Is Now The Time To Put Tingyi (Cayman Islands) Holding (HKG:322) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Tingyi (Cayman Islands) Holding (HKG:322), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Tingyi (Cayman Islands) Holding

Tingyi (Cayman Islands) Holding's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that Tingyi (Cayman Islands) Holding has grown EPS by 44% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

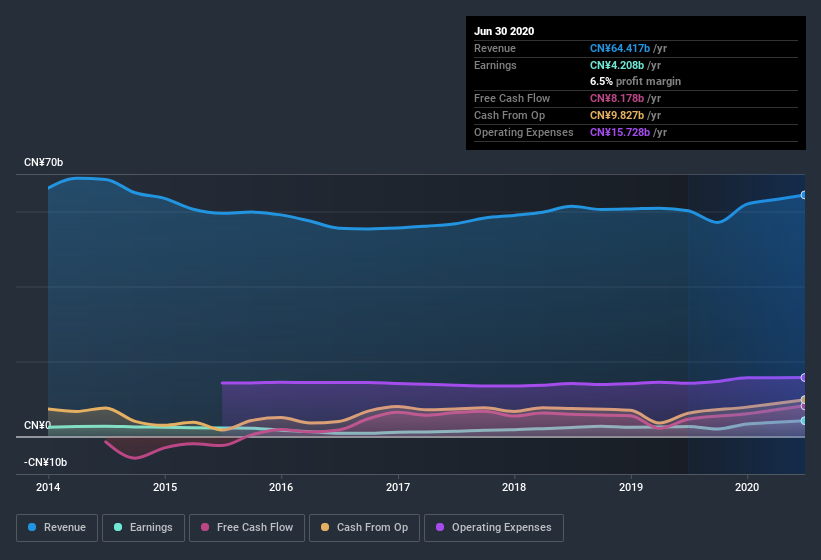

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Tingyi (Cayman Islands) Holding's EBIT margins were flat over the last year, revenue grew by a solid 7.1% to CN¥64b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Tingyi (Cayman Islands) Holding's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Tingyi (Cayman Islands) Holding Insiders Aligned With All Shareholders?

Since Tingyi (Cayman Islands) Holding has a market capitalization of HK$75b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. To be specific, they have CN¥307m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Tingyi (Cayman Islands) Holding To Your Watchlist?

Tingyi (Cayman Islands) Holding's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Tingyi (Cayman Islands) Holding is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that Tingyi (Cayman Islands) Holding is showing 2 warning signs in our investment analysis , you should know about...

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Tingyi (Cayman Islands) Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tingyi (Cayman Islands) Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:322

Tingyi (Cayman Islands) Holding

An investment holding company, manufactures and sells instant noodles, beverages, and instant food products in the People’s Republic of China.

Solid track record with adequate balance sheet.