Even after rising 11% this past week, Tibet Water Resources (HKG:1115) shareholders are still down 82% over the past five years

Tibet Water Resources Ltd. (HKG:1115) shareholders should be happy to see the share price up 26% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Five years have seen the share price descend precipitously, down a full 83%. So we don't gain too much confidence from the recent recovery. The fundamental business performance will ultimately determine if the turnaround can be sustained. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Tibet Water Resources

SWOT Analysis for Tibet Water Resources

- Net debt to equity ratio below 40%.

- Current share price is above our estimate of fair value.

- Shareholders have been diluted in the past year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Lack of analyst coverage makes it difficult to determine 1115's earnings prospects.

- Debt is not well covered by operating cash flow.

Tibet Water Resources wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Tibet Water Resources saw its revenue shrink by 21% per year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 13% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

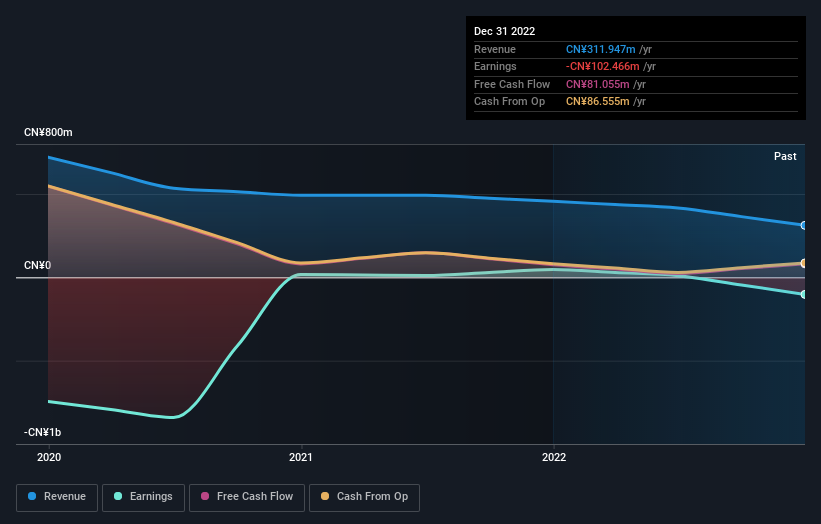

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Tibet Water Resources has rewarded shareholders with a total shareholder return of 14% in the last twelve months. Notably the five-year annualised TSR loss of 13% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Tibet Water Resources you should know about.

Tibet Water Resources is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Water Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1115

Tibet Water Resources

An investment holding company, engages in the production and sale of water and beer products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives