- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2219

Earnings Report: Chaoju Eye Care Holdings Limited Missed Revenue Estimates By 7.9%

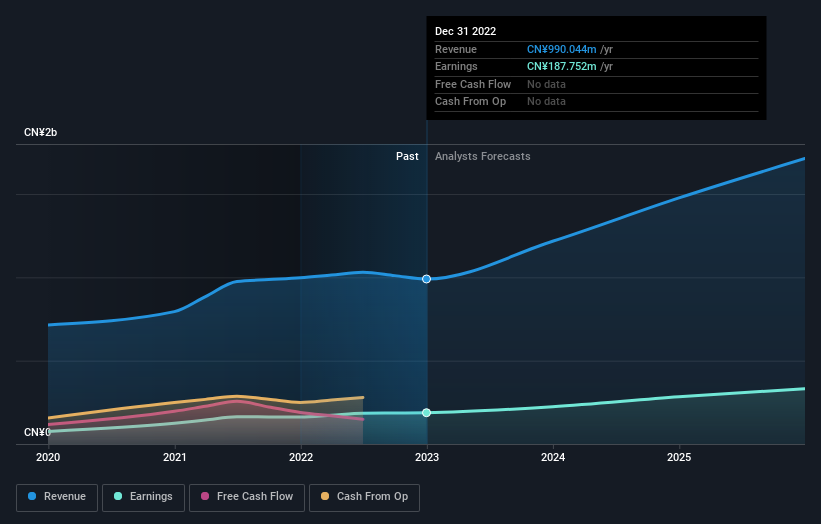

As you might know, Chaoju Eye Care Holdings Limited (HKG:2219) recently reported its yearly numbers. Revenues came in 7.9% below expectations, at CN¥990m. Statutory earnings per share were relatively better off, with a per-share profit of CN¥0.27 being roughly in line with analyst estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

View our latest analysis for Chaoju Eye Care Holdings

Following the latest results, Chaoju Eye Care Holdings' three analysts are now forecasting revenues of CN¥1.22b in 2023. This would be a substantial 23% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to shoot up 24% to CN¥0.33. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥1.32b and earnings per share (EPS) of CN¥0.34 in 2023. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

Despite the cuts to forecast earnings, there was no real change to the HK$7.38 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Chaoju Eye Care Holdings, with the most bullish analyst valuing it at HK$7.75 and the most bearish at HK$7.00 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Chaoju Eye Care Holdings' rate of growth is expected to accelerate meaningfully, with the forecast 23% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 11% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 14% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Chaoju Eye Care Holdings to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Chaoju Eye Care Holdings. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Chaoju Eye Care Holdings. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Chaoju Eye Care Holdings going out to 2025, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 2 warning signs for Chaoju Eye Care Holdings that you need to be mindful of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2219

Chaoju Eye Care Holdings

Owns and operates a network of ophthalmic hospitals and optical centers in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives