The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Kaisun Holdings Limited (HKG:8203) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Kaisun Holdings

What Is Kaisun Holdings's Net Debt?

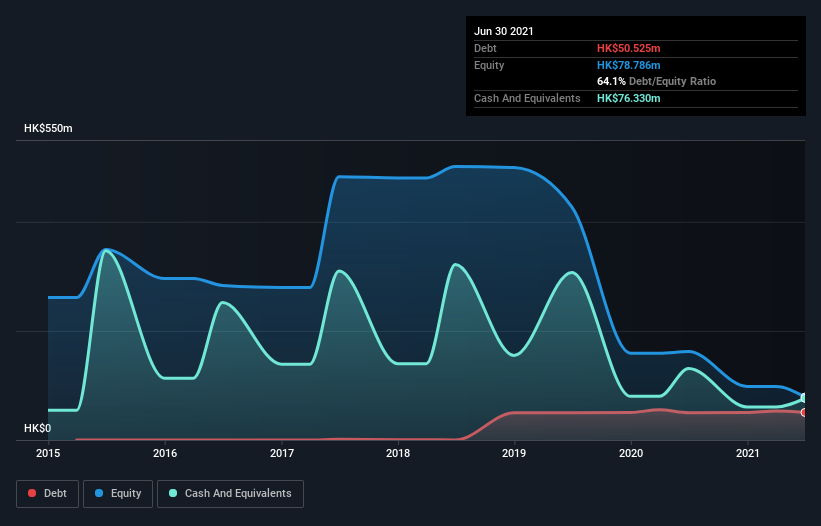

The chart below, which you can click on for greater detail, shows that Kaisun Holdings had HK$50.5m in debt in June 2021; about the same as the year before. However, its balance sheet shows it holds HK$76.3m in cash, so it actually has HK$25.8m net cash.

A Look At Kaisun Holdings' Liabilities

The latest balance sheet data shows that Kaisun Holdings had liabilities of HK$235.1m due within a year, and liabilities of HK$47.6m falling due after that. On the other hand, it had cash of HK$76.3m and HK$41.4m worth of receivables due within a year. So it has liabilities totalling HK$164.9m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the HK$109.5m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Kaisun Holdings would likely require a major re-capitalisation if it had to pay its creditors today. Given that Kaisun Holdings has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kaisun Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Kaisun Holdings reported revenue of HK$70m, which is a gain of 45%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Kaisun Holdings?

Although Kaisun Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of HK$10m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. The saving grace for the stock is the strong revenue growth of 45% over the last twelve months. But the stock still looks risky to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Kaisun Holdings is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kaisun Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8203

Kaisun Holdings

An investment holding company, engages in the mining, exploitation, processing, production, and sale of coal in Hong Kong, the People’s Republic of China, Vietnam, and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives