- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1345

China Pioneer Pharma Holdings (HKG:1345) Is Paying Out Less In Dividends Than Last Year

China Pioneer Pharma Holdings Limited (HKG:1345) is reducing its dividend to HK$0.056 on the 1st of January. However, the dividend yield of 9.3% is still a decent boost to shareholder returns.

See our latest analysis for China Pioneer Pharma Holdings

China Pioneer Pharma Holdings Doesn't Earn Enough To Cover Its Payments

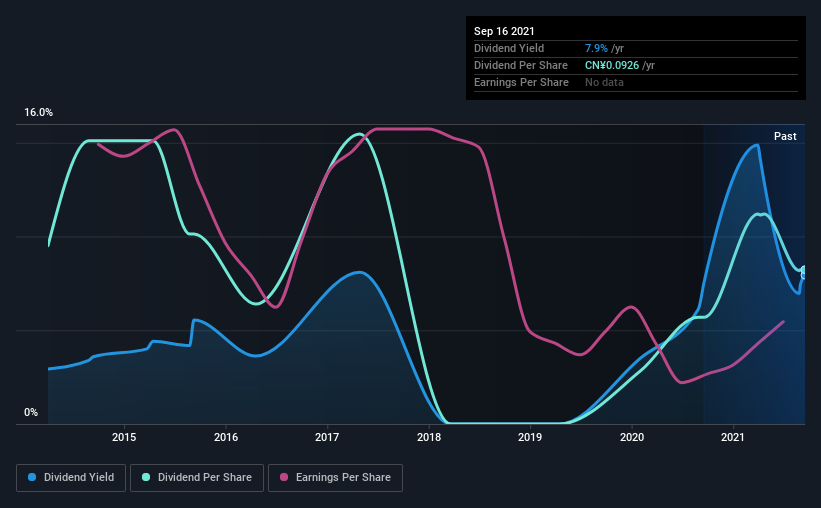

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, the dividend made up 145% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Looking forward, EPS could fall by 2.6% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 160%, which could put the dividend in jeopardy if the company's earnings don't improve.

China Pioneer Pharma Holdings' Dividend Has Lacked Consistency

Looking back, China Pioneer Pharma Holdings' dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. The dividend has gone from CN¥0.11 in 2014 to the most recent annual payment of CN¥0.093. This works out to be a decline of approximately 2.0% per year over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

China Pioneer Pharma Holdings May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. China Pioneer Pharma Holdings has seen earnings per share falling at 2.6% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

China Pioneer Pharma Holdings' Dividend Doesn't Look Great

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. We don't think that this is a great candidate to be an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for China Pioneer Pharma Holdings (1 makes us a bit uncomfortable!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Shanghai Pioneer Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1345

Shanghai Pioneer Holding

An investment holding company, markets, promotes, and sells pharmaceutical products and medical devices primarily in the People’s Republic of China.

Excellent balance sheet with questionable track record.