Undervalued Small Caps With Insider Activity To Watch In November 2024

Reviewed by Simply Wall St

In the current market landscape, small-cap stocks have demonstrated resilience, holding up better than their large-cap counterparts despite a busy earnings week that left major indices mostly lower. As investors navigate through mixed economic signals and cautious corporate earnings reports, identifying potential opportunities in the small-cap segment requires a focus on companies with strong fundamentals and strategic insider activity.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.9x | 0.6x | 34.73% | ★★★★★★ |

| Hanover Bancorp | 10.2x | 2.3x | 43.28% | ★★★★★☆ |

| Paradeep Phosphates | 24.6x | 0.8x | 27.20% | ★★★★★☆ |

| Maharashtra Seamless | 10.0x | 1.7x | 35.44% | ★★★★★☆ |

| Optima Health | NA | 1.3x | 36.45% | ★★★★☆☆ |

| Semen Indonesia (Persero) | 21.0x | 0.7x | 30.13% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.9x | 1.7x | -47.87% | ★★★☆☆☆ |

| Avia Avian | 17.8x | 4.1x | 2.44% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Bajel Projects | 259.3x | 2.0x | 26.35% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

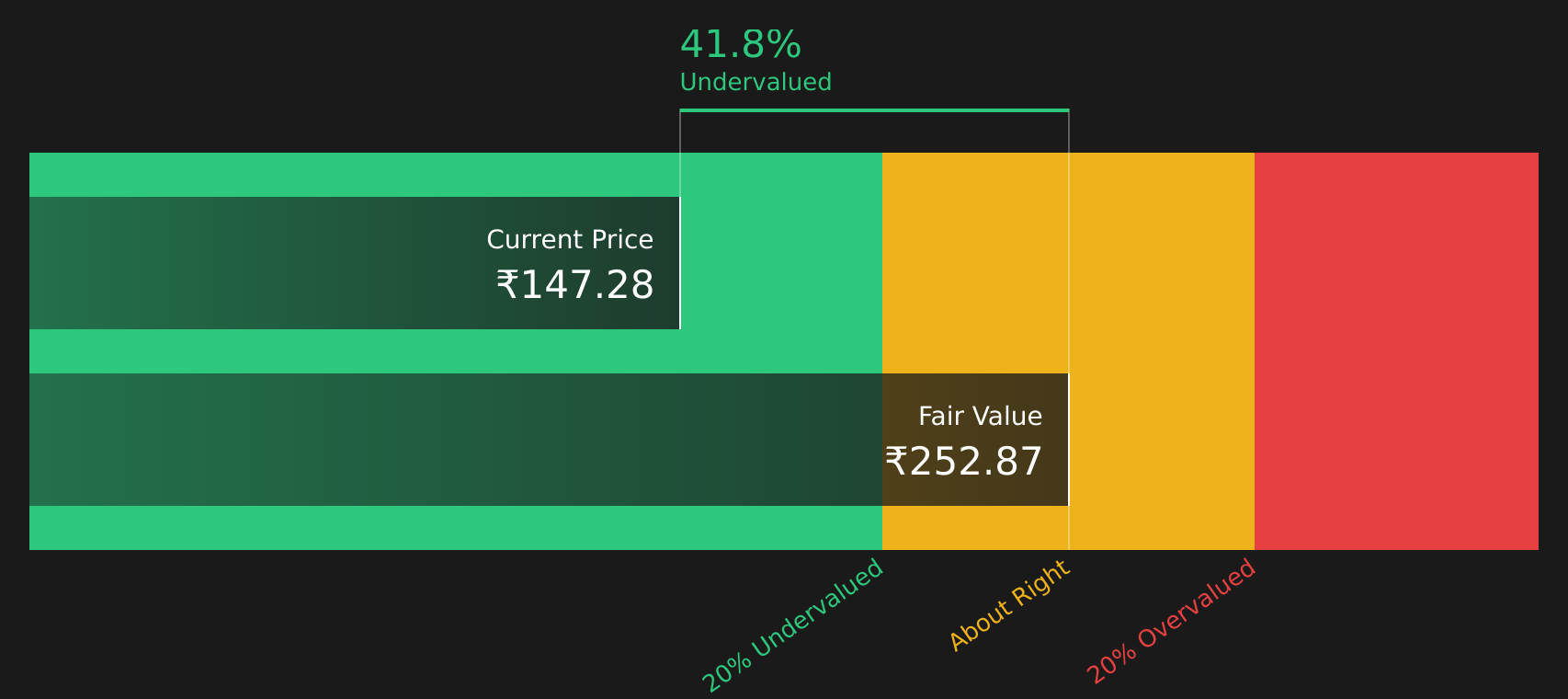

Bajel Projects (NSEI:BAJEL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bajel Projects focuses on power transmission and distribution, with a market capitalization of ₹1.27 billion.

Operations: Bajel Projects generates its revenue primarily from the Power Transmission and Power Distribution segment, with recent figures showing ₹14.76 billion in this area. The company experienced fluctuations in its gross profit margin, ranging from -7.48% to 32.53% over the observed periods, indicating variability in cost management and pricing strategies. Operating expenses include significant allocations towards general and administrative costs, which have varied across different quarters but reached up to ₹902.73 million recently.

PE: 259.3x

Bajel Projects, a smaller company in its sector, has recently seen insider confidence with Maneck Davar acquiring 25,000 shares for approximately ₹6.71 million in October 2024. Despite facing regulatory challenges from the Maharashtra Pollution Control Board requiring a new ₹1 million bank guarantee, Bajel's financials show promise. For Q1 ending June 2024, sales surged to ₹5.06 billion from ₹1.97 billion year-on-year, and net income rebounded to ₹55 million from a previous loss of ₹17 million.

- Get an in-depth perspective on Bajel Projects' performance by reading our valuation report here.

Examine Bajel Projects' past performance report to understand how it has performed in the past.

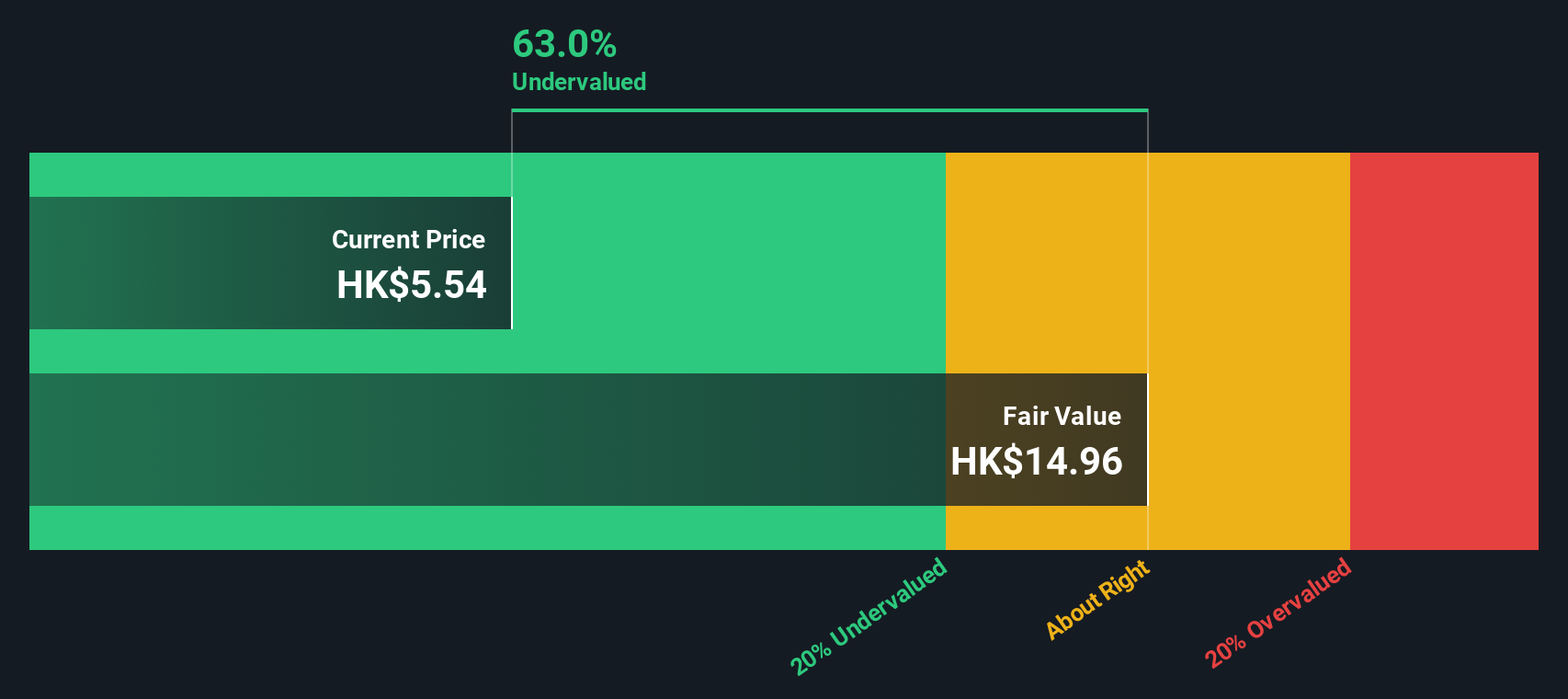

Xtep International Holdings (SEHK:1368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xtep International Holdings is a Chinese company specializing in the design, development, and manufacturing of sportswear products, with a market capitalization of CN¥22.34 billion.

Operations: The company's revenue primarily comes from the Mass Market segment, with significant contributions from Athleisure and Professional Sports. The gross profit margin has shown an upward trend, reaching 43.70% as of June 2024. Operating expenses are largely driven by sales and marketing activities, which have consistently been a substantial part of the cost structure.

PE: 12.3x

Xtep International Holdings, a player in the athletic apparel industry, is expanding its footprint with the opening of its first store in Malaysia. The company's earnings for H1 2024 showed growth, with sales reaching CNY 7.2 billion and net income at CNY 752 million. Insider confidence is evident as they have been purchasing shares recently. Xtep's innovative product launches, like the 160X 6.0 series racing shoe, highlight its commitment to technology and performance enhancement for athletes worldwide.

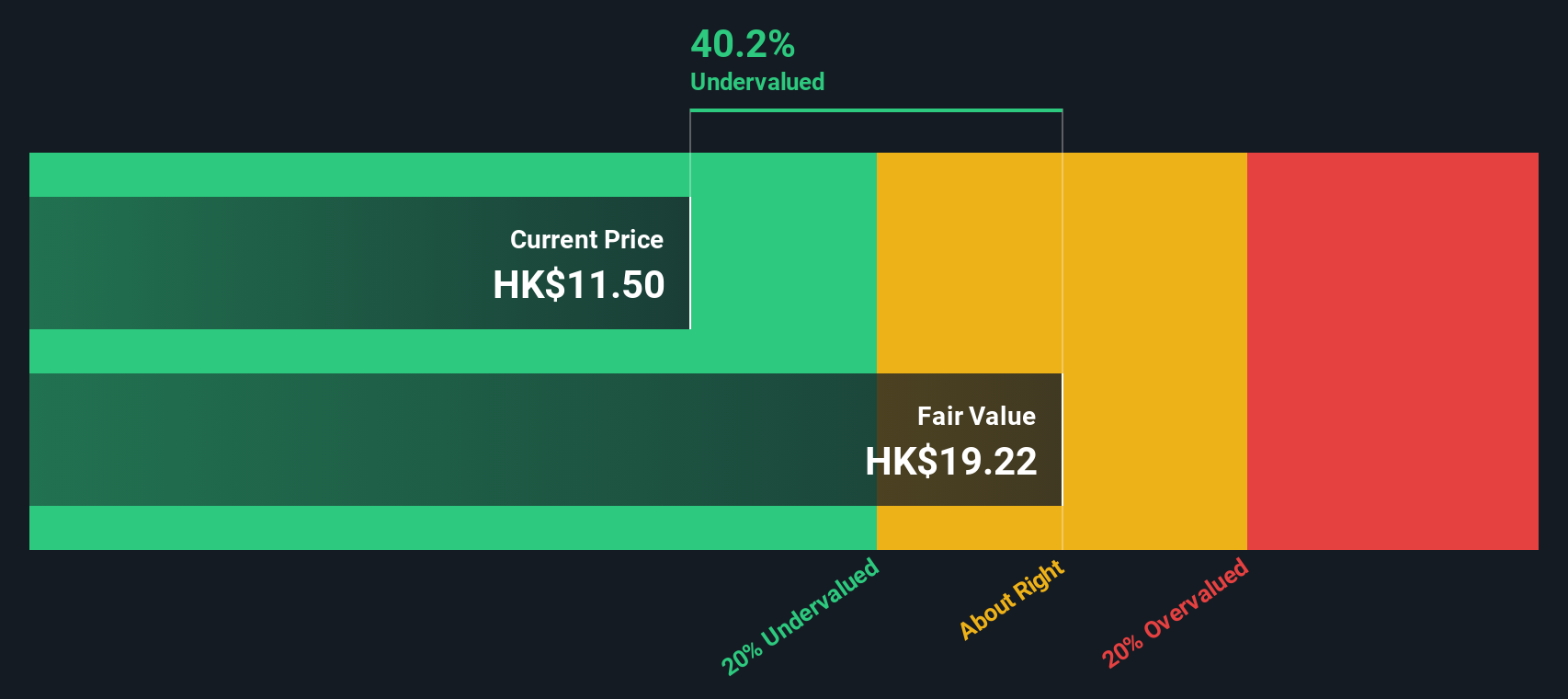

Beijing Chunlizhengda Medical Instruments (SEHK:1858)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Beijing Chunlizhengda Medical Instruments specializes in the manufacture and trading of surgical implants, instruments, and related products, with a market capitalization of approximately HK$3.62 billion.

Operations: The company generates revenue primarily from the manufacture and trading of surgical implants, instruments, and related products. Over the recent periods, its gross profit margin has shown a trend with fluctuations, reaching 70.04% in the latest period. Operating expenses are significant, driven by sales and marketing as well as research and development costs.

PE: 18.7x

Beijing Chunlizhengda Medical Instruments, a smaller company in the medical sector, has experienced a recent dip in financial performance with nine-month sales at CNY 508.28 million and net income at CNY 61.15 million, both lower than last year. Despite this, insider confidence is evident through share repurchases totaling CNY 5.04 million from June to September 2024. Additionally, the company announced an interim dividend of RMB 0.83 per ten shares for H Shareholders in October, reflecting ongoing shareholder value efforts amidst challenging conditions.

Key Takeaways

- Click here to access our complete index of 177 Undervalued Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1368

Xtep International Holdings

Designs, develops, manufactures, markets, and sells sports footwear, apparel, and accessories for adults and children in Mainland China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives