Vitasoy International Holdings (HKG:345) stock falls 4.9% in past week as five-year earnings and shareholder returns continue downward trend

Vitasoy International Holdings Limited (HKG:345) shareholders will doubtless be very grateful to see the share price up 107% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 66% after a long stretch. So is the recent increase sufficient to restore confidence in the stock? Not yet. Of course, this could be the start of a turnaround.

With the stock having lost 4.9% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Vitasoy International Holdings

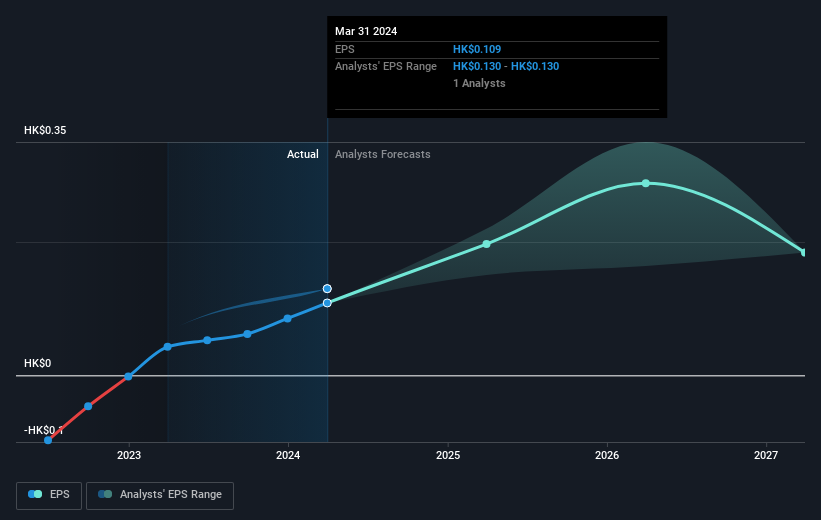

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Looking back five years, both Vitasoy International Holdings' share price and EPS declined; the latter at a rate of 30% per year. The share price decline of 19% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. With a P/E ratio of 92.90, it's fair to say the market sees a brighter future for the business.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Vitasoy International Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Vitasoy International Holdings provided a TSR of 10% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 10% endured over half a decade. It could well be that the business is stabilizing. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:345

Vitasoy International Holdings

An investment holding company, manufactures and sells food and beverages in Mainland China, Hong Kong, Australia, New Zealand, and Singapore.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives