Investors Still Waiting For A Pull Back In Dekon Food and Agriculture Group (HKG:2419)

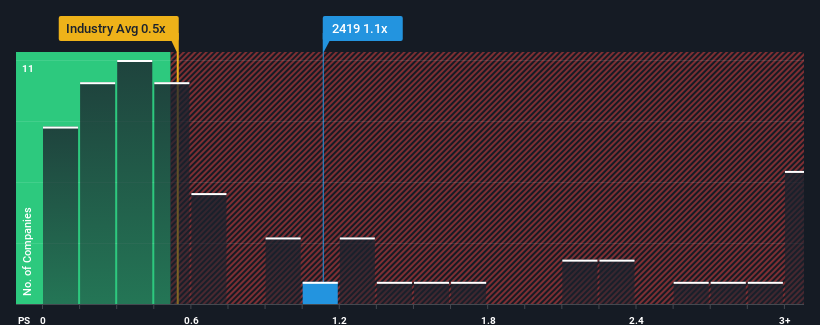

When close to half the companies in the Food industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.5x, you may consider Dekon Food and Agriculture Group (HKG:2419) as a stock to potentially avoid with its 1.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Dekon Food and Agriculture Group

What Does Dekon Food and Agriculture Group's P/S Mean For Shareholders?

Recent times have been advantageous for Dekon Food and Agriculture Group as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Dekon Food and Agriculture Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Dekon Food and Agriculture Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 7.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 98% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 23% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 7.5% per annum growth forecast for the broader industry.

With this in mind, it's not hard to understand why Dekon Food and Agriculture Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Dekon Food and Agriculture Group's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Dekon Food and Agriculture Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Food industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Dekon Food and Agriculture Group with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2419

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives