- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1518

The five-year underlying earnings growth at New Century Healthcare Holding (HKG:1518) is promising, but the shareholders are still in the red over that time

While it may not be enough for some shareholders, we think it is good to see the New Century Healthcare Holding Co. Limited (HKG:1518) share price up 18% in a single quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 67% in the period. So we're not so sure if the recent bounce should be celebrated. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for New Century Healthcare Holding

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, New Century Healthcare Holding moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 7.5% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

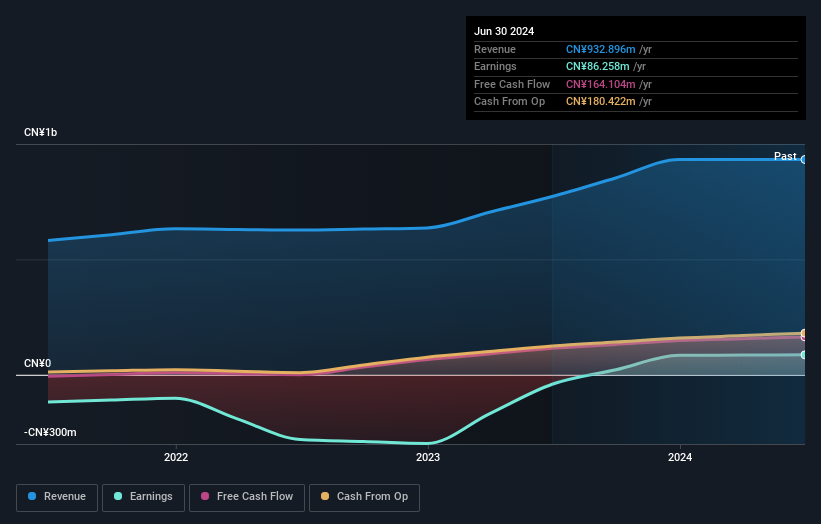

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that New Century Healthcare Holding shareholders have received a total shareholder return of 37% over one year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with New Century Healthcare Holding .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if New Century Healthcare Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1518

New Century Healthcare Holding

An investment holding company, provides healthcare services to women and children in the People’s Republic of China.

Flawless balance sheet and good value.