- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1302

Assessing LifeTech Scientific (SEHK:1302) Valuation Following Latest Board and Leadership Appointments

Reviewed by Simply Wall St

LifeTech Scientific (SEHK:1302) has unveiled a wave of board and leadership changes, highlighted by the appointment of Ms. Chen Dongxia as Independent Non-executive Director. Several seasoned executives are also joining the management team.

See our latest analysis for LifeTech Scientific.

LifeTech Scientific’s stock has caught the market’s attention recently, with a year-to-date share price return of 40.15%. This reflects renewed optimism following this fresh leadership lineup. While the last three years have delivered negative total shareholder returns, the combination of seasoned executive appointments and international business expansion efforts is feeding hopes for a longer-term turnaround and building positive momentum.

If strong management moves pique your interest, it could be the perfect moment to discover See the full list for free.

With the stock’s substantial rally this year and a notable discount to analyst targets still in place, investors are left to ask whether the recent turnaround is just getting started or if the market has already priced in LifeTech Scientific’s future growth.

Price-to-Earnings of 112.4x: Is it justified?

LifeTech Scientific trades at a high price-to-earnings ratio of 112.4x, which is well above its last close at HK$1.92 and indicates a steep premium compared to peers.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of a company’s earnings. In the medical equipment sector, this metric often reflects expectations about future profit growth, innovation, and market position.

A ratio this high suggests the market is pricing in significant future growth or potential, even though the company's earnings have actually declined over the past five years. Compared to the Hong Kong Medical Equipment industry average of 19.4x and a peer average of 31.7x, LifeTech’s valuation appears expensive and may be difficult to justify without a strong turnaround story.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 112.4x (OVERVALUED)

However, given LifeTech Scientific's recent history of declining earnings and inconsistent multi-year returns, optimism may be tested if fundamentals do not improve soon.

Find out about the key risks to this LifeTech Scientific narrative.

Another View: What Does the DCF Model Show?

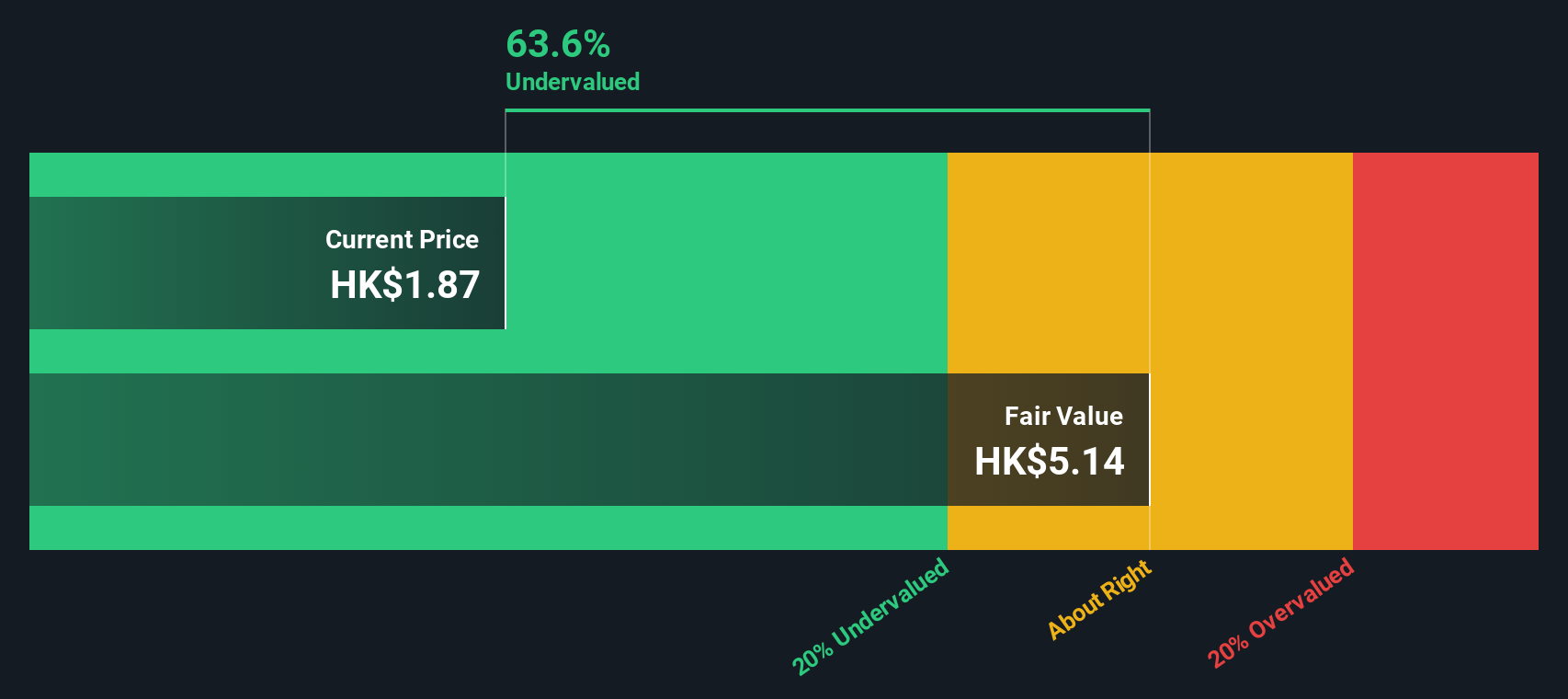

While the price-to-earnings ratio makes LifeTech Scientific look expensive, our DCF model offers a contrasting perspective. According to this approach, the stock trades around 62.6% below its estimated fair value. Could this deep discount point to overlooked upside, or does it reflect deeper concerns?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out LifeTech Scientific for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own LifeTech Scientific Narrative

If you see the numbers differently or want to investigate your own thesis, you can easily build a personalized view in just minutes. Do it your way

A great starting point for your LifeTech Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always on the lookout for the next opportunity. Use the Simply Wall Street Screener to find companies that align with your goals and stay ahead of the curve.

- Uncover potential hidden gems by checking out these 3564 penny stocks with strong financials with strong financials and the potential for growth.

- Access exciting market disruptors by browsing these 25 AI penny stocks that focus on advancements in artificial intelligence and automation.

- Target undervalued opportunities that others may overlook by using these 917 undervalued stocks based on cash flows to identify attractive picks based on comprehensive cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1302

LifeTech Scientific

An investment holding company, develops, manufactures, and trades in interventional medical devices for cardiovascular and peripheral vascular diseases and disorders in Mainland China, Europe, Rest of Asia, India, South America, Africa, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026