- Hong Kong

- /

- Oil and Gas

- /

- SEHK:931

Subdued Growth No Barrier To China LNG Group Limited (HKG:931) With Shares Advancing 25%

China LNG Group Limited (HKG:931) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.6% over the last year.

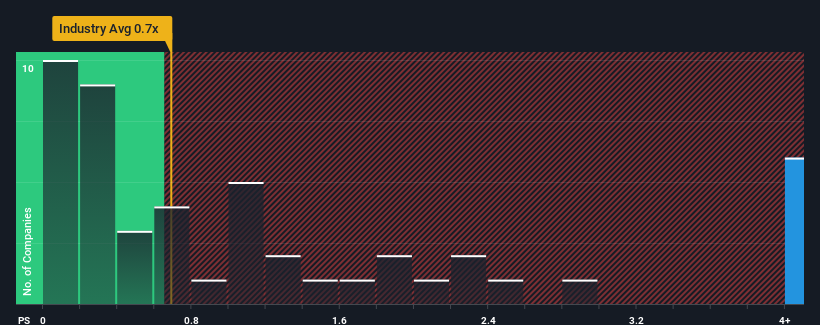

After such a large jump in price, when almost half of the companies in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider China LNG Group as a stock not worth researching with its 8.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China LNG Group

What Does China LNG Group's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at China LNG Group over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China LNG Group will help you shine a light on its historical performance.How Is China LNG Group's Revenue Growth Trending?

In order to justify its P/S ratio, China LNG Group would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 51%. The last three years don't look nice either as the company has shrunk revenue by 89% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 5.6% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that China LNG Group's P/S exceeds that of its industry peers. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be extremely difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does China LNG Group's P/S Mean For Investors?

China LNG Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China LNG Group revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for China LNG Group (2 are a bit unpleasant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:931

China HK Power Smart Energy Group

An investment holding company, sells and distributes liquefied natural gas (LNG) in the People’s Republic of China and Hong Kong.

Overvalued minimal.

Market Insights

Community Narratives