- China

- /

- Basic Materials

- /

- SZSE:300767

Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In a week marked by global rate cuts and mixed performances across major indices, the Nasdaq Composite stood out by reaching a record high, driven largely by growth stocks. With inflation showing signs of stalling and labor markets cooling, expectations for further monetary easing are rising, creating an intriguing backdrop for investors seeking opportunities in high-growth companies with significant insider ownership. In such an environment, stocks that combine robust growth potential with strong insider confidence can offer compelling prospects for those looking to navigate the current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

MicroTech Medical (Hangzhou) (SEHK:2235)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MicroTech Medical (Hangzhou) Co., Ltd. focuses on the research, development, manufacture, and sale of medical devices for diabetes monitoring, treatment, and management both in China and internationally with a market cap of HK$2.13 billion.

Operations: The company generates CN¥293.23 million from its segment focused on the research, development, manufacture, and sales of medical devices for diabetes care.

Insider Ownership: 25.9%

Revenue Growth Forecast: 41% p.a.

MicroTech Medical (Hangzhou) is projected to experience significant growth, with revenue expected to increase by 41% annually, outpacing the Hong Kong market's average. Earnings are forecasted to grow substantially at 104.97% per year, and the company is anticipated to become profitable within three years. Despite limited recent insider trading activity, a share buyback completed in May demonstrates management's confidence in its prospects, repurchasing shares worth HK$22.86 million since January 2024.

- Click here to discover the nuances of MicroTech Medical (Hangzhou) with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that MicroTech Medical (Hangzhou) is trading beyond its estimated value.

Asia Cuanon Technology (Shanghai)Ltd (SHSE:603378)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asia Cuanon Technology (Shanghai) Ltd, with a market cap of CN¥3.04 billion, operates in the construction materials industry, specializing in the production and sale of insulation and decorative materials.

Operations: Asia Cuanon Technology (Shanghai) Ltd generates its revenue primarily from the production and sale of insulation and decorative materials within the construction materials industry.

Insider Ownership: 15.6%

Revenue Growth Forecast: 16.5% p.a.

Asia Cuanon Technology (Shanghai) is forecasted to achieve revenue growth of 16.5% annually, surpassing the CN market average. Despite recent financial setbacks, including a net loss of CNY 18.6 million for the first nine months of 2024, it remains well-valued compared to peers. A recent acquisition by Zhuhai Hengqin Caidong Fund Management highlights investor interest, acquiring a 5.14% stake for approximately CNY 170 million, signaling confidence in its future potential despite current challenges with debt coverage and dividend sustainability.

- Take a closer look at Asia Cuanon Technology (Shanghai)Ltd's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Asia Cuanon Technology (Shanghai)Ltd's share price might be too pessimistic.

QuakeSafe Technologies (SZSE:300767)

Simply Wall St Growth Rating: ★★★★★☆

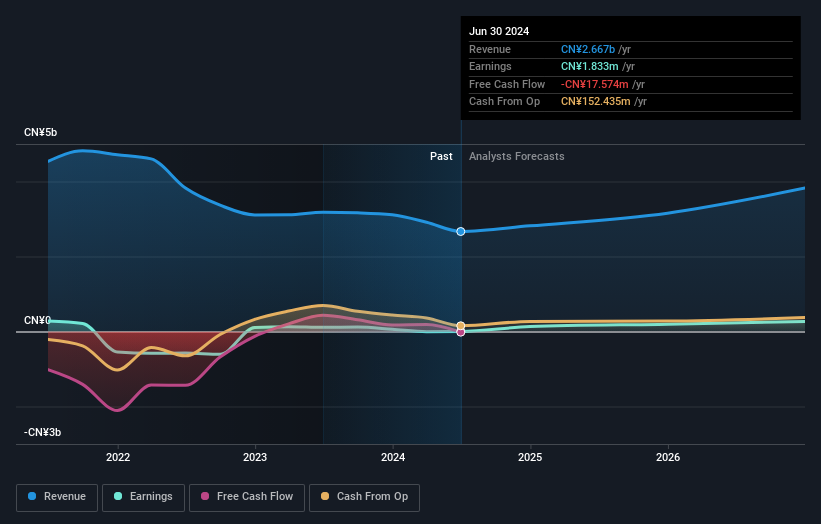

Overview: QuakeSafe Technologies Co., Ltd. develops, produces, and sells anti-seismic and shock absorber products in China with a market cap of CN¥2.82 billion.

Operations: QuakeSafe Technologies generates revenue through the development, production, and sale of anti-seismic and shock absorber products in China.

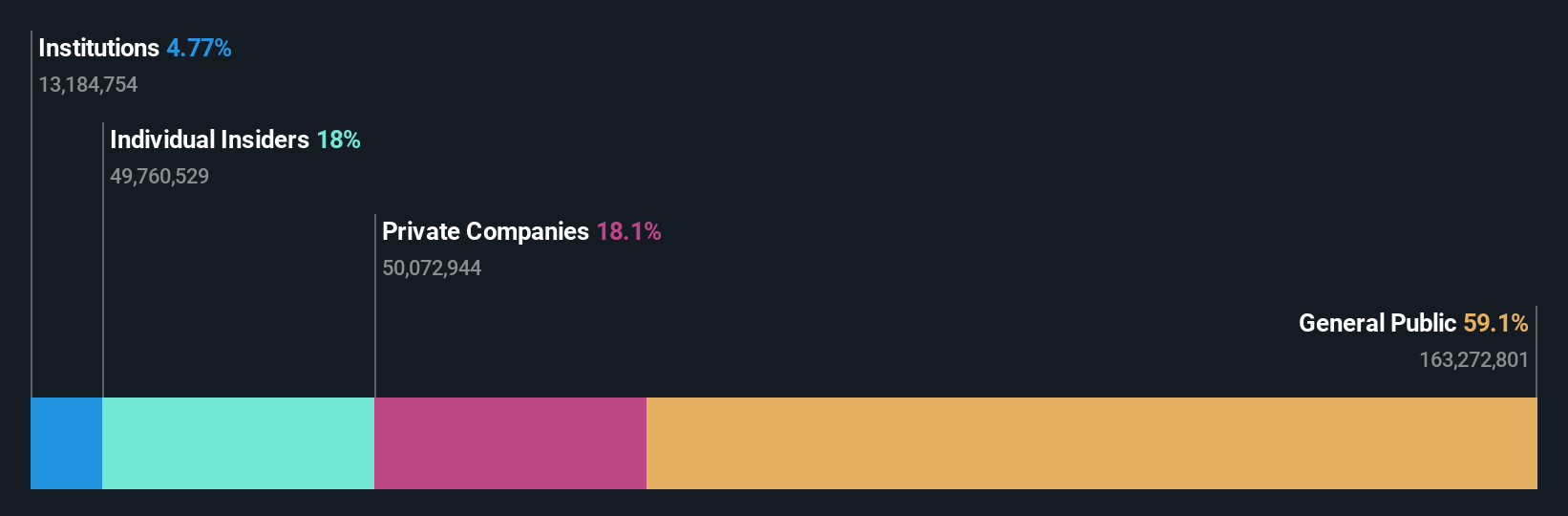

Insider Ownership: 20.3%

Revenue Growth Forecast: 29.1% p.a.

QuakeSafe Technologies has experienced a volatile share price recently but is considered undervalued, trading at 82.1% below its estimated fair value. Despite posting a net loss of CNY 56.84 million for the first nine months of 2024, it is expected to achieve profitability within three years with revenue growth forecasted at 29.1% annually, outpacing the Chinese market average. However, its return on equity remains low and insider trading activity appears minimal over the past three months.

- Dive into the specifics of QuakeSafe Technologies here with our thorough growth forecast report.

- Our valuation report here indicates QuakeSafe Technologies may be overvalued.

Key Takeaways

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1516 more companies for you to explore.Click here to unveil our expertly curated list of 1519 Fast Growing Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if QuakeSafe Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300767

QuakeSafe Technologies

Develops, produces, and sells anti-seismic products and shock absorber products in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives