- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2252

Shanghai MicroPort MedBot (Group) (HKG:2252) dips 8.3% this week as increasing losses might not be inspiring confidence among its investors

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Shanghai MicroPort MedBot (Group) Co., Ltd. (HKG:2252) share price is down 12% in the last year. That's disappointing when you consider the market declined 0.5%. Shanghai MicroPort MedBot (Group) may have better days ahead, of course; we've only looked at a one year period. It's down 41% in about a quarter.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Shanghai MicroPort MedBot (Group)

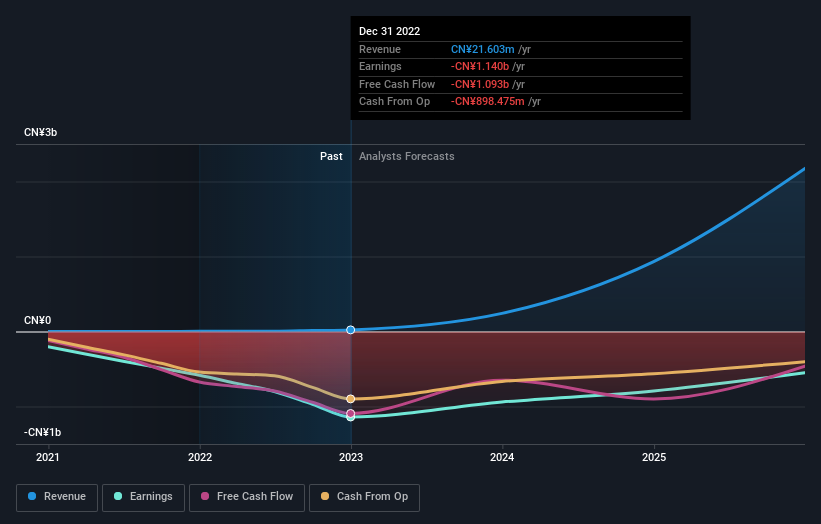

Given that Shanghai MicroPort MedBot (Group) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Shanghai MicroPort MedBot (Group) grew its revenue by 905% over the last year. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 12% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Shanghai MicroPort MedBot (Group) shareholders are down 12% for the year, even worse than the market loss of 0.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's worth noting that the last three months did the real damage, with a 41% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Shanghai MicroPort MedBot (Group) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2252

Shanghai MicroPort MedBot (Group)

Shanghai MicroPort MedBot (Group) Co., Ltd.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives