Not Many Are Piling Into Zhengwei Group Holdings Company Limited (HKG:2147) Stock Yet As It Plummets 49%

Zhengwei Group Holdings Company Limited (HKG:2147) shareholders that were waiting for something to happen have been dealt a blow with a 49% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 81% loss during that time.

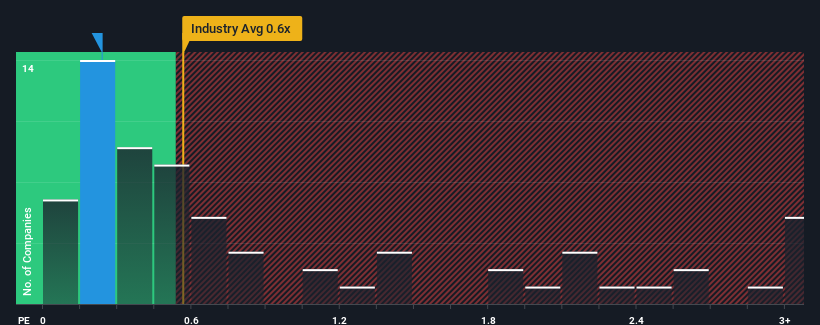

Even after such a large drop in price, there still wouldn't be many who think Zhengwei Group Holdings' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Food industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Zhengwei Group Holdings

How Has Zhengwei Group Holdings Performed Recently?

Revenue has risen firmly for Zhengwei Group Holdings recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Zhengwei Group Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhengwei Group Holdings' earnings, revenue and cash flow.How Is Zhengwei Group Holdings' Revenue Growth Trending?

Zhengwei Group Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 57% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 10% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Zhengwei Group Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Zhengwei Group Holdings' P/S

Following Zhengwei Group Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Zhengwei Group Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Zhengwei Group Holdings (1 doesn't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhengwei Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2147

Zhengwei Group Holdings

An investment holding company, engages in sourcing, processing, and trading dried delicacies, snacks, dried aquatic products, grains, seasonings, and others in the People’s Republic of China.

Adequate balance sheet slight.

Market Insights

Community Narratives