- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1989

If You Like EPS Growth Then Check Out Pine Care Group (HKG:1989) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Pine Care Group (HKG:1989). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Pine Care Group

How Fast Is Pine Care Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Pine Care Group has grown EPS by 19% per year, compound, in the last three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Pine Care Group is growing revenues, and EBIT margins improved by 4.8 percentage points to 14%, over the last year. That's great to see, on both counts.

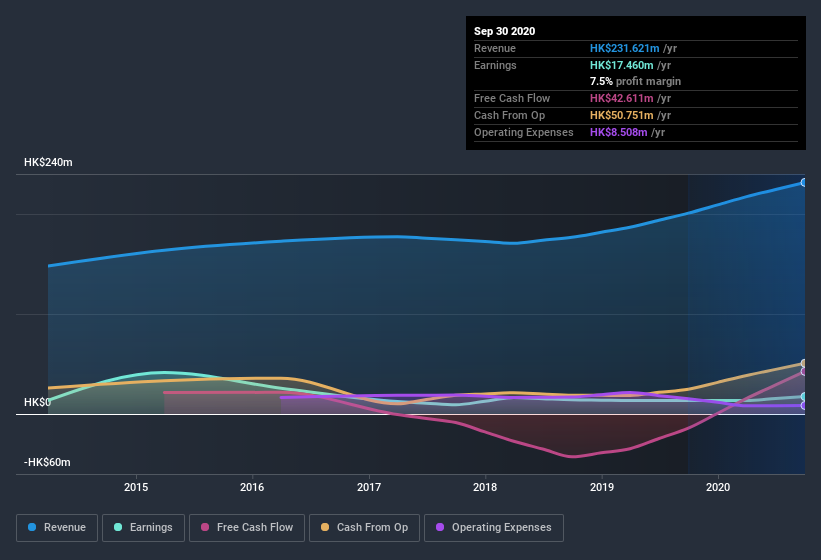

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Pine Care Group isn't a huge company, given its market capitalization of HK$1.1b. That makes it extra important to check on its balance sheet strength.

Are Pine Care Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth -HK$243m) this was overshadowed by a mountain of buying, totalling HK$396m in just one year. I find this encouraging because it suggests they are optimistic about the Pine Care Group's future. Zooming in, we can see that the biggest insider purchase was by Executive Chairman Yiu Sing Tang for HK$138m worth of shares, at about HK$1.65 per share.

On top of the insider buying, we can also see that Pine Care Group insiders own a large chunk of the company. In fact, they own 67% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have HK$720m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Yip Keung Chan, is paid less than the median for similar sized companies. For companies with market capitalizations under HK$1.6b, like Pine Care Group, the median CEO pay is around HK$1.8m.

The Pine Care Group CEO received total compensation of just HK$738k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Pine Care Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Pine Care Group's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Even so, be aware that Pine Care Group is showing 4 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Pine Care Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Pine Care Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1989

Pine Care Group

Pine Care Group Limited, together with its subsidiaries, provides elderly home care services in Hong Kong.

Weak fundamentals or lack of information.

Similar Companies

Market Insights

Community Narratives