It is doubtless a positive to see that the EPI (Holdings) Limited (HKG:689) share price has gained some 146% in the last three months. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 84% in that time. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for EPI (Holdings)

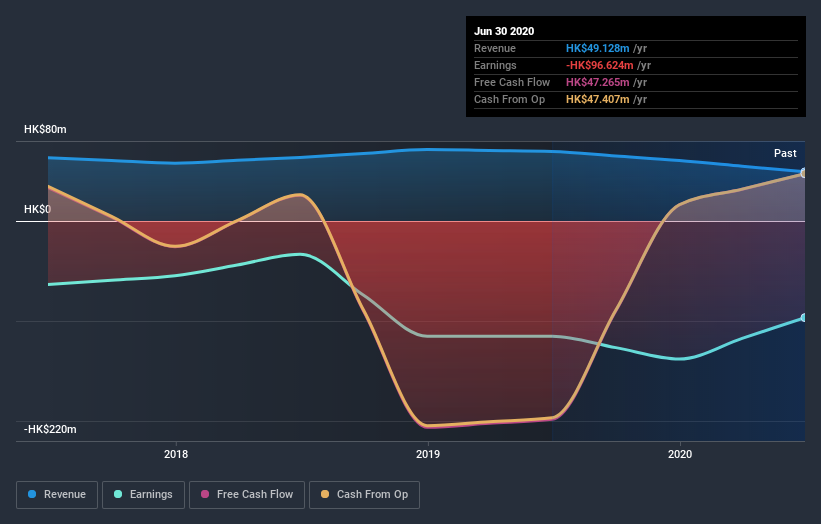

Given that EPI (Holdings) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years EPI (Holdings) saw its revenue shrink by 2.6% per year. That is not a good result. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that EPI (Holdings) has rewarded shareholders with a total shareholder return of 19% in the last twelve months. That certainly beats the loss of about 7% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand EPI (Holdings) better, we need to consider many other factors. Take risks, for example - EPI (Holdings) has 2 warning signs we think you should be aware of.

Of course EPI (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade EPI (Holdings), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EPI (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:689

EPI (Holdings)

An investment holding company, primarily engages in the exploration and production of petroleum in Canada and Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives