Owning 84% in Nongfu Spring Co., Ltd. (HKG:9633) means that insiders are heavily invested in the company's future

To get a sense of who is truly in control of Nongfu Spring Co., Ltd. (HKG:9633), it is important to understand the ownership structure of the business. With 84% stake, individual insiders possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

With such a notable stake in the company, insiders would be highly incentivised to make value accretive decisions.

Let's take a closer look to see what the different types of shareholders can tell us about Nongfu Spring.

Our analysis indicates that 9633 is potentially overvalued!

What Does The Institutional Ownership Tell Us About Nongfu Spring?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

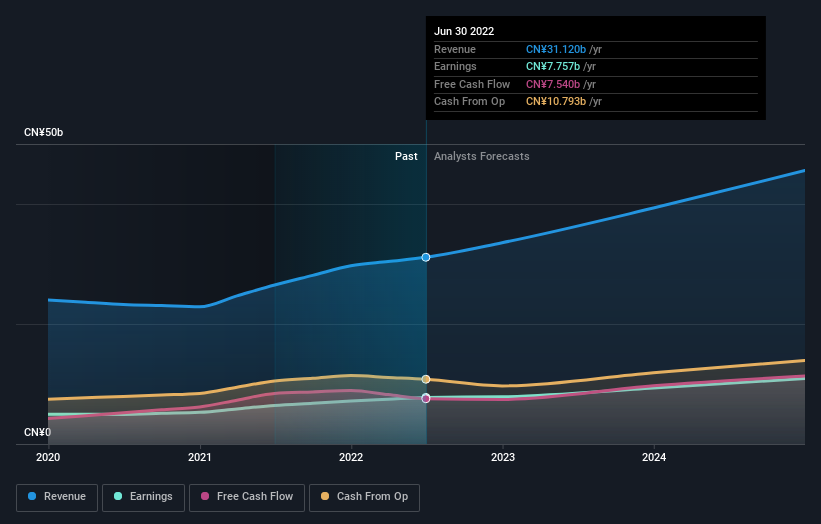

Institutions have a very small stake in Nongfu Spring. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Nongfu Spring is not owned by hedge funds. The company's CEO Shanshan Zhong is the largest shareholder with 84% of shares outstanding. With such a huge stake, we infer that they have significant control of the future of the company. It's usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider with such skin in the game. The Vanguard Group, Inc. is the second largest shareholder owning 0.6% of common stock, and BlackRock, Inc. holds about 0.5% of the company stock.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Nongfu Spring

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems that insiders own more than half the Nongfu Spring Co., Ltd. stock. This gives them a lot of power. Given it has a market cap of HK$479b, that means insiders have a whopping HK$403b worth of shares in their own names. It is good to see this level of investment. You can check here to see if those insiders have been selling any of their shares.

General Public Ownership

The general public, who are usually individual investors, hold a 13% stake in Nongfu Spring. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Nongfu Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9633

Nongfu Spring

Researches, develops, produces, and markets packaged drinking water and beverage products primarily in Mainland China.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives