- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

IVD Medical Holding (HKG:1931) Is Increasing Its Dividend To CN¥0.0556

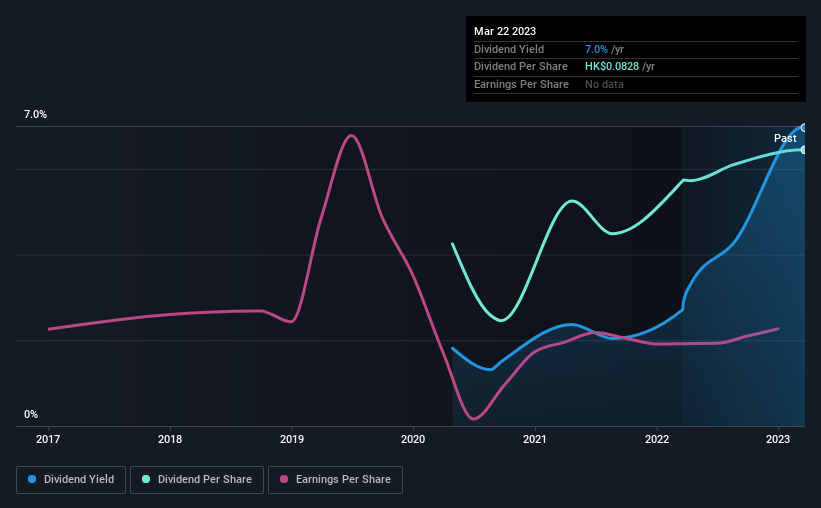

IVD Medical Holding Limited (HKG:1931) has announced that it will be increasing its dividend from last year's comparable payment on the 6th of June to CN¥0.0556. This will take the annual payment to 7.0% of the stock price, which is above what most companies in the industry pay.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. IVD Medical Holding's stock price has reduced by 39% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

View our latest analysis for IVD Medical Holding

IVD Medical Holding's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment was quite easily covered by earnings, but it made up 443% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Unless the company can turn things around, EPS could fall by 2.9% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 54%, which is definitely feasible to continue.

IVD Medical Holding's Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The dividend has gone from an annual total of CN¥0.0479 in 2020 to the most recent total annual payment of CN¥0.0727. This means that it has been growing its distributions at 15% per annum over that time. IVD Medical Holding has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend's Growth Prospects Are Limited

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. IVD Medical Holding has seen earnings per share falling at 2.9% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

IVD Medical Holding's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think IVD Medical Holding's payments are rock solid. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We don't think IVD Medical Holding is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for IVD Medical Holding that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade IVD Medical Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives