ZJLD Group's (HKG:6979) Earnings Are Weaker Than They Seem

Despite posting some strong earnings, the market for ZJLD Group Inc's (HKG:6979) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for ZJLD Group

Zooming In On ZJLD Group's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

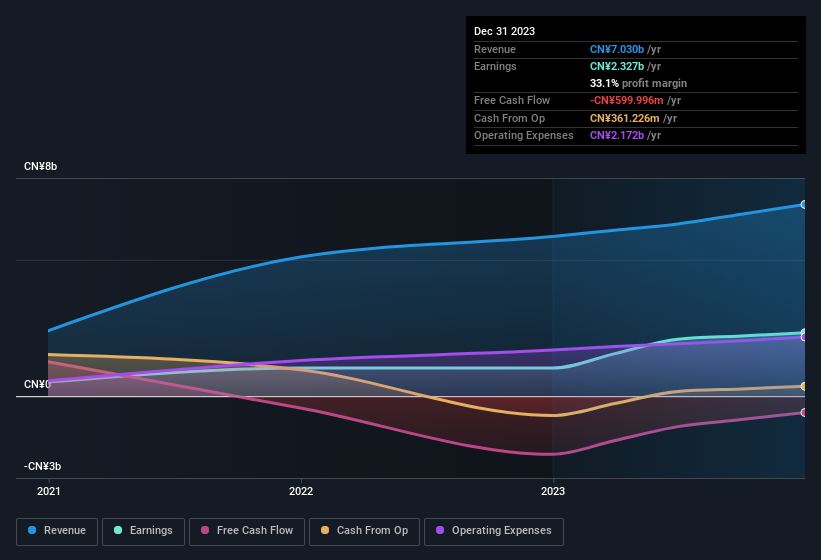

Over the twelve months to December 2023, ZJLD Group recorded an accrual ratio of 0.51. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of CN¥600m, in contrast to the aforementioned profit of CN¥2.33b. We also note that ZJLD Group's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥600m.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On ZJLD Group's Profit Performance

As we discussed above, we think ZJLD Group's earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that ZJLD Group's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that, its earnings per share increased by 77% in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into ZJLD Group, you'd also look into what risks it is currently facing. When we did our research, we found 2 warning signs for ZJLD Group (1 can't be ignored!) that we believe deserve your full attention.

Today we've zoomed in on a single data point to better understand the nature of ZJLD Group's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if ZJLD Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6979

ZJLD Group

Engages in the production and sale of baijiu products in China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives