- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1515

Broker Revenue Forecasts For China Resources Medical Holdings Company Limited (HKG:1515) Are Surging Higher

Celebrations may be in order for China Resources Medical Holdings Company Limited (HKG:1515) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline. The stock price has risen 8.3% to HK$9.75 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

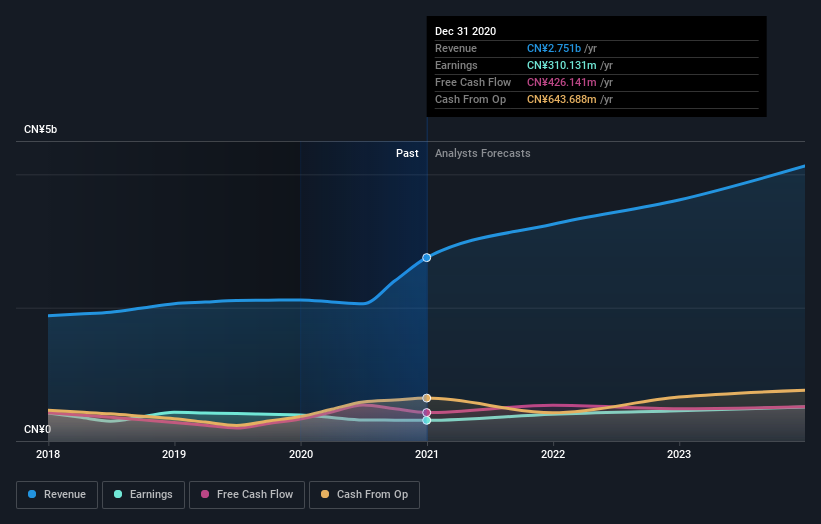

Following the upgrade, the current consensus from China Resources Medical Holdings' four analysts is for revenues of CN¥3.3b in 2021 which - if met - would reflect a meaningful 18% increase on its sales over the past 12 months. Per-share earnings are expected to soar 35% to CN¥0.33. Previously, the analysts had been modelling revenues of CN¥2.9b and earnings per share (EPS) of CN¥0.33 in 2021. The forecasts seem more optimistic now, with a solid increase in revenue and a slight bump in earnings per share estimates.

Check out our latest analysis for China Resources Medical Holdings

It will come as no surprise to learn that the analysts have increased their price target for China Resources Medical Holdings 23% to CN¥6.72 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values China Resources Medical Holdings at CN¥11.68 per share, while the most bearish prices it at CN¥6.61. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting China Resources Medical Holdings' growth to accelerate, with the forecast 18% annualised growth to the end of 2021 ranking favourably alongside historical growth of 11% per annum over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 17% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that China Resources Medical Holdings is expected to grow at about the same rate as the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. There was also an upgrade to revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at China Resources Medical Holdings.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple China Resources Medical Holdings analysts - going out to 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade China Resources Medical Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1515

China Resources Medical Holdings

An investment holding company, provides general healthcare, hospital management, and other hospital-related services in the People’s Republic of China.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives