As Hong Kong's Hang Seng Index experiences a significant rally, buoyed by China's recent stimulus measures, investors are increasingly looking at dividend stocks as a reliable source of income amidst the market's volatility. In this context, selecting stocks with strong fundamentals and consistent dividend payouts can be particularly appealing for those seeking stability and potential returns in an evolving economic landscape.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Consun Pharmaceutical Group (SEHK:1681) | 8.30% | ★★★★★☆ |

| China Hongqiao Group (SEHK:1378) | 8.81% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.70% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 9.09% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.18% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.00% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.64% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.34% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.27% | ★★★★★☆ |

Click here to see the full list of 87 stocks from our Top SEHK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Expressway (SEHK:576)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Expressway Co., Ltd. is an investment holding company that constructs, operates, maintains, and manages roads in the People’s Republic of China with a market cap of HK$34.64 billion.

Operations: Zhejiang Expressway Co., Ltd. generates revenue from its Toll Operation segment, contributing CN¥10.53 billion, and its Securities Operation segment, which brings in CN¥6.02 billion.

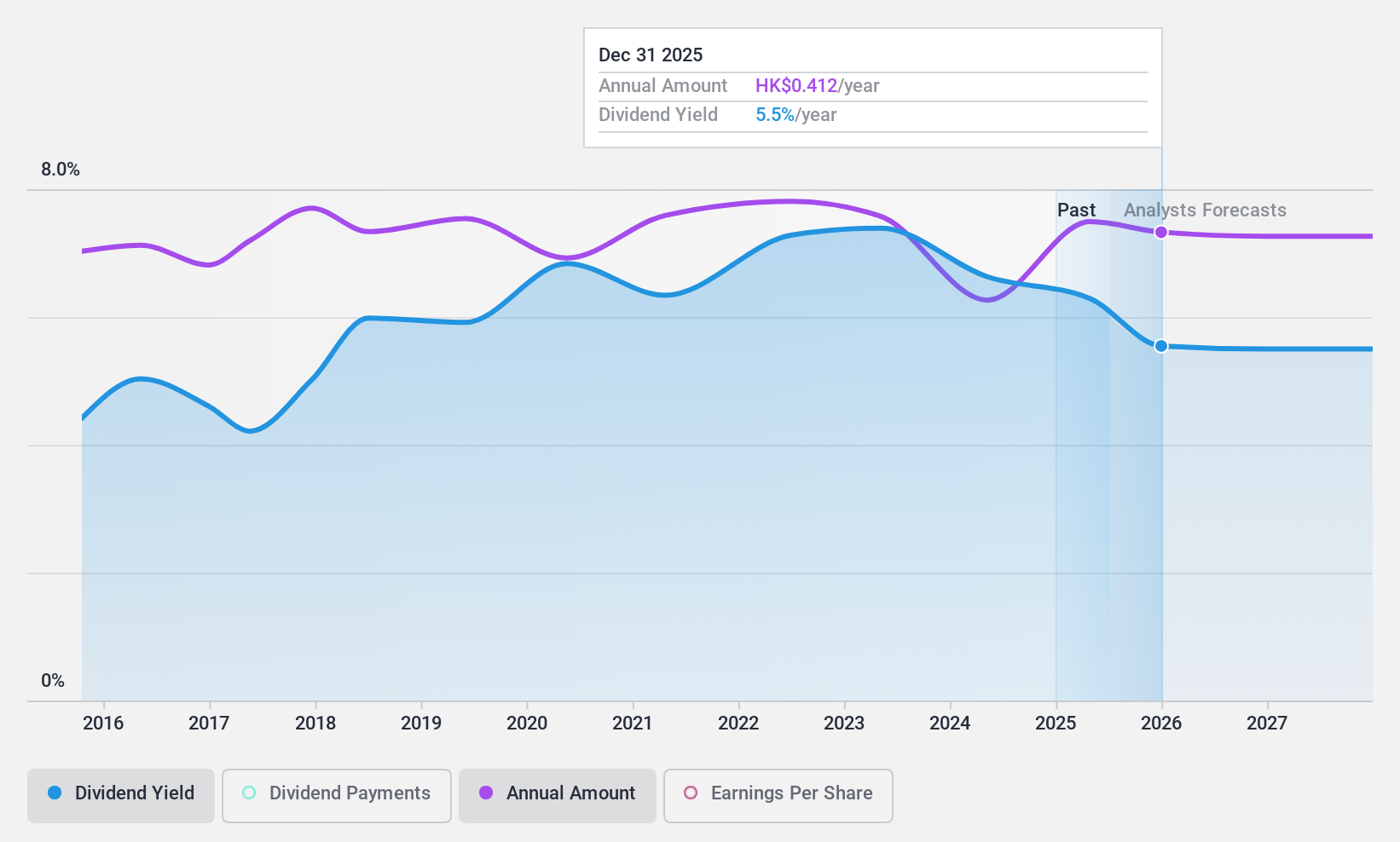

Dividend Yield: 6.1%

Zhejiang Expressway offers a stable dividend history, with payouts reliably increasing over the past decade. The dividends are well-covered by both earnings and cash flows, maintaining a payout ratio of 32% and a cash payout ratio of 30.9%, respectively. Although its current yield of 6.11% is below the top quartile in Hong Kong, it remains attractive due to its stability and coverage. Recent earnings growth supports future dividend sustainability amidst strategic infrastructure developments like emergency repairs on Huihang Expressway.

- Click to explore a detailed breakdown of our findings in Zhejiang Expressway's dividend report.

- Our comprehensive valuation report raises the possibility that Zhejiang Expressway is priced lower than what may be justified by its financials.

China Medical System Holdings (SEHK:867)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Medical System Holdings Limited is an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China with a market cap of HK$22.76 billion.

Operations: The company's revenue from the marketing, promotion, sales, and manufacturing of pharmaceutical products amounts to CN¥7.01 billion.

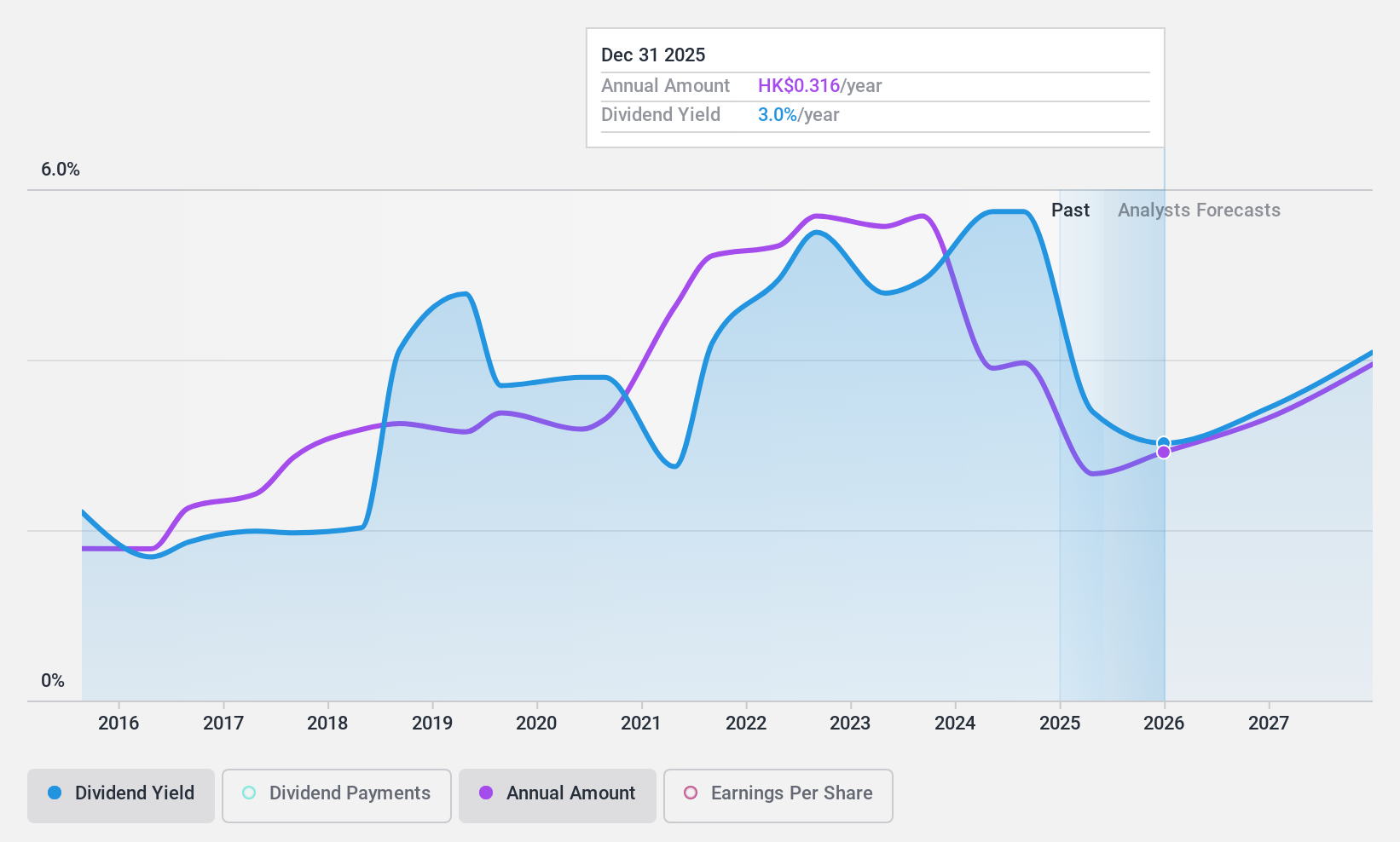

Dividend Yield: 4.6%

China Medical System Holdings' dividend history is marked by volatility, with recent decreases reflecting this trend. The interim dividend of HK$0.164 highlights a cautious approach amid declining earnings, which fell to CNY 910.43 million from CNY 1.92 billion year-on-year. Despite a payout ratio of 40.3%, dividends are well-covered by earnings and cash flows, suggesting sustainability in the near term. Recent product developments may bolster future financial performance, potentially impacting dividend stability positively.

- Click here to discover the nuances of China Medical System Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report China Medical System Holdings implies its share price may be lower than expected.

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas in China, Canada, and internationally, with a market cap of approximately HK$1.03 trillion.

Operations: CNOOC Limited generates revenue primarily through its Exploration and Production (E&P) segment, which accounts for CN¥370.42 billion, and its Trading Business segment, contributing CN¥80.39 billion.

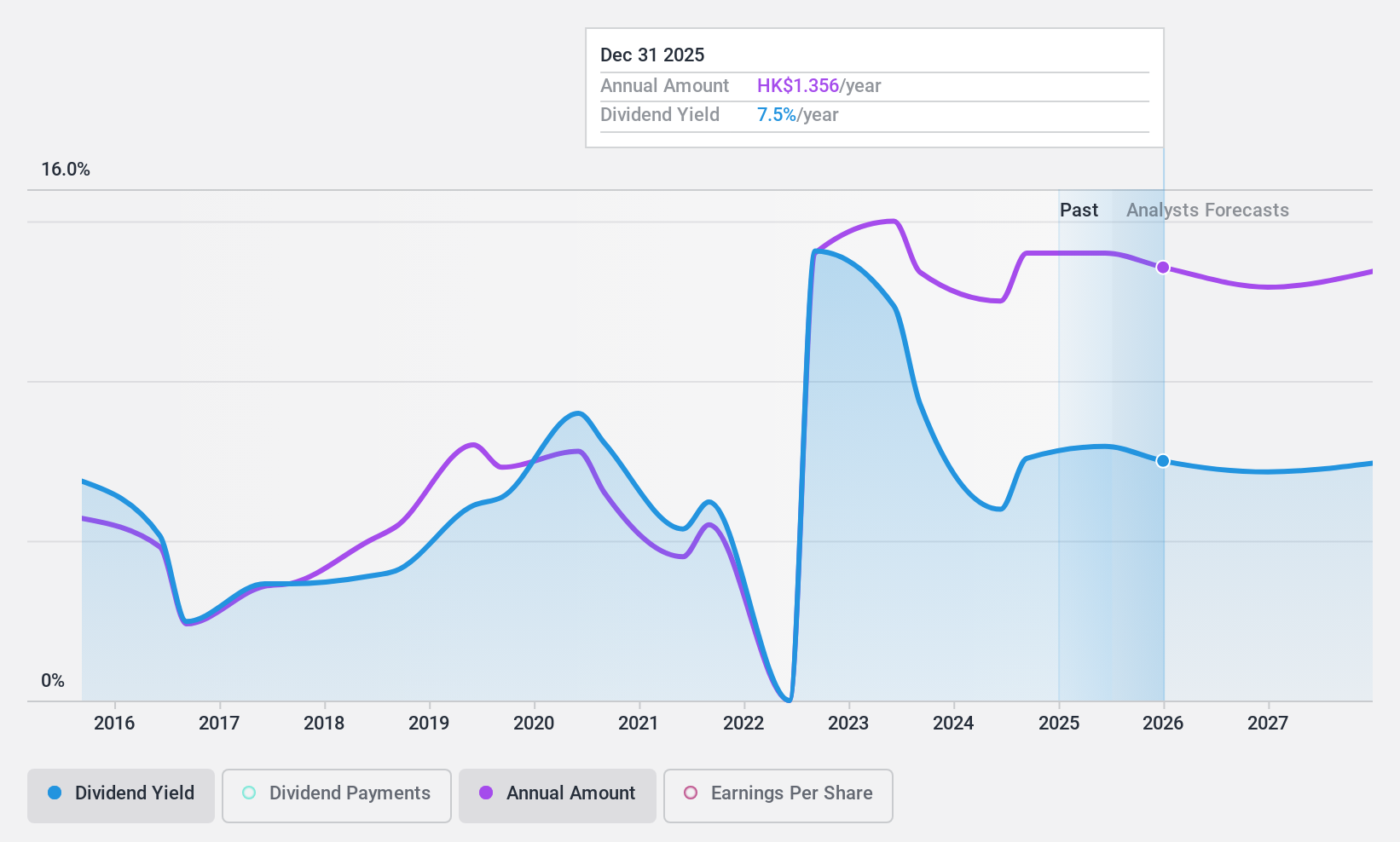

Dividend Yield: 6%

CNOOC's dividend payments have been volatile over the past decade, with a recent interim dividend of HK$0.74 per share. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios at 43.5% and 52.3%, respectively. Recent developments include the Shenhai-1 Phase II project commencement and significant exploration breakthroughs in Bohai Bay, which may enhance future revenue streams but do not guarantee immediate dividend stability or growth.

- Unlock comprehensive insights into our analysis of CNOOC stock in this dividend report.

- Our valuation report here indicates CNOOC may be undervalued.

Summing It All Up

- Embark on your investment journey to our 87 Top SEHK Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:867

China Medical System Holdings

An investment holding company, manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives