- Hong Kong

- /

- Oil and Gas

- /

- SEHK:702

Sino Oil and Gas Holdings Limited (HKG:702) Stock Rockets 26% But Many Are Still Ignoring The Company

Sino Oil and Gas Holdings Limited (HKG:702) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 71%.

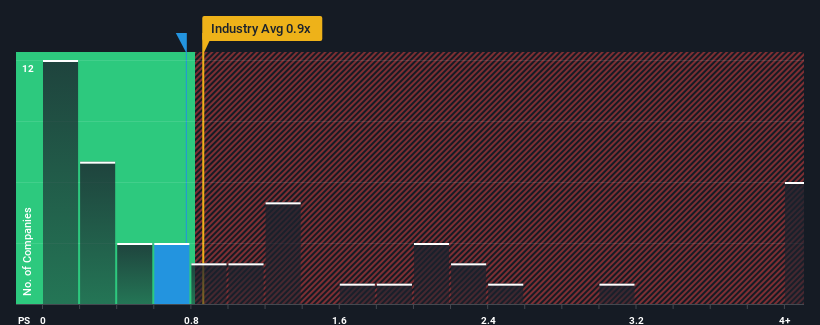

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sino Oil and Gas Holdings' P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Oil and Gas industry in Hong Kong is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sino Oil and Gas Holdings

How Sino Oil and Gas Holdings Has Been Performing

Sino Oil and Gas Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sino Oil and Gas Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Sino Oil and Gas Holdings?

Sino Oil and Gas Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. The latest three year period has also seen a 14% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 5.0% shows it's a great look while it lasts.

In light of this, it's peculiar that Sino Oil and Gas Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Sino Oil and Gas Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As mentioned previously, Sino Oil and Gas Holdings currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Sino Oil and Gas Holdings (1 doesn't sit too well with us!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:702

Sino Oil and Gas Holdings

An investment holding company, engages in exploration, development, and production of coalbed methane in Hong Kong and the People's Republic of China.

Good value slight.

Similar Companies

Market Insights

Community Narratives