- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2276

Shanghai Conant Optical (SEHK:2276) Is Up 14.4% After UBS Highlights Smartglasses Potential - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

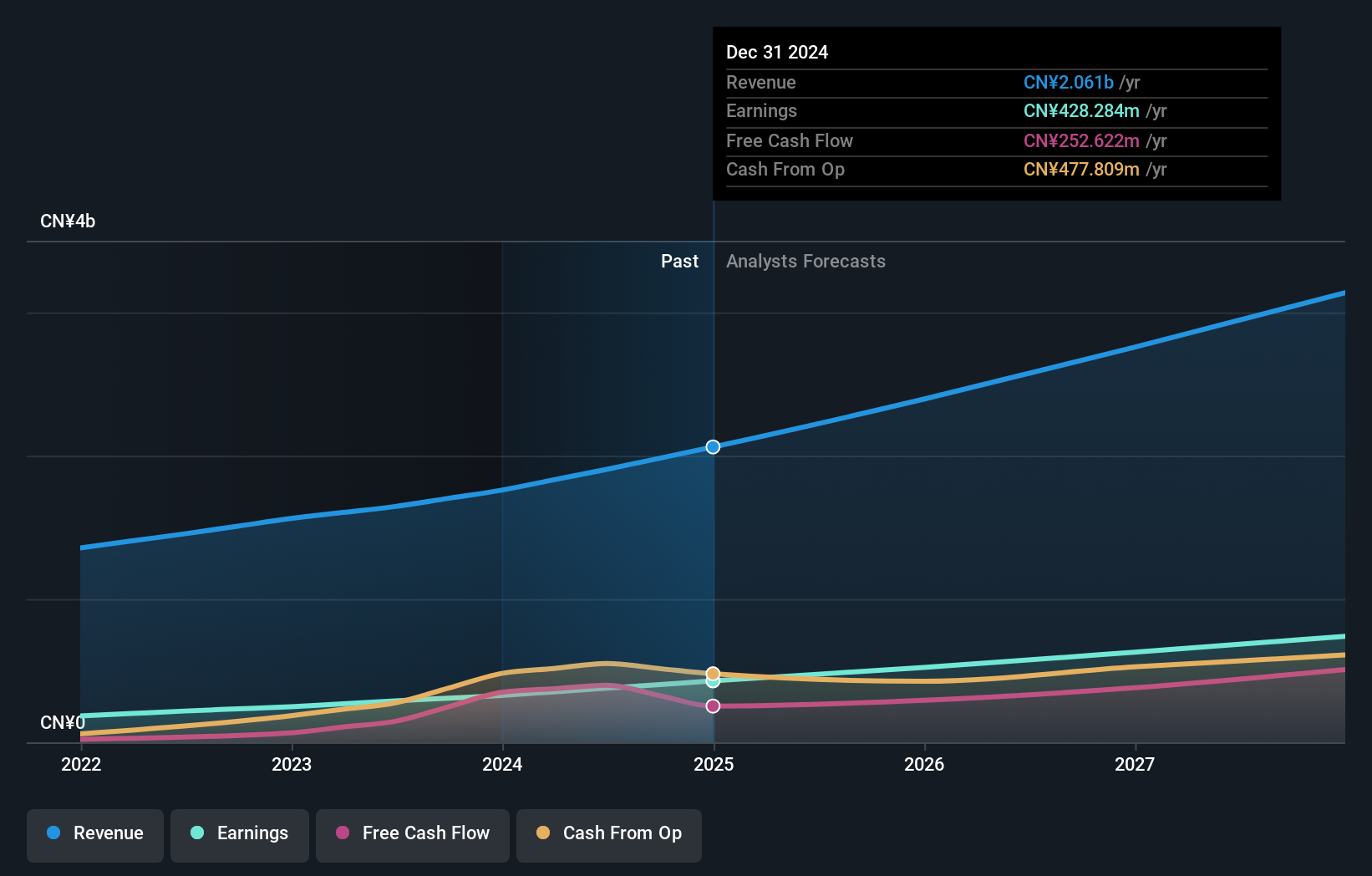

- UBS recently initiated coverage on Shanghai Conant Optical with a Buy rating and highlighted the company as the world’s second-largest spectacle lens producer by volume in 2024.

- The broker also pointed to the company’s traditional lens business and emerging smartglasses segment as key drivers of its long-term earnings potential.

- With these growth drivers in focus, we’ll now explore how UBS’s new coverage shapes Shanghai Conant Optical’s broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Shanghai Conant Optical's Investment Narrative?

To own Shanghai Conant Optical, you need to believe the company can keep compounding its core spectacle lens earnings while successfully opening up a new leg of growth in smartglasses, without overpaying for that promise. UBS’s initiation reinforces that narrative by spotlighting its global scale and smartglasses optionality, which may strengthen sentiment and near term attention but does not, on its own, change the underlying earnings or cash flows that matter most. The key short term catalysts still look tied to execution on high value lens mix, margin delivery against guidance and how the market reassesses a valuation already on a high earnings multiple after a very large one year total return. At the same time, UBS’s optimism raises the stakes on existing risks around board turnover, limited independence and high non cash earnings quality.

Yet behind the growth story, the combination of a high P/E and a still‑new board is easy to miss.

Shanghai Conant Optical's shares have been on the rise but are still potentially undervalued by 25%. Find out what it's worth.Exploring Other Perspectives

Simply Wall St Community members’ fair values range from HK$51.52 to HK$73.30 across 2 submissions, underlining how far apart views can be. Set that against a stock that already carries a rich earnings multiple and a powerful recent price run, and you can see why many investors are weighing execution risk in both the traditional lens and smartglasses businesses before committing fresh capital.

Explore 2 other fair value estimates on Shanghai Conant Optical - why the stock might be worth 7% less than the current price!

Build Your Own Shanghai Conant Optical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shanghai Conant Optical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shanghai Conant Optical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shanghai Conant Optical's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2276

Shanghai Conant Optical

Manufactures and sells resin spectacle lenses in Mainland China, the Americas, Asia, Europe, Oceania, and Africa.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion