Vitasoy International Holdings (HKG:345) Has A Pretty Healthy Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Vitasoy International Holdings Limited (HKG:345) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Vitasoy International Holdings

How Much Debt Does Vitasoy International Holdings Carry?

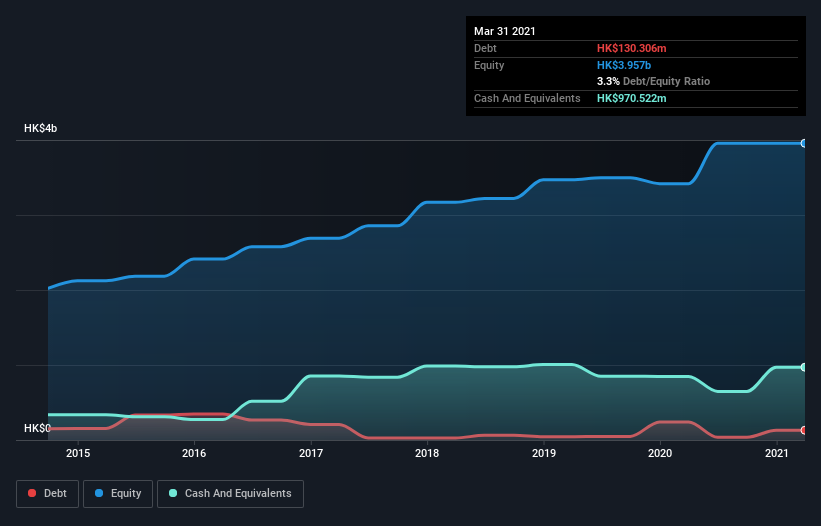

You can click the graphic below for the historical numbers, but it shows that Vitasoy International Holdings had HK$130.3m of debt in March 2021, down from HK$241.4m, one year before. But it also has HK$970.5m in cash to offset that, meaning it has HK$840.2m net cash.

How Strong Is Vitasoy International Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Vitasoy International Holdings had liabilities of HK$3.08b due within 12 months and liabilities of HK$235.6m due beyond that. Offsetting these obligations, it had cash of HK$970.5m as well as receivables valued at HK$1.27b due within 12 months. So its liabilities total HK$1.08b more than the combination of its cash and short-term receivables.

Since publicly traded Vitasoy International Holdings shares are worth a total of HK$26.4b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Vitasoy International Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely.

Also good is that Vitasoy International Holdings grew its EBIT at 14% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Vitasoy International Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Vitasoy International Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Vitasoy International Holdings's free cash flow amounted to 47% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Vitasoy International Holdings has HK$840.2m in net cash. And it also grew its EBIT by 14% over the last year. So we don't think Vitasoy International Holdings's use of debt is risky. We'd be motivated to research the stock further if we found out that Vitasoy International Holdings insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:345

Vitasoy International Holdings

An investment holding company, manufactures and sells food and beverages in Mainland China, Hong Kong, Australia, New Zealand, and Singapore.

Excellent balance sheet with proven track record.