- Hong Kong

- /

- Oil and Gas

- /

- SEHK:8270

We Ran A Stock Scan For Earnings Growth And China CBM Group (HKG:8270) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China CBM Group (HKG:8270). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide China CBM Group with the means to add long-term value to shareholders.

Check out our latest analysis for China CBM Group

China CBM Group's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for China CBM Group to have grown EPS from CN¥0.0047 to CN¥0.032 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

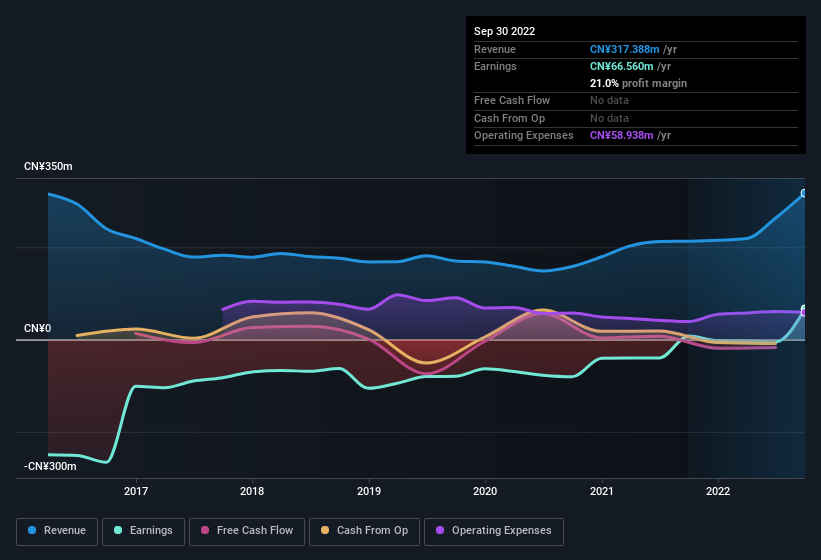

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. China CBM Group maintained stable EBIT margins over the last year, all while growing revenue 49% to CN¥317m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China CBM Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for China CBM Group is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. In one fell swoop, Executive Chairman Zhong Sheng Wang, spent HK$11m, at a price of HK$0.06 per share. It doesn't get much better than that, in terms of large investments from insiders.

And the insider buying isn't the only sign of alignment between shareholders and the board, since China CBM Group insiders own more than a third of the company. To be exact, company insiders hold 66% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling CN¥2.1b. That level of investment from insiders is nothing to sneeze at.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Zhong Sheng Wang, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like China CBM Group with market caps between CN¥1.4b and CN¥5.5b is about CN¥2.9m.

China CBM Group offered total compensation worth CN¥1.4m to its CEO in the year to December 2021. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add China CBM Group To Your Watchlist?

China CBM Group's earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe China CBM Group deserves timely attention. You still need to take note of risks, for example - China CBM Group has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

The good news is that China CBM Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8270

China CBM Group

An investment holding company, engages in the exploitation, liquefaction production, and sale of natural gas and coalbed gas in the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives