Are China Putian Food Holding's (HKG:1699) Statutory Earnings A Good Guide To Its Underlying Profitability?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding China Putian Food Holding (HKG:1699).

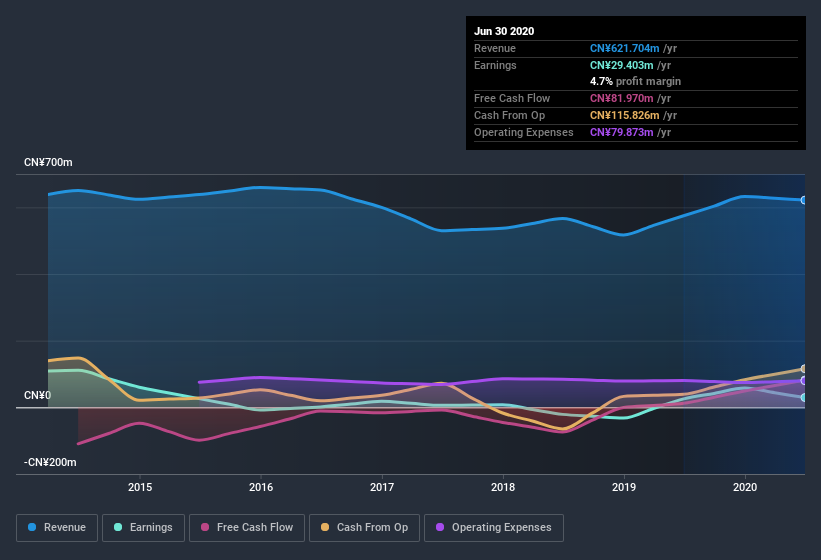

We like the fact that China Putian Food Holding made a profit of CN¥29.4m on its revenue of CN¥621.7m, in the last year.

Check out our latest analysis for China Putian Food Holding

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of China Putian Food Holding.

Our Take On China Putian Food Holding's Profit Performance

Because of this, we think that it may be that China Putian Food Holding's statutory profits are better than its underlying earnings power. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, China Putian Food Holding has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade China Putian Food Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1699

China Putian Food Holding

China Putian Food Holding Limited, an investment holding company, engages in hogs farming and slaughtering, and selling pork and commodity hog products in the People’s Republic of China.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives