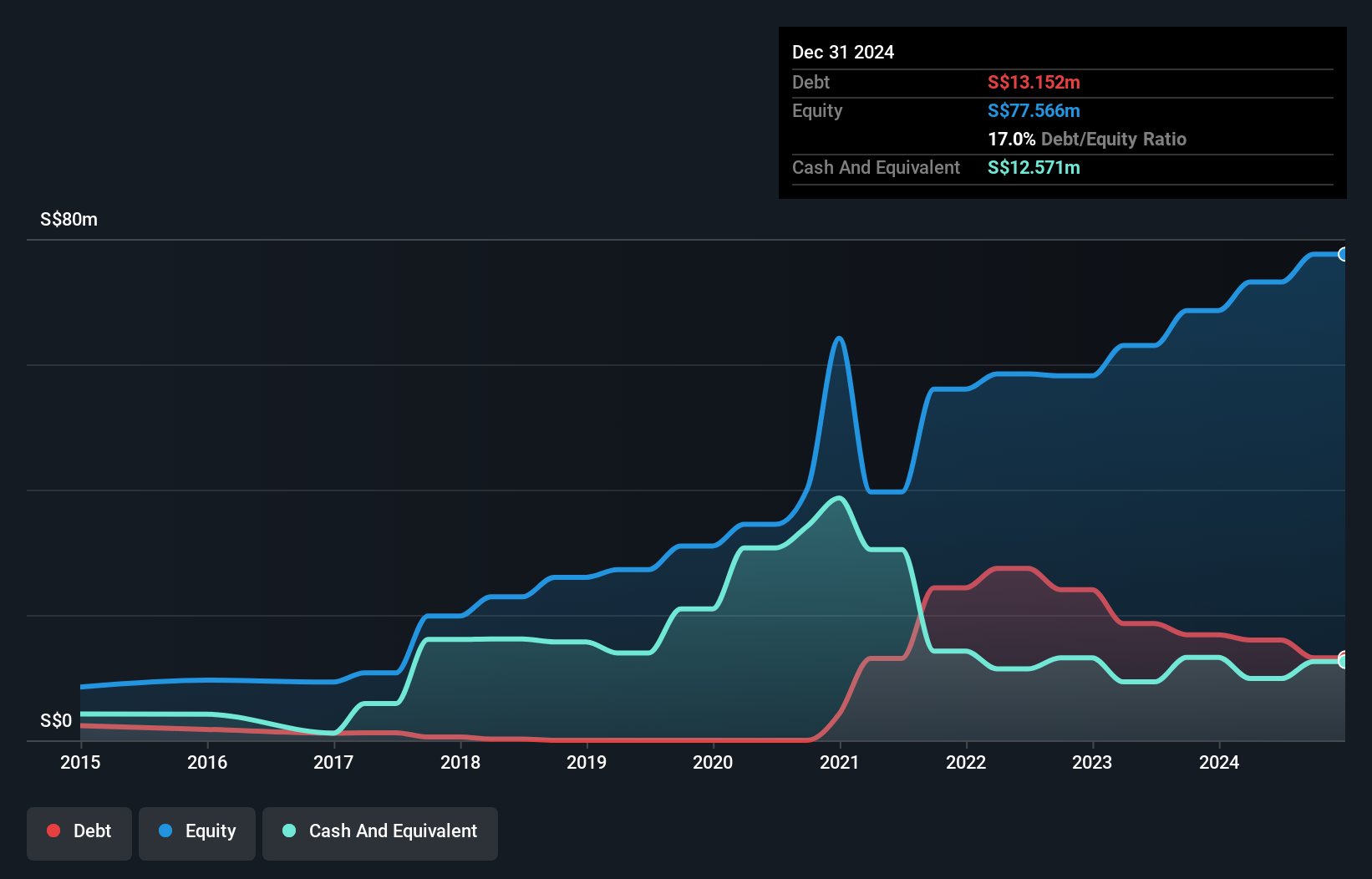

Union Gas Holdings, with a market cap of SGD107.97 million, benefits from accelerated earnings growth of 35.6% over the past year, surpassing its five-year average decline. Its revenue streams are diversified across natural gas (SGD5.75 million), liquefied petroleum gas (SGD104.98 million), and diesel (SGD15.19 million). The company’s debt is well-covered by operating cash flow and interest payments are comfortably managed with an EBIT coverage of 11.3 times. While trading significantly below estimated fair value, Union Gas Holdings maintains stable weekly volatility and has not diluted shareholders recently despite its low return on equity at 15.9%.

- Navigate through the intricacies of Union Gas Holdings with our comprehensive balance sheet health report here.

- Evaluate Union Gas Holdings' historical performance by accessing our past performance report.

Mostostal Zabrze (WSE:MSZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mostostal Zabrze S.A. is involved in design, production, construction, and assembly activities with a market cap of PLN348.42 million.

Operations: Revenue Segments: No specific revenue segments have been reported.

Market Cap: PLN348.42M

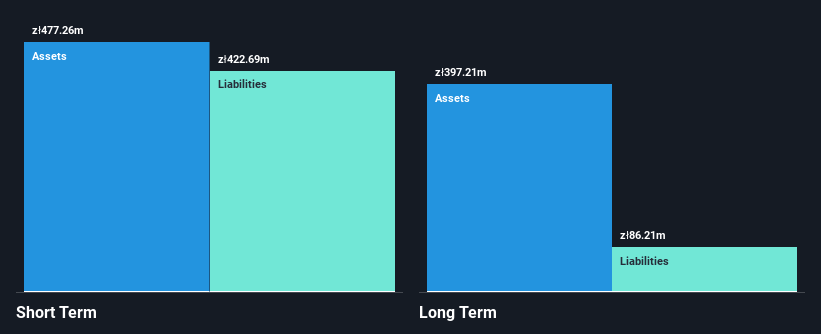

Mostostal Zabrze, with a market cap of PLN348.42 million, has demonstrated robust financial health and growth in the construction sector. Its earnings surged by 42.8% over the past year, outpacing industry averages, though forecasted to decline by 14.1% annually over the next three years. The company's debt is well-managed, with operating cash flow covering it substantially and more cash on hand than total debt. Short-term assets exceed both short- and long-term liabilities significantly, ensuring liquidity stability. Trading below its estimated fair value and without recent shareholder dilution, Mostostal Zabrze presents a compelling case for potential investors seeking value in this segment.

- Get an in-depth perspective on Mostostal Zabrze's performance by reading our balance sheet health report here.

- Examine Mostostal Zabrze's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Unlock our comprehensive list of 5,781 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:1F2

Union Gas Holdings

An investment holding company, provides fuel products in Singapore and Indonesia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives