Amidst the backdrop of global market volatility and evolving economic conditions, Asian small-cap stocks are garnering attention, particularly as investors navigate the complexities of U.S.-China trade tensions and fluctuating interest rates. In this environment, identifying stocks that demonstrate strong fundamentals and insider buying can be key indicators of potential value, offering intriguing opportunities for those looking to explore the Asian small-cap landscape.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.2x | 1.3x | 31.36% | ★★★★★★ |

| Bumitama Agri | 10.5x | 1.5x | 48.48% | ★★★★☆☆ |

| East West Banking | 3.1x | 0.7x | 19.48% | ★★★★☆☆ |

| Vita Life Sciences | 15.0x | 1.6x | 37.04% | ★★★★☆☆ |

| Nickel Asia | 22.0x | 2.3x | 41.83% | ★★★★☆☆ |

| Cettire | NA | 0.3x | 24.65% | ★★★★☆☆ |

| BWP Trust | 10.3x | 13.5x | 11.53% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 41.97% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.8x | 0.4x | -440.21% | ★★★☆☆☆ |

| Chinasoft International | 24.2x | 0.7x | -1337.44% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Value Rating: ★★★☆☆☆

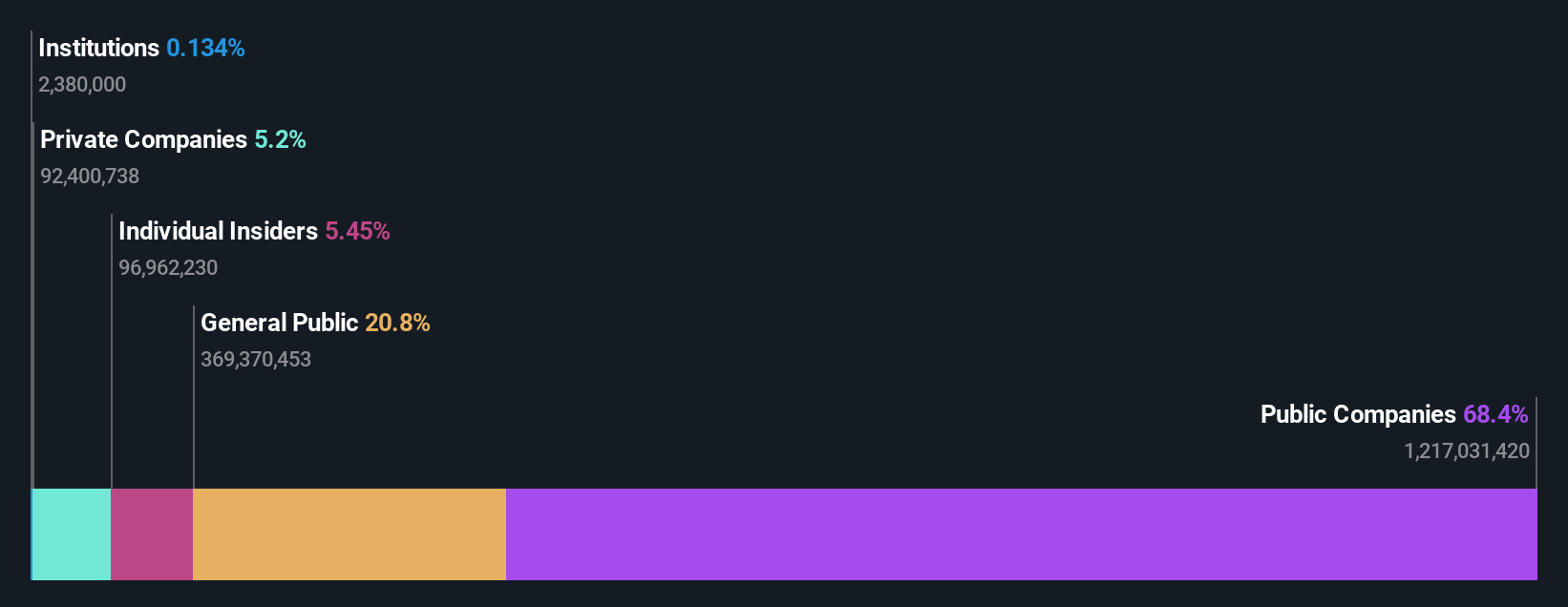

Overview: Ausnutria Dairy is a company that focuses on the production and distribution of nutrition and dairy-related products, with a market capitalization of CN¥8.36 billion.

Operations: Ausnutria Dairy's primary revenue streams are derived from its Dairy and Related Products segment, generating CN¥7.29 billion, while Nutrition Products contribute CN¥314.75 million. The company's gross profit margin has seen fluctuations, peaking at 53.52% in early 2020 before declining to 38.64% by the end of 2023. Operating expenses predominantly consist of sales and marketing costs, which have remained a significant portion of overall expenses throughout the periods reviewed.

PE: 13.4x

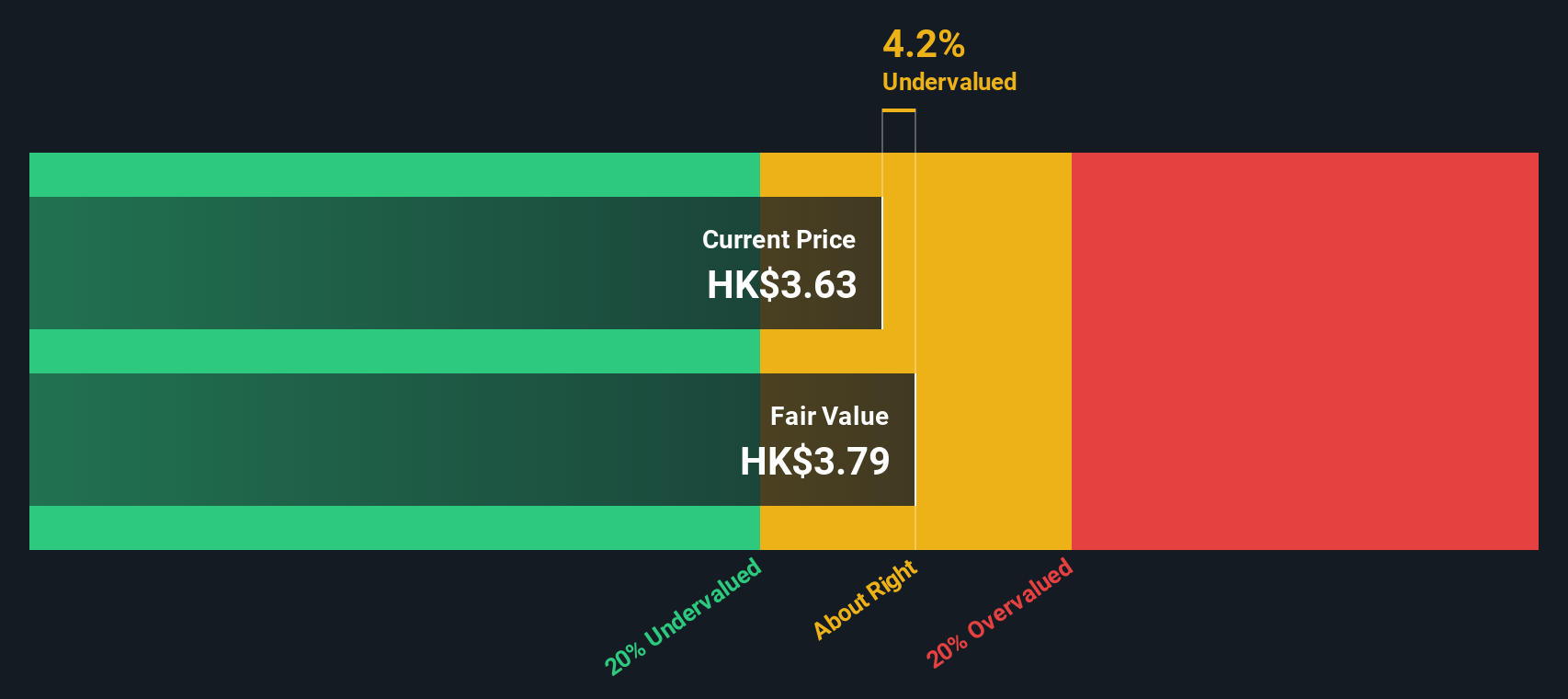

Ausnutria Dairy, a notable player in Asia's small-cap sector, reported a rise in sales to CNY 3.89 billion for the first half of 2025, up from CNY 3.68 billion the previous year, with net income climbing to CNY 180.45 million. Insider confidence was evident as they increased their stake over recent months through share purchases. Despite relying solely on external borrowing for funding, earnings are projected to grow annually by 15.51%. The company recently completed a buyback of nearly two million shares for HKD 3.75 million by May end, signaling potential value recognition within its operations and future growth prospects amidst industry challenges.

Eagle Nice (International) Holdings (SEHK:2368)

Simply Wall St Value Rating: ★★★☆☆☆

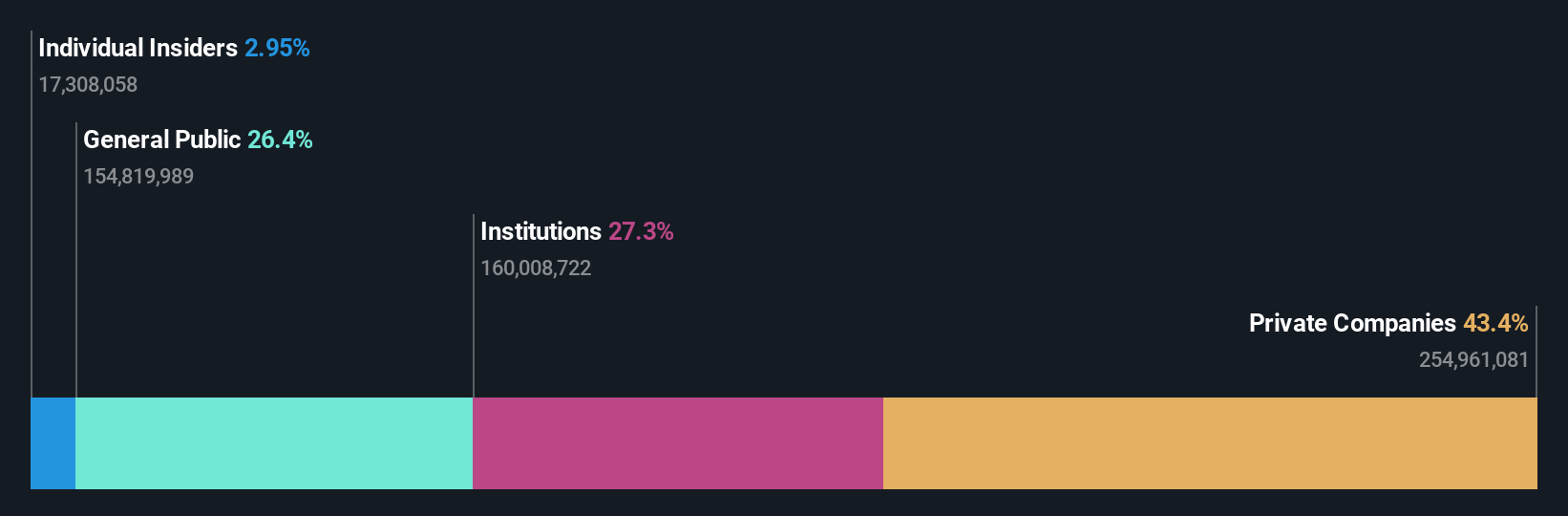

Overview: Eagle Nice (International) Holdings is engaged in the manufacturing and trading of sports and casual wear, with a market presence in regions including the USA, Japan, Europe, South Korea, and the Chinese Mainland, and a market capitalization of HK$1.92 billion.

Operations: The company generates revenue primarily from the Chinese Mainland, with significant contributions from the USA and Europe. Over recent periods, it has experienced fluctuations in its gross profit margin, which reached 18.57% as of March 2025. The cost of goods sold (COGS) is a major expense component, consistently accounting for a substantial portion of revenue. Operating expenses have shown an upward trend alongside rising non-operating expenses, impacting net income margins over time.

PE: 9.4x

Eagle Nice, a small company in Asia, has shown insider confidence with a purchase of 102,000 shares by an insider for HK$405,664 between April and October 2025. However, the company's earnings have declined by 3.1% annually over the past five years. Profit margins dropped to 4.5% from last year's 6.5%, and its debt is not well covered by operating cash flow due to reliance on external borrowing. Despite these challenges, potential growth could be supported if financial conditions improve.

Luk Fook Holdings (International) (SEHK:590)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Luk Fook Holdings (International) operates as a jewelry retailer and wholesaler with key segments in licensing, retailing across Mainland China, Hong Kong, Macau, and overseas markets, and wholesaling in Hong Kong and Mainland China.

Operations: The company's revenue is primarily derived from retailing in Hong Kong, Macau, and overseas markets, with significant contributions from mainland retailing and wholesaling activities. Over recent periods, the gross profit margin has shown an upward trend reaching 33.11% by March 2025. The company incurs substantial operating expenses, with sales and marketing being a major component.

PE: 13.4x

Luk Fook Holdings, a smaller player in Asia's investment landscape, recently saw insider confidence with Founder Wai Sheung Wong purchasing 635,000 shares for approximately HK$9.2 million between August and October 2025. This move suggests optimism about the company's prospects amidst its reliance on higher-risk external borrowing. The recent board changes, including Anson Kwok's appointment as an Independent Non-executive Director, bring seasoned banking expertise to the table. Earnings are projected to grow by nearly 17% annually, indicating potential growth opportunities despite funding challenges.

Key Takeaways

- Investigate our full lineup of 45 Undervalued Asian Small Caps With Insider Buying right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1717

Ausnutria Dairy

An investment holding company, primarily engages in the research and development, production, marketing, processing, packaging, and distribution of dairy and related products, and nutrition products.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives