The Returns At Chia Tai Enterprises International (HKG:3839) Provide Us With Signs Of What's To Come

What trends should we look for it we want to identify stocks that can multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Although, when we looked at Chia Tai Enterprises International (HKG:3839), it didn't seem to tick all of these boxes.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Chia Tai Enterprises International is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0045 = US$1.3m ÷ (US$331m - US$42m) (Based on the trailing twelve months to December 2020).

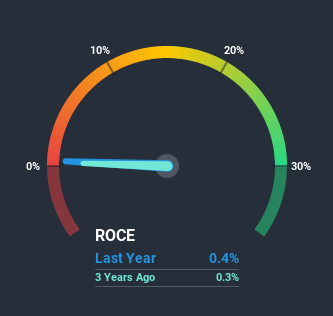

So, Chia Tai Enterprises International has an ROCE of 0.4%. Ultimately, that's a low return and it under-performs the Food industry average of 13%.

See our latest analysis for Chia Tai Enterprises International

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Chia Tai Enterprises International's past further, check out this free graph of past earnings, revenue and cash flow.

So How Is Chia Tai Enterprises International's ROCE Trending?

On the surface, the trend of ROCE at Chia Tai Enterprises International doesn't inspire confidence. Around five years ago the returns on capital were 5.6%, but since then they've fallen to 0.4%. And considering revenue has dropped while employing more capital, we'd be cautious. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

What We Can Learn From Chia Tai Enterprises International's ROCE

In summary, we're somewhat concerned by Chia Tai Enterprises International's diminishing returns on increasing amounts of capital. Long term shareholders who've owned the stock over the last five years have experienced a 41% depreciation in their investment, so it appears the market might not like these trends either. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

If you'd like to know about the risks facing Chia Tai Enterprises International, we've discovered 1 warning sign that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Chia Tai Enterprises International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3839

Chia Tai Enterprises International

Manufactures and sells animal health products and chlortetracycline in Mainland China, the Asia Pacific, the Americas, Europe, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives