- Hong Kong

- /

- Oil and Gas

- /

- SEHK:554

Optimistic Investors Push Hans Energy Company Limited (HKG:554) Shares Up 35% But Growth Is Lacking

The Hans Energy Company Limited (HKG:554) share price has done very well over the last month, posting an excellent gain of 35%. Unfortunately, despite the strong performance over the last month, the full year gain of 6.7% isn't as attractive.

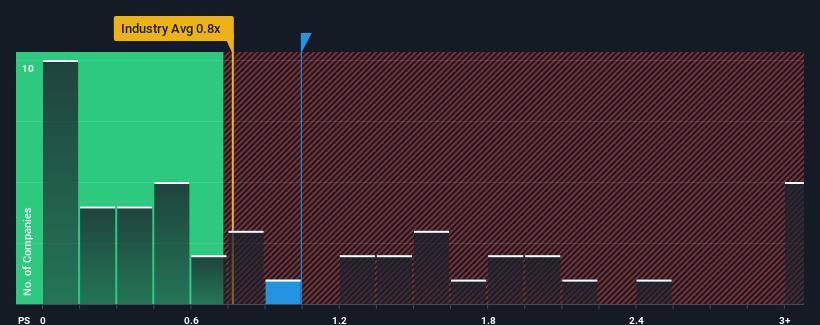

In spite of the firm bounce in price, there still wouldn't be many who think Hans Energy's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Hong Kong's Oil and Gas industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Hans Energy

How Has Hans Energy Performed Recently?

Recent times have been quite advantageous for Hans Energy as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hans Energy will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Hans Energy?

In order to justify its P/S ratio, Hans Energy would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 62% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 0.7% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Hans Energy is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What We Can Learn From Hans Energy's P/S?

Its shares have lifted substantially and now Hans Energy's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that Hans Energy trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Hans Energy with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hans Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:554

Hans Group Holdings

An investment holding company, provides terminal, jetties, storage tanks, and warehousing and logistic services for petroleum, liquid chemical, and gas products in the People’s Republic of China.

Good value with imperfect balance sheet.

Market Insights

Community Narratives