Vitasoy International Holdings (SEHK:345) Eyes Growth in Plant-Based Sector Despite Challenges

Reviewed by Simply Wall St

Vitasoy International Holdings (SEHK:345) has achieved an impressive earnings growth of 86.5% over the past year, significantly outperforming the broader Food industry. The company is poised for continued success with a forecasted annual earnings growth of 35.6%, driven by strategic product innovations and strong financial health. However, challenges such as modest revenue growth and operational issues in Australia highlight areas needing strategic focus. The company report discusses key areas including financial performance, growth prospects, and regulatory challenges.

Core Advantages Driving Sustained Success for Vitasoy International Holdings

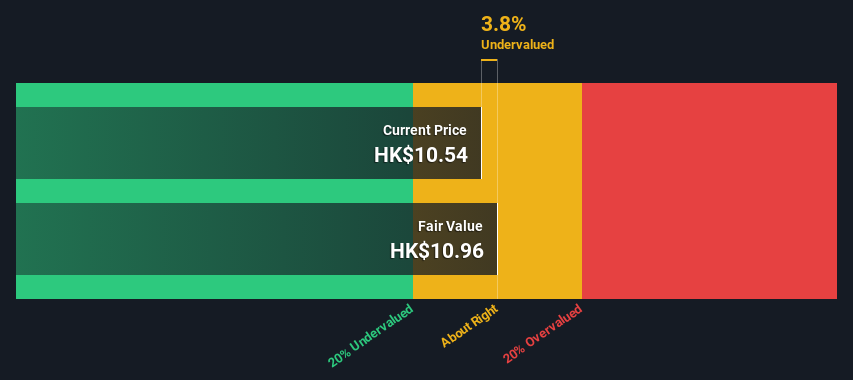

Vitasoy International Holdings has demonstrated remarkable earnings growth of 86.5% over the past year, outpacing the broader Food industry. This impressive performance is complemented by a forecasted earnings growth of 35.6% annually, surpassing the Hong Kong market average. The company's financial position is strong, with more cash than total debt and interest payments covered 27.5 times over, as highlighted by Group Chief Financial Officer Ian Hong Ng. Furthermore, the company's strategic focus on product innovation, as noted by CEO Roberto Guidetti, has led to the deployment of new equity campaigns for the VITASOY and VITA brands, enhancing their market competitiveness. Despite the high Price-To-Earnings Ratio of 102.1x, which is above industry averages, the company trades slightly below its estimated fair value, suggesting a nuanced valuation perspective.

Critical Issues Affecting the Performance of Vitasoy International Holdings and Areas for Growth

The company faces challenges with a revenue growth forecast of 3.2% per year, which lags behind the Hong Kong market average of 7.8%. Additionally, the Return on Equity stands at a modest 3.9%, well below the ideal threshold of 20%. Over the past five years, earnings have declined by 50.6% annually, indicating potential areas for improvement. The current net profit margin of 2% remains relatively low, despite improvements from last year. Manufacturing issues in Australia have also contributed to operational losses, as noted by Guidetti, impacting overall performance. These factors, coupled with the high Price-To-Earnings Ratio, suggest that while Vitasoy is financially stable, there are areas that require strategic focus to enhance growth and profitability.

Emerging Markets Or Trends for Vitasoy International Holdings

Vitasoy is well-positioned to capitalize on significant growth opportunities in the plant-based food and beverage sector, which is gaining traction among new generations of consumers. The company's joint venture in the Philippines with Universal Robina Corporation continues to scale up, leveraging a single-serve, on-the-go platform to drive growth. Guidetti's confidence in the long-term potential of geographical expansion and per capita consumption growth highlights the company's strategic focus on market expansion. Continued product innovation, as seen in recent core product launches, is expected to further strengthen Vitasoy's market position and drive future earnings growth.

Regulatory Challenges Facing Vitasoy International Holdings

Vitasoy faces competitive pressures in an increasingly dynamic industry, necessitating a focus on maintaining value competitiveness for its brands. The company must navigate these challenges while addressing operational and cost issues, such as those in its tofu business, to restore profitability. As Guidetti emphasizes, stringent cost control measures and leveraging existing business segments are crucial for sustaining growth. Additionally, the company's high Price-To-Earnings Ratio compared to industry peers suggests potential overvaluation risks, which could impact investor sentiment and market performance. These external factors underscore the importance of strategic adaptability in maintaining Vitasoy's competitive edge.

Conclusion

Vitasoy International Holdings has achieved significant earnings growth, surpassing industry averages, which reflects its strategic focus on product innovation and financial stability. However, the company's challenges, such as lower revenue growth forecasts and modest return on equity, highlight areas needing strategic attention to sustain this momentum. Its high Price-To-Earnings Ratio suggests that while the company is financially stable and slightly undervalued compared to its fair value, investor sentiment may be cautious due to perceived high valuation. To maintain its competitive edge and drive future growth, Vitasoy must address operational inefficiencies and capitalize on emerging market opportunities in the plant-based sector.

Where To Now?

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:345

Vitasoy International Holdings

An investment holding company, manufactures and sells food and beverages in Mainland China, Hong Kong, Australia, New Zealand, and Singapore.

Excellent balance sheet with proven track record.