China Modern Dairy Holdings' (HKG:1117) growing losses don't faze investors as the stock swells 11% this past week

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the China Modern Dairy Holdings Ltd. (HKG:1117) share price is up 63% in the last 1 year, clearly besting the market return of around 36% (not including dividends). So that should have shareholders smiling. Looking back further, the stock price is 38% higher than it was three years ago.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, China Modern Dairy Holdings actually saw its earnings per share drop 703%. This was, in part, due to extraordinary items impacting earning in the last twelve months.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 1.0% dividend yield is doing much to support the share price. Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

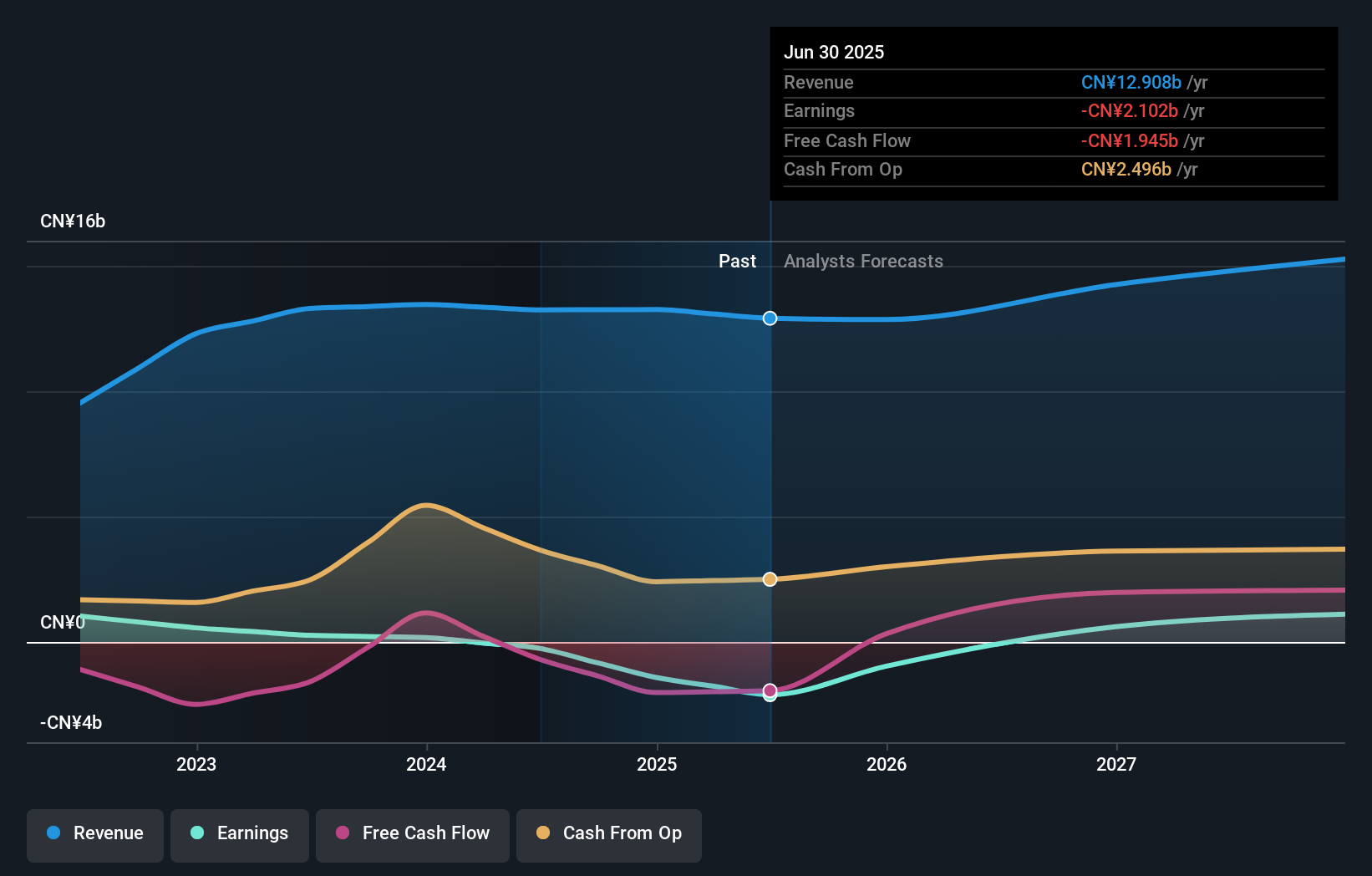

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on China Modern Dairy Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that China Modern Dairy Holdings shareholders have received a total shareholder return of 65% over one year. That's including the dividend. That certainly beats the loss of about 1.2% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. You could get a better understanding of China Modern Dairy Holdings' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like China Modern Dairy Holdings better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1117

China Modern Dairy Holdings

An investment holding company, operates dairy farming and produces raw milk in Mainland China, the United States, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026