Investors Holding Back On Health and Happiness (H&H) International Holdings Limited (HKG:1112)

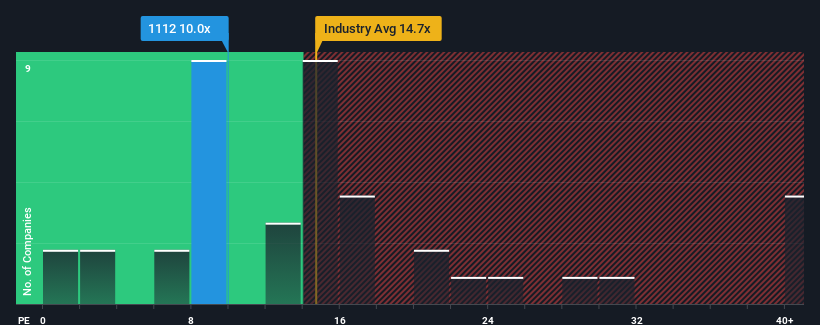

There wouldn't be many who think Health and Happiness (H&H) International Holdings Limited's (HKG:1112) price-to-earnings (or "P/E") ratio of 10x is worth a mention when the median P/E in Hong Kong is similar at about 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Health and Happiness (H&H) International Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Health and Happiness (H&H) International Holdings

Is There Some Growth For Health and Happiness (H&H) International Holdings?

The only time you'd be comfortable seeing a P/E like Health and Happiness (H&H) International Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.9%. The last three years don't look nice either as the company has shrunk EPS by 49% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 27% each year during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 16% each year, which is noticeably less attractive.

In light of this, it's curious that Health and Happiness (H&H) International Holdings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Health and Happiness (H&H) International Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Health and Happiness (H&H) International Holdings (1 shouldn't be ignored!) that we have uncovered.

Of course, you might also be able to find a better stock than Health and Happiness (H&H) International Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Health and Happiness (H&H) International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Health and Happiness (H&H) International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1112

Health and Happiness (H&H) International Holdings

An investment holding company, manufactures and sells pediatric nutrition, baby care, adult nutrition and care, and pet nutrition and care products in Mainland China, Australia, New Zealand, North America, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives