China Shengmu Organic Milk (HKG:1432) Takes On Some Risk With Its Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that China Shengmu Organic Milk Limited (HKG:1432) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for China Shengmu Organic Milk

How Much Debt Does China Shengmu Organic Milk Carry?

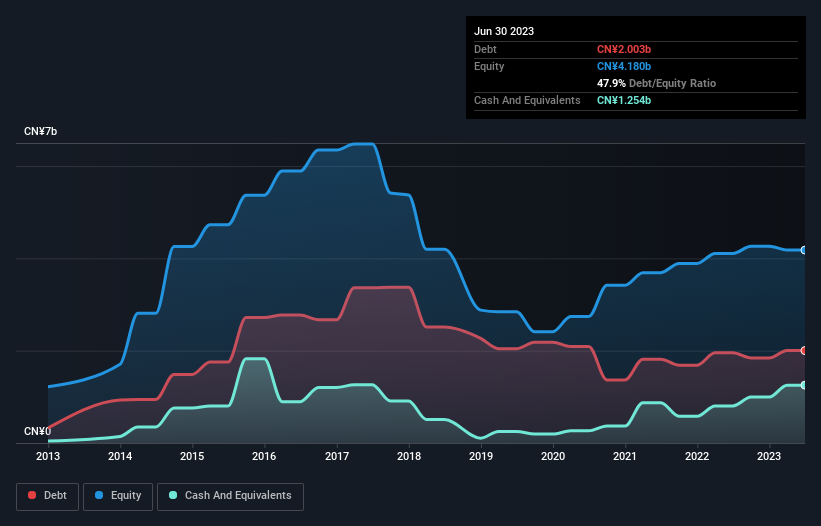

As you can see below, China Shengmu Organic Milk had CN¥2.00b of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has CN¥1.25b in cash leading to net debt of about CN¥748.9m.

A Look At China Shengmu Organic Milk's Liabilities

We can see from the most recent balance sheet that China Shengmu Organic Milk had liabilities of CN¥2.47b falling due within a year, and liabilities of CN¥1.12b due beyond that. Offsetting these obligations, it had cash of CN¥1.25b as well as receivables valued at CN¥282.8m due within 12 months. So its liabilities total CN¥2.05b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of CN¥2.32b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

China Shengmu Organic Milk has a low net debt to EBITDA ratio of only 0.92. And its EBIT easily covers its interest expense, being 12.7 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the bad news is that China Shengmu Organic Milk has seen its EBIT plunge 16% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. But it is China Shengmu Organic Milk's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, China Shengmu Organic Milk reported free cash flow worth 18% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Mulling over China Shengmu Organic Milk's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that China Shengmu Organic Milk's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that China Shengmu Organic Milk is showing 3 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade China Shengmu Organic Milk, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1432

China Shengmu Organic Milk

An investment holding company, engages in the production and distribution of raw milk and dairy products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives