- China

- /

- Basic Materials

- /

- SZSE:002596

Undervalued Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets continue to reach new heights, driven by optimism around potential trade deals and advancements in artificial intelligence, investors are exploring various avenues for growth. Penny stocks, a term that may feel outdated but still relevant today, represent opportunities in smaller or newer companies often overlooked by mainstream investors. By focusing on those with strong financials and clear growth potential, these stocks can offer value without the typical risks associated with this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,724 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

New Century Healthcare Holding (SEHK:1518)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Century Healthcare Holding Co. Limited is an investment holding company that offers healthcare services to women and children in the People’s Republic of China, with a market cap of HK$483.18 million.

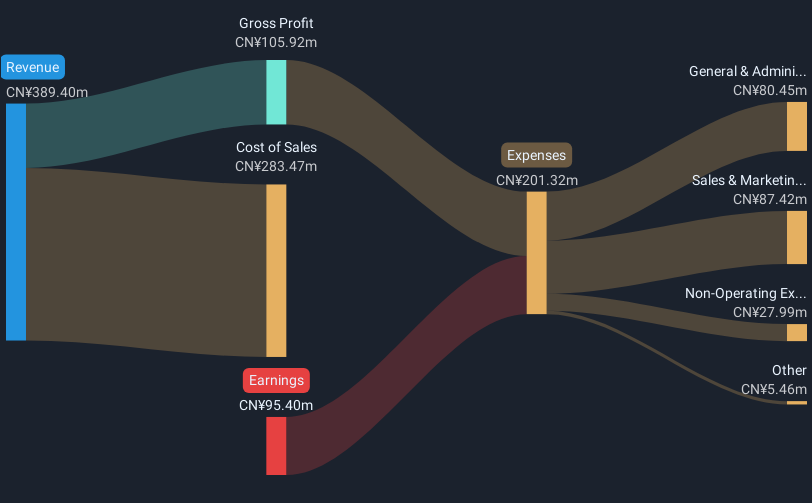

Operations: The company generates revenue primarily from its Pediatrics segment, contributing CN¥821.90 million, and its Obstetrics and Gynecology segment, which adds CN¥101.85 million.

Market Cap: HK$483.18M

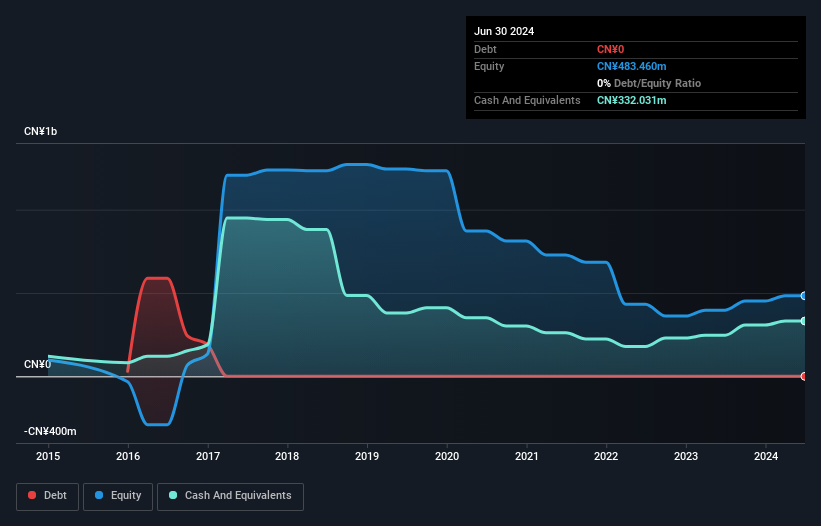

New Century Healthcare Holding has recently become profitable, marking a significant shift in its financial trajectory. The company demonstrates strong financial health with short-term assets of CN¥447.4 million exceeding both short and long-term liabilities, and it operates debt-free. Its earnings have grown by 20.2% annually over the past five years, supported by high-quality earnings and a robust return on equity of 28.2%. Trading significantly below its estimated fair value suggests potential undervaluation, although investors should note its unstable dividend history and stable but notable weekly volatility of 8%.

- Click here and access our complete financial health analysis report to understand the dynamics of New Century Healthcare Holding.

- Gain insights into New Century Healthcare Holding's historical outcomes by reviewing our past performance report.

Hubei Mailyard ShareLtd (SHSE:600107)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hubei Mailyard Share Co., Ltd, along with its subsidiaries, is involved in the manufacture, processing, and sale of clothes, apparel, textiles, and accessories both in China and internationally, with a market cap of CN¥1.52 billion.

Operations: Hubei Mailyard Share Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.52B

Hubei Mailyard Share Co., Ltd faces challenges with declining sales and increasing losses, reporting a net loss of CN¥48.56 million for the nine months ended September 2024. Despite unprofitability, the company maintains financial stability with short-term assets of CN¥656.8 million covering both its short- and long-term liabilities, and it holds more cash than debt. The management team is relatively experienced, though the board is newer. While earnings have declined significantly over five years, shareholders haven't faced dilution recently. The company's cash runway extends beyond a year if current free cash flow trends persist despite historical reductions.

- Click here to discover the nuances of Hubei Mailyard ShareLtd with our detailed analytical financial health report.

- Learn about Hubei Mailyard ShareLtd's historical performance here.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd specializes in the production and sale of commercial concrete and cement in China, with a market capitalization of CN¥3.58 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥1.52 billion.

Market Cap: CN¥3.58B

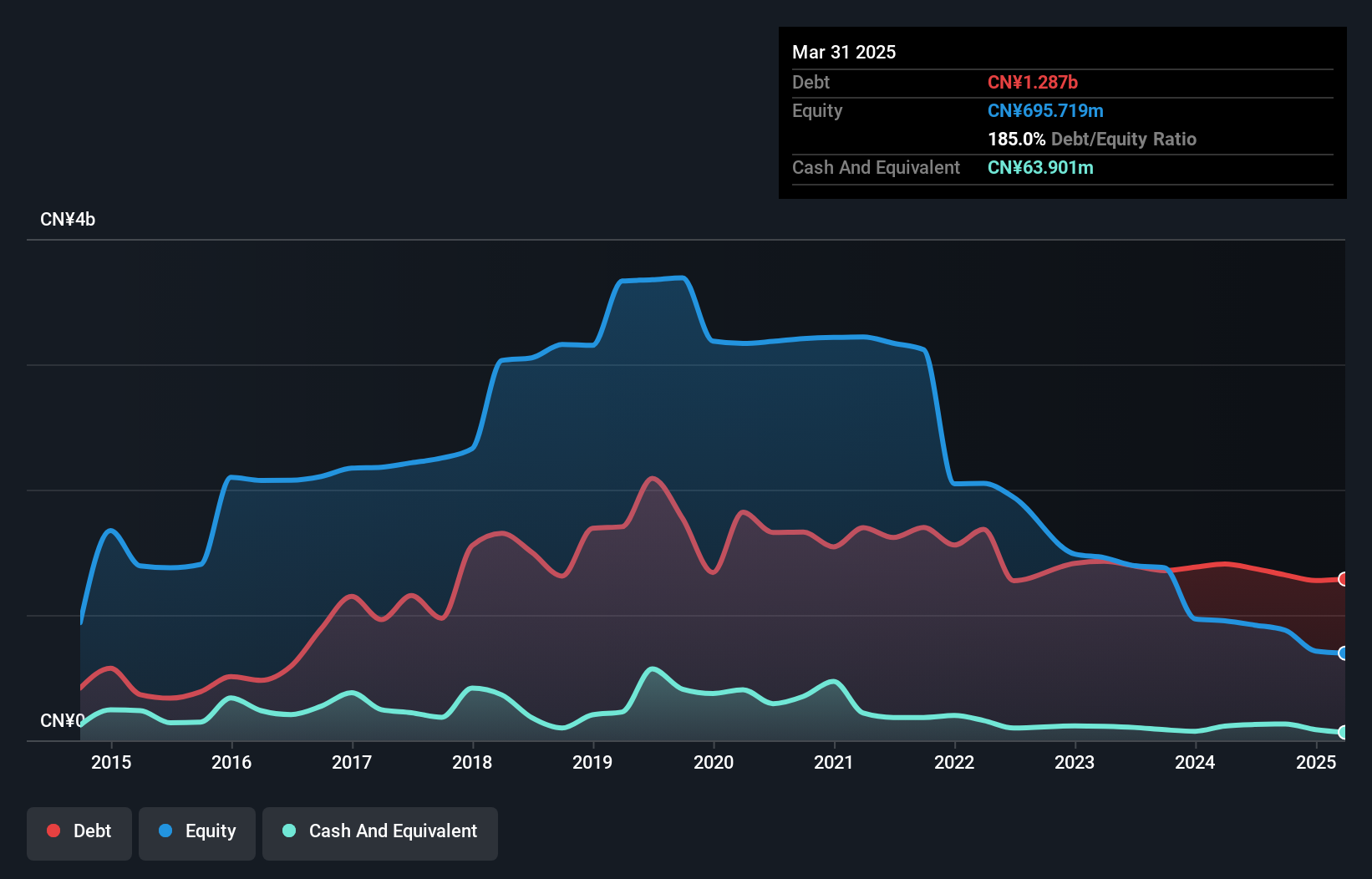

Hainan RuiZe New Building Material Co., Ltd is experiencing financial difficulties, with a net loss of CN¥87.03 million for the nine months ending September 2024, despite generating sales of CN¥1.04 billion. The company remains unprofitable and has seen increased losses over the past five years. However, it maintains sufficient short-term assets to cover its liabilities and boasts a seasoned management team with an average tenure of over ten years. Shareholders have not faced dilution recently, but the company's high net debt to equity ratio indicates significant leverage challenges ahead amidst ongoing volatility in share price performance.

- Get an in-depth perspective on Hainan RuiZe New Building MaterialLtd's performance by reading our balance sheet health report here.

- Explore historical data to track Hainan RuiZe New Building MaterialLtd's performance over time in our past results report.

Where To Now?

- Explore the 5,724 names from our Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hainan RuiZe New Building MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002596

Hainan RuiZe New Building MaterialLtd

Produces and sells commercial concrete and cement in China.

Adequate balance sheet minimal.

Market Insights

Community Narratives