- Hong Kong

- /

- Real Estate

- /

- SEHK:1278

The five-year underlying earnings growth at China New Town Development (HKG:1278) is promising, but the shareholders are still in the red over that time

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding China New Town Development Company Limited (HKG:1278) during the five years that saw its share price drop a whopping 80%. And some of the more recent buyers are probably worried, too, with the stock falling 33% in the last year. On top of that, the share price is down 20% in the last week.

With the stock having lost 20% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for China New Town Development

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

China New Town Development became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 26% per year is viewed as evidence that China New Town Development is shrinking. That could explain the weak share price.

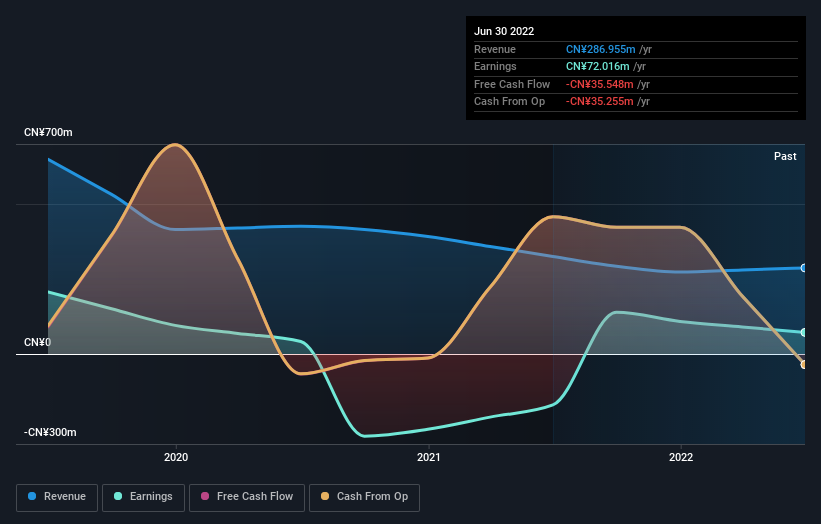

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. In some ways, TSR is a better measure of how well an investment has performed. Over the last 5 years, China New Town Development generated a TSR of -78%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We regret to report that China New Town Development shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 2.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - China New Town Development has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1278

China New Town Development

Operates as a new town developer in the People’s Republic of China and Hong Kong.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives