Why Investors Shouldn't Be Surprised By Chaoda Modern Agriculture (Holdings) Limited's (HKG:682) 79% Share Price Surge

Chaoda Modern Agriculture (Holdings) Limited (HKG:682) shareholders have had their patience rewarded with a 79% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

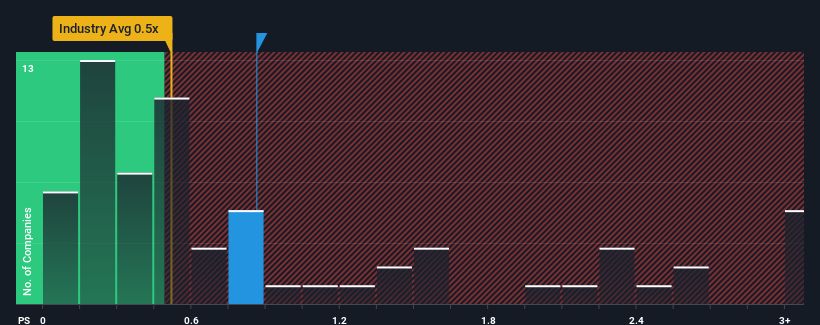

In spite of the firm bounce in price, it's still not a stretch to say that Chaoda Modern Agriculture (Holdings)'s price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Food industry in Hong Kong, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Chaoda Modern Agriculture (Holdings)

How Chaoda Modern Agriculture (Holdings) Has Been Performing

The recent revenue growth at Chaoda Modern Agriculture (Holdings) would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Chaoda Modern Agriculture (Holdings), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chaoda Modern Agriculture (Holdings)'s to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.1%. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.6% shows it's about the same on an annualised basis.

In light of this, it's understandable that Chaoda Modern Agriculture (Holdings)'s P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Chaoda Modern Agriculture (Holdings)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears to us that Chaoda Modern Agriculture (Holdings) maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you take the next step, you should know about the 2 warning signs for Chaoda Modern Agriculture (Holdings) (1 is a bit concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:682

Chaoda Modern Agriculture (Holdings)

An investment holding company, engages in growing and selling agricultural products primarily in Hong Kong.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives