- Hong Kong

- /

- Healthtech

- /

- SEHK:2251

Beijing Airdoc Technology Co., Ltd.'s (HKG:2251) Shares Leap 28% Yet They're Still Not Telling The Full Story

Beijing Airdoc Technology Co., Ltd. (HKG:2251) shares have had a really impressive month, gaining 28% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

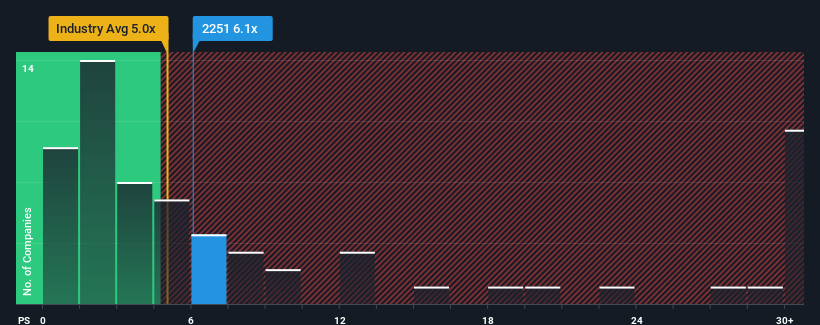

In spite of the firm bounce in price, it's still not a stretch to say that Beijing Airdoc Technology's price-to-sales (or "P/S") ratio of 6.1x right now seems quite "middle-of-the-road" compared to the Healthcare Services industry in Hong Kong, where the median P/S ratio is around 5.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Beijing Airdoc Technology

How Has Beijing Airdoc Technology Performed Recently?

Recent times have been advantageous for Beijing Airdoc Technology as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Beijing Airdoc Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Beijing Airdoc Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Beijing Airdoc Technology would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. The strong recent performance means it was also able to grow revenue by 137% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 54% each year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 16% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Beijing Airdoc Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Beijing Airdoc Technology's P/S?

Beijing Airdoc Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beijing Airdoc Technology currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Beijing Airdoc Technology with six simple checks on some of these key factors.

If you're unsure about the strength of Beijing Airdoc Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Airdoc Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2251

Beijing Airdoc Technology

Provides artificial intelligence (AI) empowered retina-based early detection, diagnosis, and health risk assessment solutions for medical institutions, consumer healthcare environments, and eye health management settings in Mainland China and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives