- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2211

How Much Is Universal Health International Group Holding Limited (HKG:2211) CEO Getting Paid?

Dongtao Jin became the CEO of Universal Health International Group Holding Limited (HKG:2211) in 2017, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Universal Health International Group Holding pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Universal Health International Group Holding

How Does Total Compensation For Dongtao Jin Compare With Other Companies In The Industry?

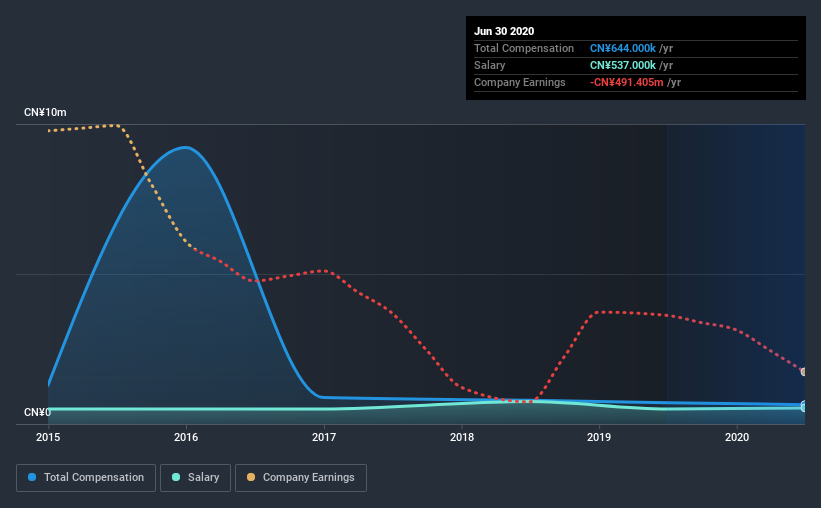

At the time of writing, our data shows that Universal Health International Group Holding Limited has a market capitalization of HK$153m, and reported total annual CEO compensation of CN¥644k for the year to June 2020. That's a notable decrease of 9.0% on last year. We note that the salary portion, which stands at CN¥537.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.7m. This suggests that Dongtao Jin is paid below the industry median. What's more, Dongtao Jin holds HK$2.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥537k | CN¥501k | 83% |

| Other | CN¥107k | CN¥207k | 17% |

| Total Compensation | CN¥644k | CN¥708k | 100% |

On an industry level, roughly 91% of total compensation represents salary and 9.4% is other remuneration. There isn't a significant difference between Universal Health International Group Holding and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Universal Health International Group Holding Limited's Growth

Over the past three years, Universal Health International Group Holding Limited has seen its earnings per share (EPS) grow by 18% per year. In the last year, its revenue is down 38%.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Universal Health International Group Holding Limited Been A Good Investment?

With a three year total loss of 77% for the shareholders, Universal Health International Group Holding Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, Universal Health International Group Holding Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, the company has impressed with its EPS growth over three years. Although we would've liked to see positive investor returns, it would be bold of us to criticize CEO compensation when EPS are up. But shareholders will likely want to hold off on any raise for Dongtao until investor returns are positive.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for Universal Health International Group Holding (2 are a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Universal Health International Group Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2211

Universal Health International Group Holding

An investment holding company, distributes and retails drugs, healthcare products, and other pharmaceutical products in the northeastern region of the People’s Republic of China.

Slight with mediocre balance sheet.

Market Insights

Community Narratives