- Hong Kong

- /

- Oil and Gas

- /

- SEHK:883

CNOOC (SEHK:883) Reports Strong Earnings Growth, Boosted by Shenhai-1 Phase II Project Initiation

Reviewed by Simply Wall St

CNOOC (SEHK:883) recently announced strong earnings for the nine months ending September 30, 2024, with sales and revenue reaching CNY 326,024 million, a notable increase from the previous year. The company also reported a significant rise in net income to CNY 116,659 million, reflecting its financial health and strategic management. As CNOOC embarks on the Shenhai-1 Phase II Natural Gas Development Project, readers should anticipate discussions on how these developments may impact its market position and address ongoing challenges such as forecasted earnings decline and inconsistent dividends.

See the full analysis report here for a deeper understanding of CNOOC.

Innovative Factors Supporting CNOOC

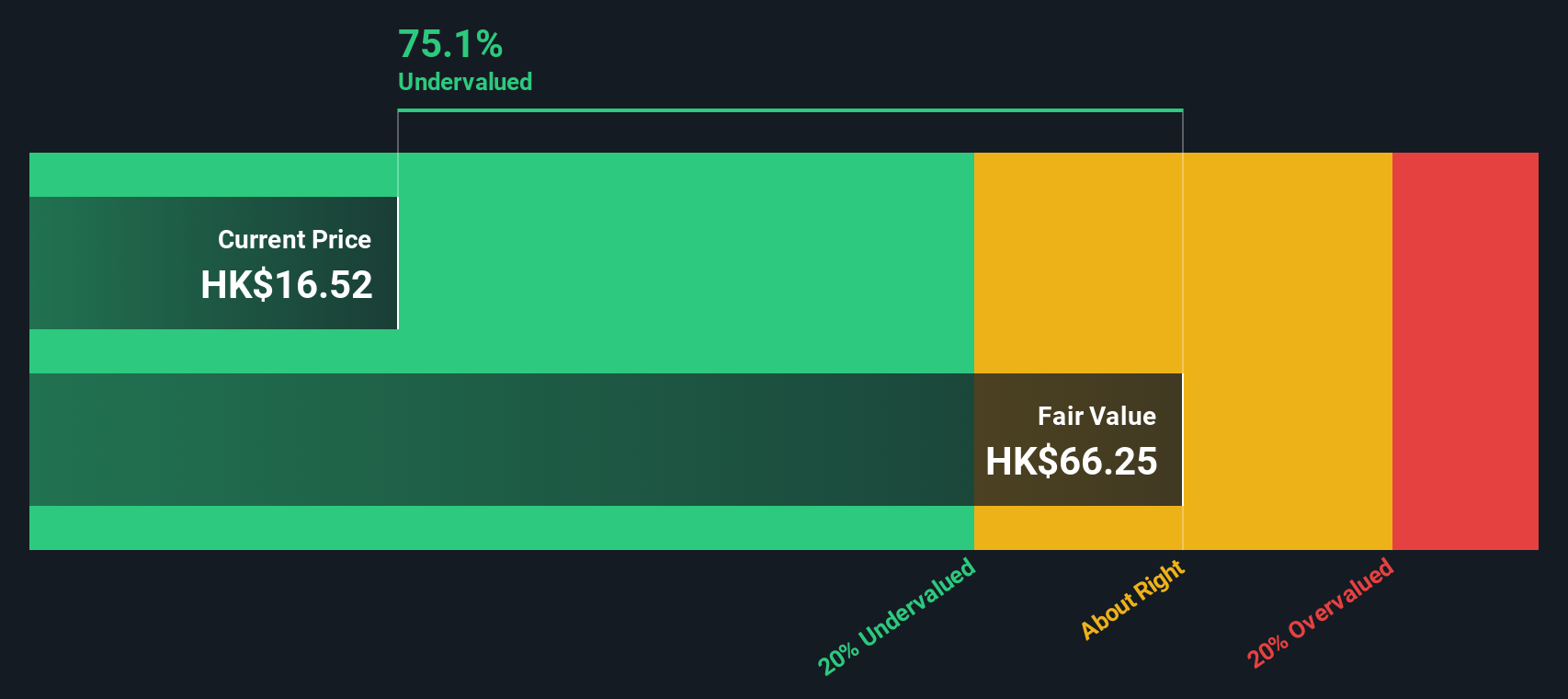

CNOOC has showcased impressive earnings growth, with a 9.4% increase over the past year, surpassing the industry average of -2.7%. Over the last five years, earnings have grown by 27.5% annually. The company's net profit margin improved to 32.8% from 31.2% last year, indicating strong profitability. With more cash than total debt, CNOOC's financial health is solid. The experienced management team, with an average tenure of 3 years, plays a crucial role in strategic decision-making, enhancing the company's market positioning. Furthermore, CNOOC is trading at 64.2% below its estimated fair value, suggesting potential upside with a target price over 20% higher than the current share price.

Explore the current health of CNOOC and how it reflects on its financial stability and growth potential.Challenges Constraining CNOOC's Potential

Despite strong financial health, CNOOC faces challenges with a forecasted earnings decline over the next three years. The return on equity stands at 19.9%, which is considered low. Revenue growth is projected at a mere 0.1% per year, lagging behind the Hong Kong market's 7.8%. Dividend payments have been inconsistent, with a yield of 7.5%, slightly below the top 25% of dividend payers in the Hong Kong market. These financial challenges highlight areas where CNOOC needs to improve to align with industry standards.

See what the latest analyst reports say about CNOOC's future prospects and potential market movements.Potential Strategies for Leveraging Growth and Competitive Advantage

The commencement of the Shenhai-1 Phase II Natural Gas Development Project, expected to peak in 2025, marks a significant product-related announcement. This project is poised to enhance CNOOC's market position by increasing production capacity. Strategic alliances and product innovation could further capitalize on emerging opportunities, driving growth and competitive advantage in the industry.

To gain deeper insights into CNOOC's historical performance, explore our detailed analysis of past performance.Key Risks and Challenges That Could Impact CNOOC's Success

CNOOC is vulnerable to external factors such as economic headwinds and regulatory challenges. The unstable dividend track record might deter investors, while supply chain vulnerabilities pose significant risks. The company is actively engaging with policymakers to address regulatory hurdles, ensuring compliance and operational continuity. These proactive strategies are essential to mitigate potential threats and sustain growth.

Learn about CNOOC's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

CNOOC's impressive earnings growth and solid financial health, marked by a significant cash surplus over total debt and improved profit margins, underscore its operational foundation. The company faces challenges such as a projected earnings decline and a low return on equity, which indicate areas that require strategic focus to align with industry standards. The Shenhai-1 Phase II Natural Gas Development Project and potential strategic alliances present opportunities for enhancing production capacity and market positioning, which are crucial for sustaining growth during economic and regulatory challenges. While the company's current trading price suggests a potential upside of over 20%, the lack of a statistically confident consensus among analysts highlights the uncertainty surrounding its future performance, necessitating careful consideration of both its strengths and vulnerabilities.

Turning Ideas Into Actions

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:883

CNOOC

An investment holding company, engages in the exploration, development, production, and sale of crude oil and natural gas in the People’s Republic of China, Canada, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives