- China

- /

- Renewable Energy

- /

- SZSE:000690

Discover Promising Penny Stocks For December 2024

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with the European Central Bank and Swiss National Bank cutting rates while investors anticipate a similar move from the Federal Reserve. Amid these developments, the Nasdaq Composite has hit a record high, showcasing resilience in certain sectors despite broader market declines. Penny stocks, often associated with smaller or newer companies, continue to capture investor interest due to their potential for growth at accessible price points. Although considered an outdated term by some, penny stocks can still offer unique opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.02M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$45.15B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ruifeng Power Group Company Limited is an investment holding company involved in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China with a market capitalization of HK$2.28 billion.

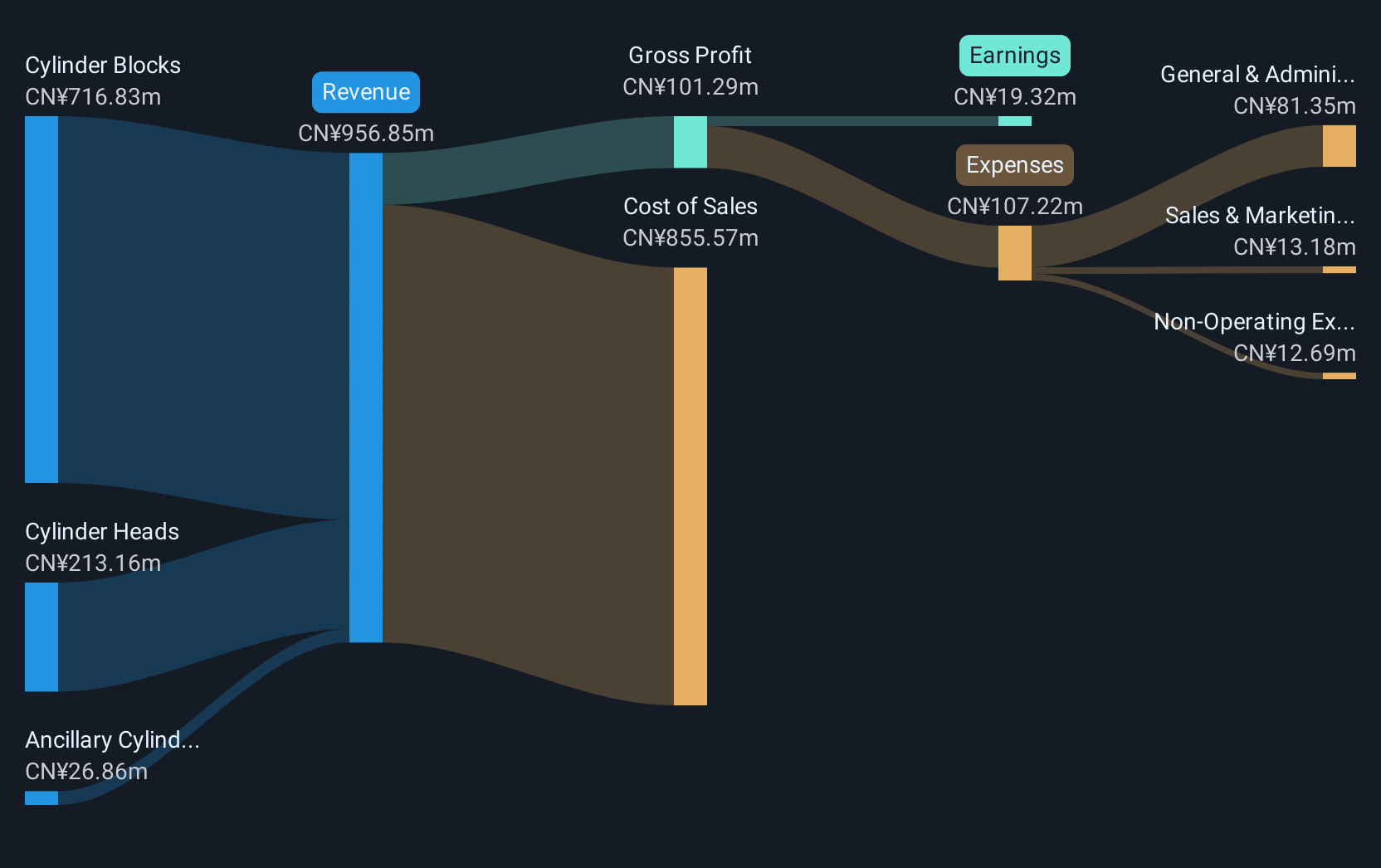

Operations: The company generates revenue from three segments: Cylinder Blocks (CN¥644.44 million), Cylinder Heads (CN¥154.71 million), and Ancillary Cylinder Block Components and Others (CN¥8.38 million).

Market Cap: HK$2.28B

Ruifeng Power Group faces challenges with declining earnings, having decreased by 26% annually over the past five years and a recent negative growth of -33.2%. Its net profit margin has also fallen to 1.7% from 3% last year. Despite these setbacks, the company maintains a satisfactory net debt to equity ratio of 23.6%, with short-term assets exceeding both short and long-term liabilities, indicating solid liquidity management. Recent changes in leadership, including appointing Mr. Lai Wai Leuk as CFO, could impact strategic direction amidst high share price volatility and auditor transitions from KPMG to Forvis Mazars.

- Unlock comprehensive insights into our analysis of Ruifeng Power Group stock in this financial health report.

- Understand Ruifeng Power Group's track record by examining our performance history report.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Energy Group Limited is an investment holding company involved in upstream oil, natural gas, and other energy-related operations across South Asia, the Middle East, and North Africa with a market cap of approximately HK$9.95 billion.

Operations: The company generates revenue through two main segments: Trading, which contributes HK$5.34 billion, and Exploration and Production, accounting for HK$10.47 billion.

Market Cap: HK$9.95B

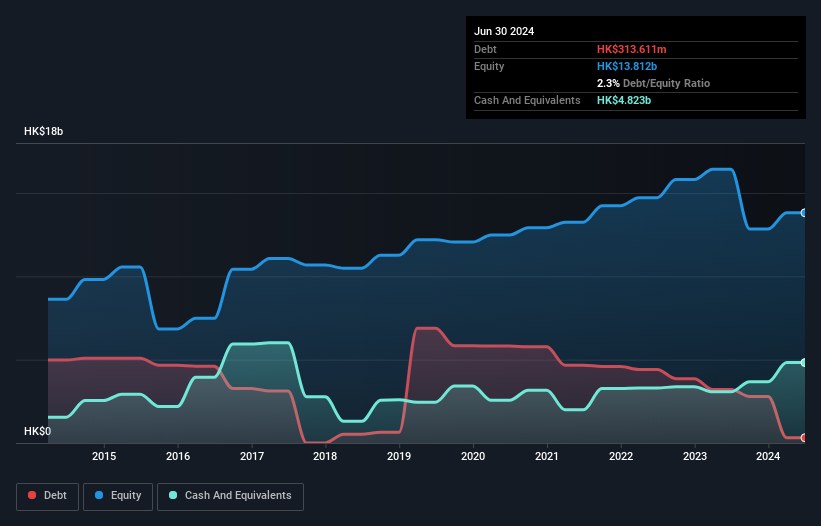

United Energy Group Limited, with a market cap of HK$9.95 billion, operates in the oil and gas sector across multiple regions. Despite being unprofitable, its financial structure remains robust as short-term assets of HK$12.6 billion exceed both short and long-term liabilities. The company has reduced its debt to equity ratio significantly over five years and maintains strong interest coverage with EBIT covering interest payments 30 times over. While earnings are forecasted to grow substantially at 57.32% annually, challenges persist with negative return on equity at -17.09%. A special dividend was announced recently, reflecting ongoing shareholder engagement efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of United Energy Group.

- Evaluate United Energy Group's prospects by accessing our earnings growth report.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the new energy sector and has a market cap of approximately CN¥10.40 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥8.68 billion.

Market Cap: CN¥10.4B

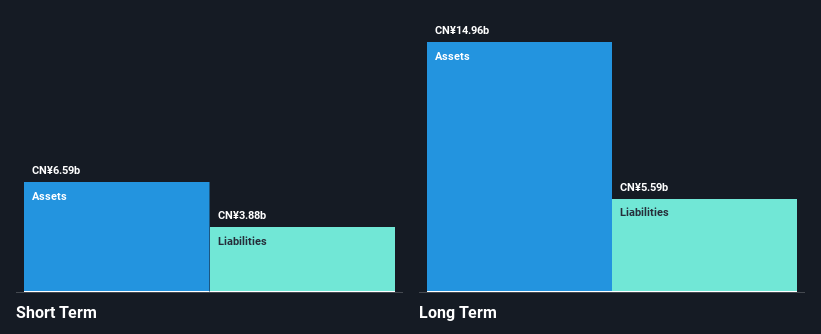

Guangdong Baolihua New Energy Stock Co., Ltd. operates in the renewable energy sector with a market cap of CN¥10.40 billion, showing stable weekly volatility over the past year at 6%. The company has demonstrated strong financial health, with short-term assets of CN¥6.6 billion exceeding both its short and long-term liabilities. Despite recent earnings growth of 31%, revenue for the first nine months of 2024 fell to CN¥6.11 billion from CN¥7.70 billion in 2023, impacting net income slightly to CN¥592.23 million from CN¥645.06 million last year, reflecting challenges amid otherwise promising prospects in its industry segment.

- Click to explore a detailed breakdown of our findings in Guangdong Baolihua New Energy Stock's financial health report.

- Review our growth performance report to gain insights into Guangdong Baolihua New Energy Stock's future.

Turning Ideas Into Actions

- Reveal the 5,810 hidden gems among our Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000690

Guangdong Baolihua New Energy Stock

Guangdong Baolihua New Energy Stock Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives