Ausnutria Dairy (HKG:1717) Is Paying Out Less In Dividends Than Last Year

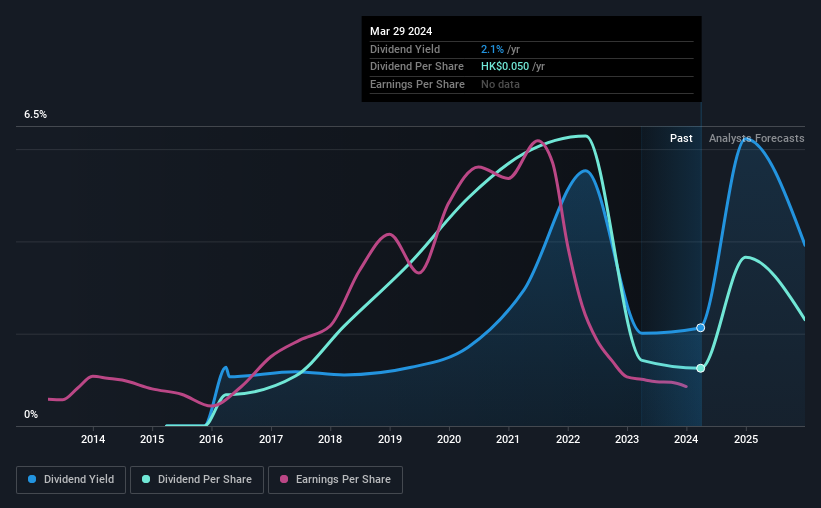

Ausnutria Dairy Corporation Ltd (HKG:1717) has announced that on 25th of June, it will be paying a dividend ofCN¥0.05, which a reduction from last year's comparable dividend. Based on this payment, the dividend yield will be 2.1%, which is lower than the average for the industry.

View our latest analysis for Ausnutria Dairy

Ausnutria Dairy's Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. Based on the last payment, Ausnutria Dairy's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 17%, which we would be comfortable to see continuing.

Ausnutria Dairy's Dividend Has Lacked Consistency

It's comforting to see that Ausnutria Dairy has been paying a dividend for a number of years now, however it has been cut at least once in that time. This suggests that the dividend might not be the most reliable. Since 2016, the annual payment back then was CN¥0.025, compared to the most recent full-year payment of CN¥0.0462. This implies that the company grew its distributions at a yearly rate of about 8.0% over that duration. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Ausnutria Dairy's earnings per share has shrunk at 27% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Ausnutria Dairy is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. See if the 5 analysts are forecasting a turnaround in our free collection of analyst estimates here. Is Ausnutria Dairy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1717

Ausnutria Dairy

An investment holding company, primarily engages in the research and development, production, marketing, processing, packaging, and distribution of dairy and related products, and nutrition products.

Excellent balance sheet and fair value.