- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

IVD Medical Holding's(HKG:1931) Share Price Is Down 28% Over The Past Year.

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the IVD Medical Holding Limited (HKG:1931) share price slid 28% over twelve months. That's well below the market return of 12%. We wouldn't rush to judgement on IVD Medical Holding because we don't have a long term history to look at. Furthermore, it's down 17% in about a quarter. That's not much fun for holders.

See our latest analysis for IVD Medical Holding

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

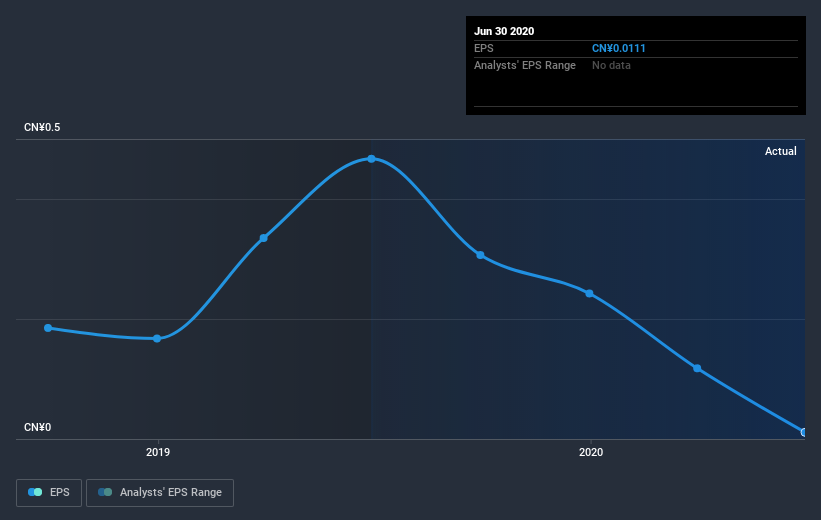

Unhappily, IVD Medical Holding had to report a 98% decline in EPS over the last year. The share price fall of 28% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. With a P/E ratio of 165.53, it's fair to say the market sees an EPS rebound on the cards.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Given that the market gained 12% in the last year, IVD Medical Holding shareholders might be miffed that they lost 27% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 17%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand IVD Medical Holding better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for IVD Medical Holding you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade IVD Medical Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives